VF Corporation, the parent of the Vans, The North Face, Timberland, Jansport and Dickies active lifestyle and street lifestyle brands, reported Wednesday that it beat third-quarter revenue and profit estimates.

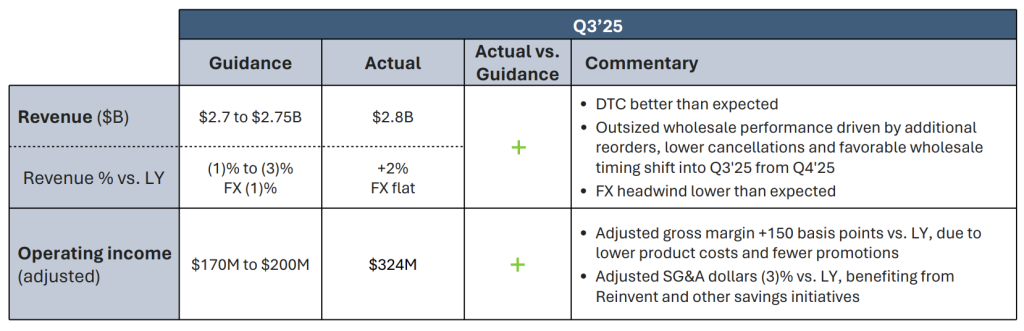

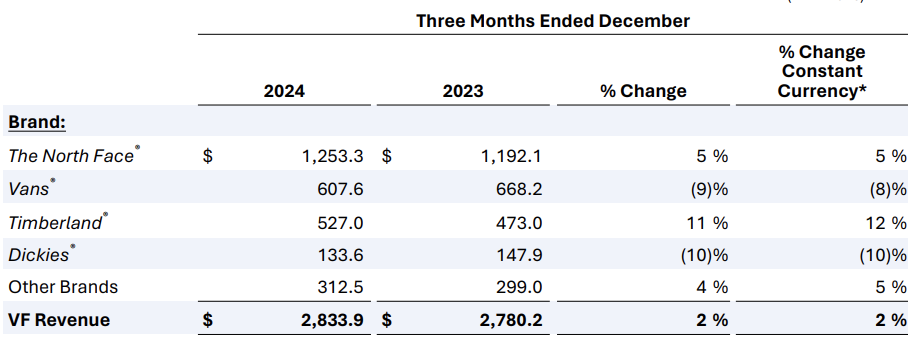

Revenues were $2.8 billion for the three-month period ended December 31, 2024, against prior guidance for revenues in the range of $2.7 billion to $2.75 billion. Revenues were up 2 percent year-over-year, compared to prior guidance for a decline in the range of 3 percent to 1 percent.

Adjusted operating income came in at $324 million for the third quarter, an easy beat against the prior guide for a range between $170 million to $200 million for the quarter.

Company CEO Bracken Darrell opened the quarterly conference call with analysts by telling the participants that what he was most excited about is what they – the analyst and investors – really can’t see yet.

The market reacted positively in pre-market trading sending VFC shares up in the low- to mid-single digits as the company’s turnaround efforts appear to be bearing fruit but tailed off into a decline for the day as details about the quarter and plans for the near future were detailed on management’s conference call with Wall Street analysts. One of the primary issues that analysts appeared to be concerned about on the call was the amount of business that was pulled forward from the fourth quarter into the third quarter.

“Now to really understand our trend line, you [need to] look at our Q3 and Q4 together,” Darell said. “While the Q3 results are better than expected, [it] somewhat benefited this quarter’s outsized wholesale performance, due to stronger reorders, lower cancellations and orders pulled forward by our retail customers into Q3 from Q4.”

He said they feel really good about the underlying performance for the second half of the year.

“We grew revenue 2 percent, while we significantly improved profitability,” the CEO continued, reiterating that the quarter was stronger than expected. “The key point to make here is that the actions we’ve taken during we’ve taken so far are delivering results.”

Darrell said “virtually every brand” was stronger in fiscal Q3 than last quarter. The North Face and Timberland both grew year-over-year and Vans delivered another quarter of sequential improvement in trend.

