Foot Locker, Inc. President and CEO Mary Dillon believes the company hit a meaningful inflection point in its business and the execution of its Lace Up Plan in the second quarter as the retailer returned to gross margin expansion. Dillon feels this demonstrates that the company’s strategic investments in support of the Lace Up Plan are taking hold.

“Our strategies across store experience, digital, loyalty, and brand building are continuing to take hold,” Dillon said. “The impact of our Lace Up Plan is accelerating. Our inventories are well-positioned, and we are flowing product to better match customer demand.”

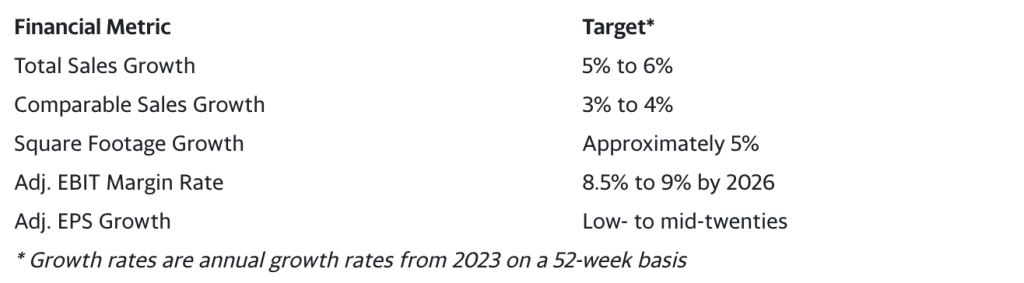

Dillon rolled out Foot Locker’s Lace Up Plan (Plan) last spring, with a goal to reach $10 billion in sales by 2026 and improve the bottom line by cleaning up inventories, closing underperforming stores and upgrading the remaining stores to create a new standard.

Dillon shared that overall comps increased 2.6 percent, ahead of expectations of flat to slightly positive, led by the global Foot Locker and Kids Foot Locker banners, which comped up 5.2 percent. She said comp sales accelerated meaningfully in the quarter as customers responded to fresh summer assortments at full price.

“Our striper training focused on omni-channel selling behavior and product education tools that are driving increases in our store-level conversion,” she commented. “Importantly, our comp trend strengthened as we moved through the quarter, with July our strongest month as we saw a solid start to the back-to-school season, especially in our stores, and with that strength continuing into August,” the CEO revealed.

“We were also particularly pleased to see stabilization in the Champs Sports banner, as the banner achieved meaningful comp improvement quarter-over-quarter as its repositioning continues to take root,” she continued.

Dillon noted that gross margin was up 50 basis points year-over-year, led by underlying improvement in merchandise margins from lower promotions and occupancy leverage and offset by the planned impact of non-recurring charges associated with the company’s recent FLX rewards program transition.

The company also unveiled its new flagship store in New York City’s Herald Square last week to much fanfare as a model for the future. Check, check, and check.

It seemed the Plan’s early results were having a positive effect. Expectations were strong that Wall Street would react positively to improving margins, a return to same-store sales growth, and a plan to jettison underperforming businesses.

Well, it didn’t turn out that way.

Wall Street did not react favorably, pushing FL shares lower on Wednesday, August 28. Shares were down 15 percent in early trading and hovered in the down 10 percent range by early afternoon trading as analysts and investors reacted negatively to some of the information Foot Locker reported.

