Driven by continued momentum in its Outdoor & Action Sports coalition, VF Corporation reported earnings per share in the quarter were up 12 percent primarily due to strong demand for The North Face, Vans and Timberland brands and gross margin expansion in every coalition.

“VF’s first quarter results reflect the continued strength of our brands and our global business platforms,” said Eric Wiseman, VF Chairman, President and Chief Executive Officer. “Led by outstanding performance from the Outdoor & Action Sports coalition, which had balanced growth across all channels and geographies, we delivered strong growth in revenue and profitability. Looking towards the balance of 2014 we are confident in our business plan and look forward to delivering another record year for our shareholders.”

First Quarter 2014 Review

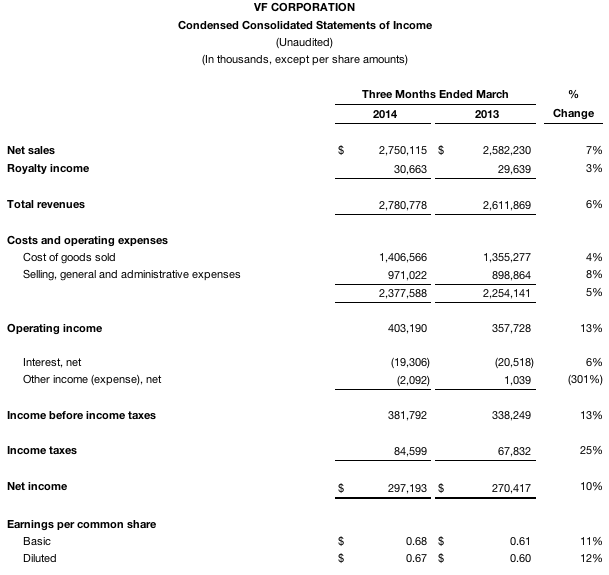

Revenues rose 6.5 percent to $2.8 billion, compared with the same period of 2013, driven by double-digit growth in our Outdoor & Action Sports, international and direct-to-consumer businesses.

Gross margin improved 130 basis points to 49.4 percent, an all-time high for any quarter in VF’s history, with improvements in every coalition. The higher gross margin is primarily driven by the continuing shift of our revenue mix toward higher margin businesses and includes 30 basis points related to the previously disclosed change in classification of retail concession fees.

SG&A as a percent of revenues rose 50 basis points to 34.9 percent in the first quarter. This increase includes 30 basis points related to the inclusion of retail concession fees.

Operating income increased 13 percent to $403 million in the first quarter, compared with $358 million in the same period of 2013. Operating margin was 14.5 percent compared with 13.7 percent in the first quarter of 2013.

Earnings per share increased 12 percent to $0.67 per share compared with $0.60 per share during the same period last year.

Coalition Review

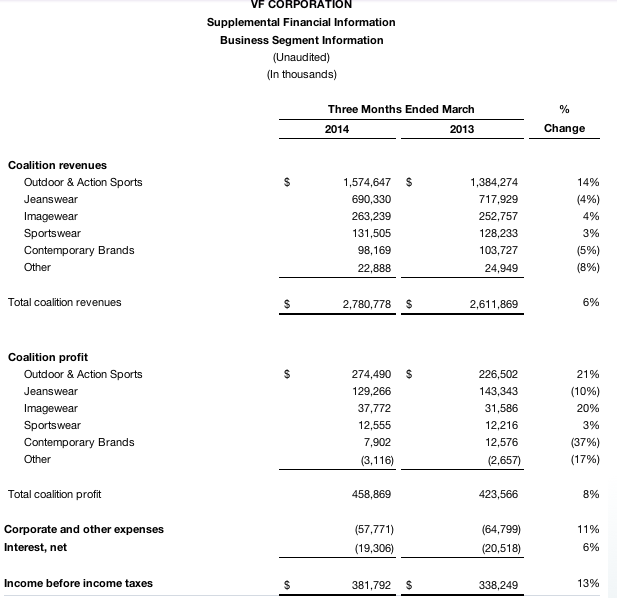

Revenues for the Outdoor & Action Sports coalition increased 14 percent in the quarter to $1.6 billion with double-digit growth across the U.S. and international markets as well as in wholesale and direct-to-consumer channels.

First quarter revenues for The North Face brand rose 14 percent globally driven by nearly 30 percent growth in direct-to-consumer sales and a high single-digit increase in the brand’s wholesale business. By region, The North Face brand’s revenues were up at a high-teen percentage rate in the Americas region, up at a mid-teen percentage rate in the Asia Pacific region and up at a low single-digit percentage in Europe.