The North Face

Revenue at The North Face was up 5 percent to $1.25 billion in the fiscal third quarter in both reported and constant-currency terms, reflecting growth in each region with even stronger performance in DTC.

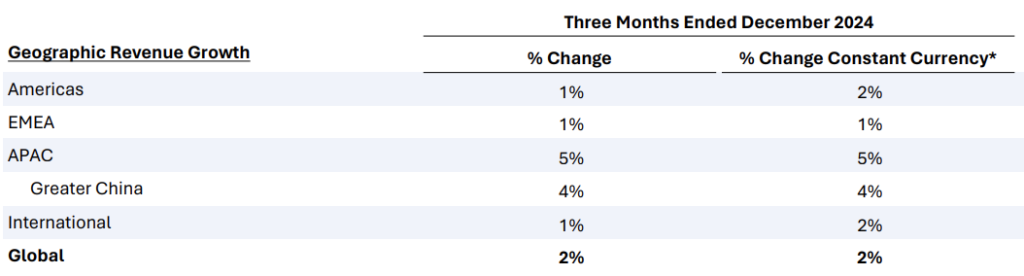

TNF saw revenues in the Americas improve 3 percent year-over-year in both reported and constant-currency terms. EMEA revenues were up 2 percent year-over-year, or up 1 percent on a constant-currency basis. APAC revenues for The North Face were up 16 percent for the third quuarter.

“We’re pushing the boundaries with our marketing and our brand building, Bracken said. “Notably, The North Face x Skims collaboration set a new bar for global collaborations, execution and impact and was one of the fastest selling collections in the history of [The] North Face.”

He said they were also thrilled to see their product teams being recognized with multiple awards for design and innovation across footwear and apparel.

“The North Face core underlying brand history is oversized relative to the size of this business, in my opinion, and I love that position,” the CEO said. “It means growth is ahead.”

Timberland

Revenue at Timberland was up 11 percent to $527 million in reported terms and up 12 percent in constant-currency terms.

Brand revenues in the Americas was up 13 percent on a reported basis and up 14 percent in constant-currency terms. The brand saw revenues increase 8 percent in the EMEA region. APAC revenues for Timberland were up 14 percent in reported terms and up 15 percent in constant-currency terms.

Dickies

Dickies brand revenues were down 10 percent to $133.6 million in the third quarter. The Americas business was down 9 percent year-over-year. The EMEA business appears to be tanking for the Dickies brand, falling in the mid-20 percent range. Revenues in the APAC region were up 10 percent for the quarter.

Vans

The company’s Vans brand saw fiscal third quarter overall revenue down 8 percent year-over-year on a constant-currency (cc) basis to $607.6 million, or a 9 percent year-over-year decline on a reported basis. The company said this trend exhibits a further sequential improvement for the brand compared to the fiscal second quarter, which was down 11 percent year-over-year.

The trend in Q3 is also a clear improvement against the nine-month year-to-date (YTD) period through December that saw reported sales down 14 percent on a reported basis and down 13 percent cc versus the prior-year comparative YTD period.

On a regional basis, the Americas outperformed the global trend for the brand in the third quarter, declining 5 percent in reported terms and down 4 percent cc versus the prior-year Q3 period. The EMEA region was down 8 percent in reported terms or down 9 percent cc compared to the year-ago period. APAC fell 31 percent in both reported and constant-currency terms for the third quarter.

“If you look at our Vans business in APAC, I think at its peak, it was $600 million,” offered Bracken Darrell, CEO, VF Corporation, parent of the Vans brand. “So think about how much potential there is there.” He hinted on the call that the current revenues could be in the $250 million neighborhood.

For a deep-dive on the Vans business, see the link at the bottom.

Channel Summary

VF Corp. saw consolidated Wholesale (sold to retail partners) revenues increase 8 percent year-over-year in the fiscal third quarter. Direct-to-Consumer, or DTC revenues, decline 3 percent in the qurter compared to the prior-year Q3 period.

The company finished the quarter with 1,160 owned-retail doors, compared to 1,255 doors at the end of the prior-year Q3 period.