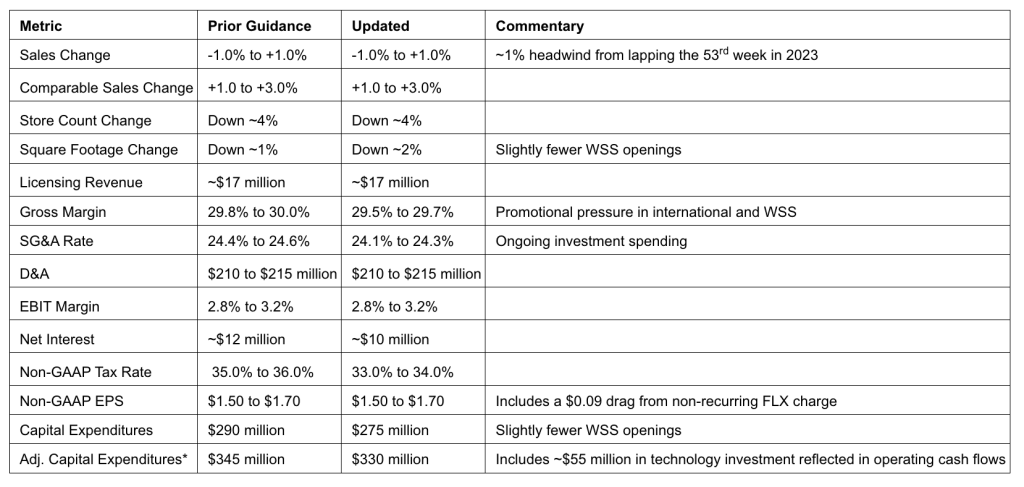

Some analysts pointed to Foot Locker’s decision to trim its gross margin forecast to a range from 29.5 percent to 29.7 percent, from previous guidance that called for a range from 29.8 percent to 30.0 percent. The company said the lowered guidance reflected a priority to discount in international stores and the Hispanic consumer-focused WSS brand.

Foot Locker also kept its outlook for fiscal-year sales growth of a range of a 1 percent decline to a 1 percent increase, while adjusted earnings per share will range from $1.50 to $1.70.

That said, the company trimmed its forecast for gross margin to range from 29.5 percent to 29.7 percent, from past guidance for 29.8 percent to 30.0 percent. Foot Locker said during its quarterly conference call with analysts that the lowered guidance reportedly reflects a higher need for discounts in international stores and at the WSS brand.

2024 Outlook

The company is reaffirming its full-year 2024 outlook, representing the 52 weeks ending February 1, 2025.

Barron‘s quoted Wedbush Analyst Tom Nikic’s note on the matter, saying he believes the weakness is due to a combination of the stock’s strong rally heading into the report and the new gross margin outlook.

SGB Media noted that FL shares have been on a roll, with the stock up 24 percent in the last month and 42 percent over a three-month period.

“We remain in wait-and-see mode on the name, as the macro environment remains challenging, product trends at #1 supplier Nike remain a question mark, and 2H guidance assumes a dramatic acceleration in profit generation,” Nikic wrote Wednesday. He reportedly rates Foot Locker stock at Neutral.

Telsey Advisory Group Analyst Cristina Fernandez, who has a Market Perform rating on the Foot Locker shares, acknowledged all the positives, even noting the retailer has pulled back on promotions, leading to higher margins, but also said that given ongoing investments and a return to normalized incentive comps, the higher sales did not allow for a better SG&A ratio, which was in line with expectations for the quarter.

“Foot Locker maintained its 2024 EPS, sales, and operating margin guidance, which might disappoint investors given 1H24 EPS came in at 10 percent of the annual guidance, the high end of the range of 5 percent to 10 percent of annual EPS,” she wrote in the TAG notes from the call. She did say that, “maintaining the guidance seems prudent given consumer uncertainty in 2H24 and where the company is on the turnaround plan.”

Citibank’s Paul Lejuez was not surprised by the downward trend in shares, either. In his Flash note issued after Foot Locker released its earnings, he said the sharp increase in share price over the last month or two may be a problem.

“FL is delivering against their plan to show sequential comp/GM improvement throughout the year; however, with shares +40 percent since early July, GM not beating market expectations, and a big sequential comp improvement still expected in 4Q (against tougher comparisons), we expect shares to trade lower today,” he said in his pre-market report before the conference call.

While the market swirled and reacted behind her, CEO Dillon stayed on script. She reviewed earnings achievements and reiterated the company’s full-year guidance, calling for a return to comp growth and EBIT margin expansion. She also said FL maintained its non-GAAP EPS guidance of $1.50 to $1.70 per share for the year.

“We remain focused on progressing against our Lace Up Plan this year and meeting our near and longer-term financial commitments, including our 8.5 percent to 9.0 percent EBIT margin targets by 2028,” she said.

CEO Dillon walked through the store plan portion of the Lace Up Plan, suggesting that the overarching principle is to simplify and optimize the business to ensure that the company can invest in and focus its energy on its core banners and markets to drive sustainable growth.

“As part of the Lace Up Plan over the past few years, we’ve made meaningful strides in streamlining areas of our regional and banner portfolio that we’re adding complexity to our business while also diluting our overall levels of profitability,” she began. “In North America, we wound down banners such as Lady Foot Locker, Footaction, Eastbay, and Atmos’ limited U.S. presence. In Europe, we closed our Runners Point and Sidestep banners. And, in Asia, we converted our operations in Singapore and Malaysia to a licensed model,” she noted.

“As we execute our Lace Up Plan, we’ve identified additional opportunities for streamlining our operations, leading to this morning’s announcement regarding our international business,” Dillon said.

In the Asia-Pacific region, Foot Locker will begin winding down its stores and e-commerce operations in South Korea. In Europe, the company will close its stores and e-commerce businesses in Denmark, Norway, and Sweden. Dillon said the company signed agreements to transfer its operations in Greece and Romania to Fourlis Group, a retail group and licensing partner in Southeast Europe.”All of these changes are expected to be completed by mid-2025,” the CEO committed.