Vans brand revenues, which represented the highest of any VF brand in the first quarter, were up 20 percent with strong, double-digit growth across all geographies, as well as in the brand’s wholesale and direct-to-consumer channels. Revenues in the Americas region were up at a low-teen percentage rate in the quarter, up more than 20 percent in Europe and more than 40 percent in the Asia Pacific region. Global direct-to-consumer revenues for the Vans brand were up 19 percent in the quarter.

Revenues for the Timberland brand were up 12 percent in the first quarter. In the Americas region, revenues increased at a high-teen percentage rate including greater than 20 percent growth in its wholesale business and solid direct-to-consumer results driven by double-digit comparable store growth rates. In Europe, the Timberland brand grew at a high single-digit percentage rate and in the Asia Pacific region, first quarter revenues were up at a low double-digit percentage rate. Globally, the Timberland brand’s growth was balanced between its direct-to-consumer and wholesale businesses in the quarter.

Jeanswear first quarter revenues were down 4 percent to $690 million. Coalition revenues in the Americas region were down at a high single-digit percentage rate due primarily to ongoing challenges in the U.S. mid-tier/department store channel and to a lesser extent, consumer trends in women’s denim. In Europe, revenues were up at a high single-digit percentage rate and sales in the Asia Pacific region were up 10 percent.

Revenues for the Wrangler brand in the first quarter were down 2 percent driven by a low single-digit decline in the Americas region, partially offset by a high single-digit increase in European revenues. First quarter revenues for the Lee brand were down 1 percent driven by a high single-digit percentage decline in the Americas region, partially offset by 10 percent growth in Europe and a mid-teen increase in Asia Pacific sales.

Imagewear revenues were up 4 percent in the quarter to $263 million driven by particular strength in its Licensed Sports Group business.

First quarter Sportswear revenues were up 3 percent to $132 million. Nautica brand revenues were flat, impacted by a shift in timing of shipments; second quarter revenues should grow at a low double-digit rate. The Kipling brand’s U.S. business achieved a high-teen percentage rate increase in revenues compared with the same period last year. Globally, the Kipling brand grew 23 percent.

In line with expectations amid a challenging premium denim market, first quarter revenues for the Contemporary Brands coalition were down 5 percent to $98 million.

International Review

International revenues in the first quarter grew 11 percent (up 10 percent in constant currency). Revenues in Europe rose 12 percent (up 8 percent in constant currency) with positive results from nearly every brand in VF’s portfolio. In the Asia Pacific region, revenues were up 16 percent (up 17 percent in constant currency) driven by 27 percent growth in China (up 25 percent in constant currency), which included strong results from every brand. Reported revenues were flat in the Americas (non-U.S.) region (up 8 percent in constant currency). International revenues were 43 percent of total VF first quarter sales in 2014 compared with 42 percent in the same period of 2013.

Direct-to-Consumer Review

Direct-to-consumer revenues grew 16 percent in the first quarter with double-digit increases in all regions of the world and growth in nearly every VF brand. Twenty-three stores were opened across our brands during the quarter bringing the total number of VF owned retail stores to 1,263. Direct-to-consumer revenues reached 23 percent of total revenues in the first quarter compared with 20 percent in the 2013 period. VF now includes revenues from its concession locations in its direct-to-consumer business; on a comparable basis, direct-to-consumer revenues in the first quarter of 2013 would have been 22 percent of total VF revenue. References to direct-to-consumer and wholesale revenue growth rates reflect the change in reporting of concessions in all periods.

Share Repurchase Program

During the first quarter, VF purchased a total of 9.1 million common shares for approximately $553 million under its Board of Directors’ share repurchase authorization, which was approved in December 2013. During the second quarter, the company purchased an additional 2.9 million shares for $173 million. No additional share repurchases in 2014 are anticipated at this time.

2014 Revenue and Earnings Outlook Raised

Revenues for 2014 are now expected to increase at the high end of the previously provided 7 to 8 percent range. Second quarter revenues are expected to increase at a similar level to that of the first quarter, and again be driven primarily by strength from our Outdoor & Action Sports coalition. For the full year, Outdoor & Action Sports coalition revenues are now expected to be up 12 to 13 percent. Full year gross margin and operating margin expectations of 49 percent and 15 percent, respectively, remain unchanged. Based on slightly stronger than expected first quarter results, earnings per share in 2014 are now expected to increase to approximately $3.06 per share, representing 13 percent growth over 2013, as compared with the $3.00 to $3.05 per share outlook provided on February 14.

Dividend Declared

On April 22, 2014, VF’s Board of Directors declared a quarterly dividend of $0.2625 per share, payable on June 20, 2014 to shareholders of record on June 10, 2014.

VF's five largest brands are The North Face, Vans, Wrangler, Timberland, and Lee. Other brands include 7 For All Mankind, Bulwark, Eagle Creek, Eastpak, Ella Moss, JanSport, Kipling, lucy, Majestic, Napapijri, Nautica, Red Kap, Reef, Riders, Splendid and SmartWool.