Regional Summary

The Americas reportedly delivered another strong quarter of improvement, going positive for the first-time in over two years.China grew 4 percent year-over-year, trailing the overall APAC region trend.

Income Statement Summary

Gross margins expanded and year-to-date cost savings are said to be “progressing to plan.”

Operating income was $226 million and Adjusted operating income was $324 million

Operating margin was 8.0 percent of revenue, up 1,130 basis points compared to the prior-year Q3 period, and Adjusted operating margin was 11.4 percent of revenue, up 360 basis points year-over-year.

Earnings per share (EPS) was 43 cents per share in fiscal Q3, compared to a loss of 24 cents per share in the year-ago Q3 period. Adjusted EPS was 62 cents in Q3 compared to Adjusted EPS of 45 cents in the year-ago Q3 period.

Other key factors that were of focus in the company’s turnaround plan included reduction in net debt, which was down $1.9 billion versus the same time last year, and net inventories down 14 percent year-over-year.

Fiscal Q4 2025 Guidance

Revenue for the fiscal fourth quarter ended March 31 is expected to decline 4 percent to 6 percent year-over-year, or down 2 percent to 4 percent in constant-currency terms.

The guide implies 2025 second half revenue revenue will decline 1 percent to 2 percent year-over-year, or flat to down 1 percent in constant-currency terms.

Company CFO Paul Vogel pitched in on the call, suggesting that the company had said previously that every quarter of the year would see sequential improvement, but that may not be the reality for the fourth quarter.

“Given the strength in Q3, the balance has changed,” Vogel noted. “The second half of the year is performing in-line with our expectations and will show meaningful improvement over the first half of the year. So while we no longer expect Q4 growth to be higher than Q3, the second half growth and overall trends are improving as planned.”

He said four factors affected the trend lines. First, DTC was better than expected in Q3.

“We had a good holiday season, which was particularly stronger in [The] North Face and Timberland,” the CFO detailed. “Second, we saw outsized wholesale performance due to additional reorders, lower cancellations and a favorable shift to deliveries into Q3 from Q4, a portion of which came from partners taking on inventory sooner than expected ahead of an earlier Lunar New Year.”

Third, on reported revenue, he said FX headwinds were less than forecasted.

VFC had anticipated a 100 basis-point negative impact in the quarter, which did not occur. And fourth, on costs, he said they are starting to see the impact from some of the newer initiatives, which positively benefited distribution and IT costs.

Fourth quarter Adjusted operating loss is now forecast at a range of $30 million to $0 million.

VF increased FY 2025 free cash flow guidance to $440 million. “Relative to prior guidance of $425 million, this reflects higher than planned proceeds on sale of non-core physical assets and improved core fundamentals,” the company reported.

Reinvent Program

“Our transformation is well underway, and Q3 was an excellent quarter of progress across our business inside the company,” he shared, and talked about how VF was systematically remaking the company for long-term value creation, double-digit operating margins, and strong and sustained growth.

Darrell referred to the nine work streams shared at the October Investor Day that will essentially bring the company to best-of-breed processes and the reset of the entire leadership team that was part of the process to turn the business around.

“But you might not be aware that we’re now resetting the rest of the organization beneath those leaders,” he added. “So between the work streams we spoke about in October and the organization changes I’m explaining here, we’re building new structures and processes to be more effective, more efficient and in the end, more creative, it’s not just about saving money.”

Darrell continued, sharing, “If I sound energized by this, it’s because I am. This is going to create strong value, great products, elevated brands and a place to grow and learn for our people. Now enough about what’s going on inside the company.”

Darrell also provided an update on the Reinvent program, designed to turn the business around for the future. The Reinvent program has four stated priorities: Lower the cost base; Strengthen our balance sheet; Fix the U.S. business; and Deliver the Vans turnaround.

For a deep-dive on Darrell’s comments around progress of the Reinvent program, see the link at the bottom.

Image courtesy Timberland

See below for additional SGB Media coverage on VF’s Reinvent program and the turnaround effort at Vans:

EXEC: Inside the Improving Vans Performance and Turnaround Story

EXEC: VF CEO Updates Reinvent Program Deliverables, Hints at More Cuts Coming