Walmart, Inc. kicked off its two-day 2023 Investment Community meeting this week with leadership highlighting how the company is investing in strengthening its business through its employees and next-gen supply chain network of stores, clubs and fulfillment centers, and driving future global growth opportunities across its omnichannel ecosystem and high-value initiatives.

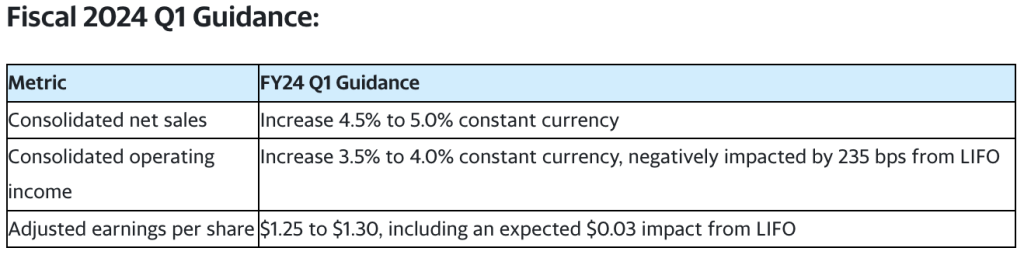

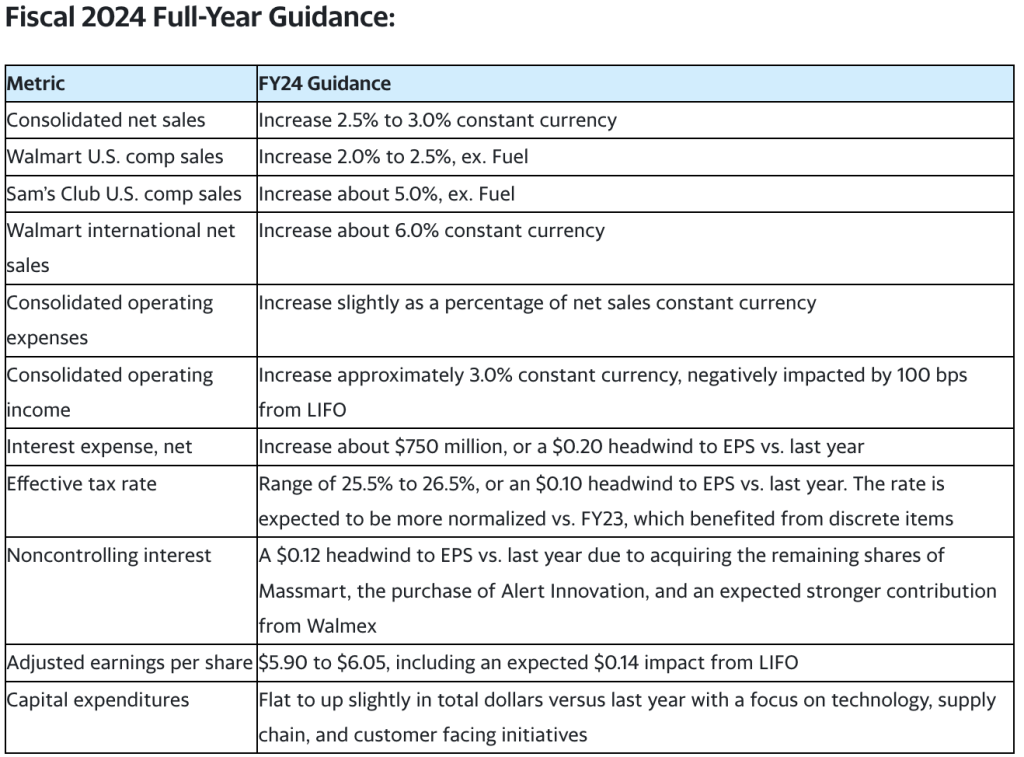

The company also reiterated its first-quarter and full-year guidance for fiscal year 2024.

“We are in a unique position to serve our customers and members however they want to shop, which will fuel continued growth,” said Doug McMillon, Walmart president and chief executive officer. “As we grow, we will improve our operating margin through productivity advancements and our category and business mix and drive returns through operating margin expansion and capital prioritization.”

A People-Led, Tech-Powered Omni-Channel Retailer

During the meeting, the retailer highlighted its purpose, culture, the importance of its employees, and reviewed its plan for a new, more connected and automated supply chain to improve the experience for its customers, employees and increase productivity.

In reengineering its supply chain to fulfill customer needs, Walmart has a more intelligent and connected omnichannel network enabled by greater use of data, more intelligent software and automation. The outcome improves in-stock, inventory accuracy and flow whether customers shop in-store, pick up or opt for delivery.

Walmart showcased its supply chain innovation on Tuesday at its Brooksville, FL, regional distribution center as part of how the company is building a scaled system of supply chain capabilities that uses a combination of data, software and robotics. Through automation and technology, the company illustrated how the increased product storage allows the distribution center to provide a more consistent, predictable and higher-quality delivery service to stores and customers and react more quickly to customer demand.

Stores operate as a place to shop and as fulfillment centers and delivery stations. Distribution and fulfillment centers hold a mix of products from suppliers and sellers, allowing Walmart to use its existing assets more efficiently.

By the end of fiscal year 2026, Walmart believes roughly 65 percent of its stores will be serviced by automation, approximately 55 percent of the fulfillment center volume will move through automated facilities, and unit cost averages could improve by roughly 20 percent.

As the changes are implemented, one outcome is roles that require less physical labor but have a higher pay rate. Over time, the company anticipates increased throughput per person because of automation while maintaining or increasing the number of employees as new roles are created.

“It all starts with our associates,” McMillon said. “We are a people-led, tech-powered omnichannel retailer. As it relates to being people-led, it’s about purpose, values, culture, opportunity, and belonging. We serve our associates by creating opportunities. Opportunities that turn jobs into careers. We help bring dignity to work by enabling them to see how they’re serving others as part of a team and helping them achieve their potential. And as we serve them, they serve our customers and members well…they make the difference.”

Financial Framework

Walmart outlined how the company expects its growth investments to transform its financial profile, centering on three building blocks:

- sales growth from its omnichannel business model;

- diversifying earnings streams through improved category and business mix; and

- scaling proven, high-return investments that drive operating leverage and improve incremental operating margins.

“We believe that we have the building blocks in place to help define the next chapter of retail and do so while driving strong growth and shareholder returns,” said John David Rainey, Walmart executive vice president and chief financial officer. “Looking at where we are today, we believe that approximately 4 percent sales growth and growing operating income at a faster rate are still the appropriate targets for our business over the next 3-to-5 years. The investments we’ve made have positioned us well, and we stand to generate steady and sustained growth at higher margins. Achieving our targeted 4 percent sales growth over the next five years would add more than $130 billion of sales on top of our roughly $600 billion base today. On top of that, we think the opportunity for operating income growth over the next 3-5 years could be better than what we’ve outlined.”

Walmart’s multi-year growth outlook assumes all three business segments contribute to its mid-single-digit sales growth target. The company is strengthening its global omnichannel ecosystem and scaling higher-margin value streams that serve customers and businesses and are natural connectors to its omnichannel retail business, including advertising, data, memberships and marketplace, all initiatives that will help deliver a better customer and member experience while driving stronger returns.

Fiscal 2024 Q1 and Full-Year Guidance

The company reiterated its Fiscal Year 2024 Q1 and full-year guidance:

Photo courtesy Walmart