Urban Outfitters, Inc., parent of the Anthropologie, Free People, FP Movement, Urban Outfitters and Nuuly retail brands, reported total company net sales for the three months ended April 30, 2024, increased 7.8 percent to a record $1.20 billion.

- Total Retail segment net sales increased 5.8 percent

- Comparable Retail segment net sales increasing 4.6 percent.

- The increase in Comparable Retail segment net sales was driven by high-single-digit positive growth in digital channel sales and low-single-digit positive growth in retail store sales.

- Comparable Retail segment net sales increased 17.1 percent at Free People and 10.4 percent at Anthropologie and decreased 13.7 percent at Urban Outfitters.

- Wholesale segment net sales increased 3.4 percent driven by a 6.3 percent increase in Free People wholesale sales due to an increase in sales to department stores and specialty customers, partially offset by a decrease in Urban Outfitters wholesale sales.

- Nuuly segment net sales increased by 51.4 percent primarily driven by a 45 percent increase in average active subscribers in the current quarter versus the prior year quarter.

Analysts had expected Urban Outfitters sales to increase 6 percent, year-over-year, to $1.18 billion, with same-store sales up 3.5 percent.

“We are pleased to report record first quarter sales and earnings driven by continued strength at the Anthropologie, Free People, FP Movement and Nuuly brands,” said Richard A. Hayne, CEO, Urban Outfitters, Inc. “Customer demand remains robust for our spring and summer fashion, which bodes well for continued sales growth in Q2.”

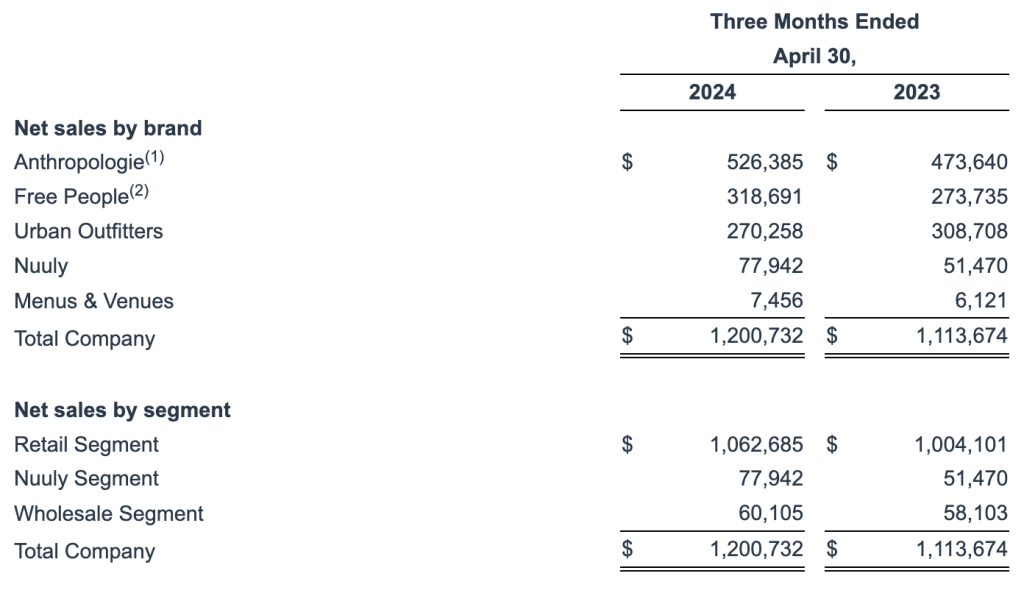

Net sales by brand and segment for the three-month periods were as follows:

The gross profit rate for the first quarter increased by 68 basis points year-over-year (YoY), and gross profit dollars increased 10.0 percent to $408.4 million from $371.2 million in the prior-year Q1 period.

First quarter adjusted gross profit rate increased by 106 basis points compared to the prior-year Q1 period, and adjusted gross profit dollars increased 11.2 percent to $413.0 million from $371.2 million. The increase in adjusted gross profit rate was said to be primarily due to higher initial merchandise markups for all brands primarily driven by company cross-functional initiatives, partially offset by higher merchandise markdowns, primarily at the Urban Outfitters brand, and a deleverage in logistics expenses.

The deleverage in logistics expenses was primarily driven by the increased penetration of Nuuly segment sales to total company sales, as well as transition and start-up expenses related to the additional Nuuly fulfillment facility that opened during the three months ended April 30, 2024. The increase in adjusted gross profit dollars was due to higher net sales and the improved adjusted gross profit rate.

First quarter selling, general and administrative (SG&A) expenses increased by $33.9 million, or 11.3 percent, compared to the prior-year Q1 period, and expressed as a percentage of net sales, deleveraged 87 basis points. The deleverage in selling, general and administrative expenses as a rate to net sales was primarily related to the Urban Outfitters brand not being able to reduce expenses at the same rate of net sales. The dollar growth in SG&A expenses was primarily related to increased marketing expenses to support double-digit customer traffic growth and increased sales at the Free People, FP Movement, Anthropologie and Nuuly brands and increased store payroll expenses to support the retail stores comparable sales growth.

Net income for the first quarter was $61.8 million, or 65 cents per diluted share.

Adjusted net income quarter was $65.5 million, or 69 cents per diluted share, an impressive 23 percent increase YoY. Adjusted net income and earnings per diluted share for the 2024 first quarter excludes store impairment and lease abandonment charges.

Analysts had expected URBN earnings per share to fall 5 percent to 53 cents in the quarter, according to FactSet.

Total inventory at quarter-end was down by $11.3 million, or 1.9 percent, compared to total inventory as of April 30, 2023. Total Retail segment inventory decreased 2.3 percent, while Retail segment comparable inventory decreased 4.7 percent. Wholesale segment inventory increased by 2.1 percent.

During the three months ended April 30, 2024, the company opened a total of 8 new retail locations including: 4 Urban Outfitters stores, 2 Anthropologie stores and 2 Free People stores (including 1 FP Movement store); and closed 4 retail locations including: 2 Urban Outfitters stores, 1 Anthropologie store and 1 Free People store.

Image courtesy Urban Outfitters, Inc.