She also said the agreements with Fourlis Group include future stores and e-commerce expansion in Southeast Europe. “Including expansion in Greece and Romania, the ambition is to open over 100 stores in the region over time,” she added.

“In combination with our plans to enter India later this year with our licensed partners Metro Brands and Nykaa Fashion, the health and contribution of our global licensing portfolio is building as we profitably expand the global reach of our Foot Locker brand in higher growth markets with reduced levels of investment and risk,” Dillon said.

In reviewing progress against the Lace Up Plan and progress against strategies in the second quarter, the CEO discussed the first imperative of the Plan—expand sneaker culture.

Expand Sneaker Culture

Dillon said this initiative aims to serve more customers and sneaker occasions through a curated assortment of premium brands and sneakers.

“With our return to positive comp sales in the second quarter led by our strong results in footwear, we’re showing that we are growing our market share through our efforts to expand sneaker culture,” she suggested. “As we return to growth in the second quarter and into the back half, we’re excited about achieving growth across all aspects of our product portfolio, including a return to growth with Nike starting in the fourth quarter of this year and into 2025.”

She said the company will achieve this by emphasizing its mutual pillars of basketball, kids and sneaker culture, leading to elevated storytelling and partnerships, including with the NBA, Home Court and The Clinic.

“For example, in the second quarter, we collaborated with Nike and Jordan Brand to tap into the growing popularity of women’s basketball through a clinic activation featuring WNBA Guard for the Atlanta Dream, Aerial Powers, former WNBA player Linnae Harper of the Chicago Sky and Jordan Brand athletes, including Mikaylah Williams of the LSU Tigers, Kiki Rice of the UCLA Bruins and Kiyomi McMiller of Rutgers Scarlet Knights,” she said.

Dillon noted that Foot Locker hosted a two-day activation in Phoenix this past July featuring a skills and drills clinic with young female hoopers, followed by a panel discussion. “Our celebration of women’s basketball with the clinic speaks to what we continue to see as a key opportunity for our business as we look ahead, namely our women’s business,” she said.

“Women’s has consistently been our fastest-growing business for the past few years,” Dillon continued. “Looking out, we continue to see ongoing opportunity in the women’s category. As we broadly tap into the women’s opportunity, our brand diversification efforts play an important role as we see more women enter our funnel through our wider brand selection.”

In the second quarter, Foot Locker introduced its first spring style and trend campaign in partnership with Adidas and New Balance. Dillon said the campaign strategically targeted women and earned the retailer nearly three billion media impressions.

“Looking ahead, next month marks the Foot Locker brand’s 50th anniversary, and we have some exciting plans to help celebrate our rich history at the heart of basketball and sneaker culture,” she hinted. “With one-of-a-kind events and exclusive co-created products from Nike, New Balance, Adidas, Puma, and Converse, we can’t wait to celebrate where we’ve been and where we’re headed throughout the next 50 years.”

The CEO also called out the initiative to drive greater distinction in the retailer’s assortment, noting that Foot Locker’s penetration in the quarter was 13 percent, down 100 basis points year-over-year against tougher franchise comparisons and reflected stronger relative strength from base aspects of its portfolio, especially among women and kids.

Power Up the Portfolio

The second pillar of the Plan calls for transforming Foot Locker’s real-estate footprint and continuing to differentiate its banners.

“On real-estate transformation, we’re continuing the progress we made last quarter with our Reimagined Store Concept. We followed up the successful opening of our first concept door in New Jersey this spring with our second concept door in Paris, La Défense, in May,” Dillon outlined. “Both stores truly bring the heart of sneakers to life. Response to this new concept has been very positive from our brand partners, stripers and customers. In both locations, we’ve seen higher conversion levels and basket sizes and meaningfully increased penetration of women’s footwear compared to the balance of chain.”

The company formally named this new concept Foot Locker Reimagined, intended to be the next evolution of the company’s store formats and the go-forward expression of the brand.

“Just last week, we were thrilled to reopen our iconic 34th Street store in New York City as our third Foot Locker Reimagined door,” Dillon noted. She said the store features a pivotal advancement with the new Home Court concept, which is Foot Locker’s premier multi-branded basketball experience, and intends to roll out this latest version of Home Court in select stores going forward.

The 34th Street (Herald Square) store in New York City also features the updated Kids Foot Locker concept with, for the first time, a new look and feel.

“Given the strong response we are seeing to our first few Reimagined doors, we are pulling forward three additional locations this year with a total of eight now planned to open in 2024,” she said. “This will include our new store later this quarter in Delhi, India, which will mark our entry into this market in coordination with our licensing partners, Metro Brands Limited and Nykaa Fashion.”

On the store refresh front, Foot Locker completed 67 refreshes in the second quarter, in addition to the over 100 doors that have been touched over the last few quarters. It is expected to continue to scale as through the back half of the year.

“We remain on target to ramp the program as we go through the third and fourth quarter, especially given that our execution of these refreshes continues to improve, in some cases turned around in just 24 hours,” Dillon added.

“From a capital return perspective, we continue to see these refreshes hitting our internal hurdle rates and payback periods, supported by both comps and gross margins outperforming the balance of chain,” she assessed.

“Our new concepts, including Foot Locker Reimagined, now represent 17 percent of our global square footage, up from 12 percent last year and moving further towards our 2026 target of 20 percent,” Dillon detailed. “Adding our store refreshes on top of our new concepts, we’re committed to elevating approximately two-thirds of our global Foot Locker and Kids’ Foot Locker doors up to our Reimagined brand standard by year-end 2025.”

Dillon also said that the move to off-mall was progressing, with penetration reaching 40 percent of square footage in North America, up four points from a year ago and closer to the company’s goal of 50 percent by 2026.

Turning to Champs, which has been a clear drag on the overall business for some time, Dillon said stabilizing the Champs Sports banner has been a key objective in improving its portfolio.

“As such, we were pleased to see progress with the repositioning of the banner in the second quarter,” the CEO said. “Comps declined 3.9 percent, which was a meaningful improvement from the first quarter and reflecting positive footwear comps. As we make progress in the banner’s repositioning, we’re seeing increases in brand awareness and share of wallet among the active athlete customer segment.”

Dillon said that the company took another leap forward with the banner and the launch of Champs Sports’ new brand platform, Sport for Life, which celebrates the connection between sports and the on-the-go lifestyle of its active customers.

“With an assist from Micah Parsons of the Dallas Cowboys, Francisco Lindor of the New York Mets, and Jaylen Waddle of the Miami Dolphins, the response from customers and our brand partners to the elevated platform has been positive,” Dillon said. “We’re excited about the expanded and elevated vision for the Champs Sports banner looking ahead, and we’ll have more to share in future quarters about the banner’s evolution.”

Deepen Customer Relationships

The third pillar of the Plan is to Deepen Customer Relationships. She said a key anchor for the initiative was a redesigned loyalty program and the development of overall CRM capabilities.

“To start, a key milestone for our business was the relaunch of our enhanced FLX rewards program in the U.S. in mid-June,” she highlighted. Twenty-four percent of our sales in the second quarter were through our loyalty program, up 200 basis points compared to last year. By adding point redemptions for cash discounts and other perks under the program, we expect to drive greater customer frequency and share of wallet.”

Dillon said the company has been ” very pleased” with FLX member responses across various KPIs, including an encouraging pace of enrollments, higher engagement with first-time redeemers, higher average order values compared to non-loyalty members, and higher units per transaction.

“As we move into the back-to-school and holiday selling periods, we’re continuing to scale and activate the new program of benefits, and we look forward to sharing incremental insights as the program moves towards our 50 percent loyalty penetration target by 2026,” she said.

Be Best-in-Class Omni

The fourth and final pillar in the Plan, Be Best-in-Class Omni, calls for improving the company’s digital presence and better integrating its customer journey across channels.

Dillon said digital penetration in the quarter increased to 15.9 percent of total sales, up 40 basis points year-over-year. The company continues to target 25 percent e-commerce penetration by 2026.

“At an enterprise level, global digital comps were up nearly 4 percent, and we continue to make strides in our online conversion rate,” Dillon shared. She said the company remains on track to roll out a new Foot Locker mobile app later this year in the fourth quarter, which the company expects to provide a faster, more modern shopping experience, along with greater product inspiration and storytelling, and serve as a hub for its new loyalty program.

Lace Up Plan Goals

As a reminder, Foot Locker set the following goals when initially rolling out its Lace Up Plan in March 2023 and the following long-term financial targets for fiscal years 2024 through 2026:

Image courtesy Foot Locker, Inc./Champs

•••

See below for additional coverage from SGB Media on Foot Locker’s Q2 brand and banner performance, the announced HQ move and store closures.

EXEC: Foot Locker Gives Q2 Nod to Nike in Basketball, Adidas and New Balance in Lifestyle

EXEC: Foot Locker Exiting New York for Sunnier Environs; Shakes Up Europe and Asia Model

Foot Locker Inc. Sees Core Foot Locker Banner Comps Grow 5.2 Percent in Q2