Unifi Inc. raised its sales guidance for its fiscal year due to strength in Repreve fiber brand in its second quarter ended December 24, but slightly moderated its earnings guidance due to a sharp uptick in raw material costs.

Second Quarter Fiscal 2018 Highlights

- Net sales increased $12.3 million, or 7.9 percent, to $167.5 million, compared to $155.2 million for the second quarter of fiscal 2017, and increased $11.4 million, or 7.4 percent, when excluding the impact of foreign currency translation;

- Revenues from premium value-added (“PVA”) products grew more than 20 percent compared to the second quarter of fiscal 2017, and represented more than 45 percent of consolidated net sales;

- Gross margin of 13.5 percent, compared to 14.3 percent for the second quarter of fiscal 2017;

- Operating income of $7.8 million, compared to $9.0 million for the second quarter of fiscal 2017;

- Diluted EPS of $0.63, compared to $0.25 for the second quarter of fiscal 2017, and Adjusted EPS of $0.43, compared to $0.34 for the second quarter of fiscal 2017; and

- Fiscal 2018 outlook is updated by raising top-line expectations and adjusting operating income and earnings guidance to reflect higher costs.

“These second quarter results demonstrated strength across our product portfolio, driving revenue growth of 7.9 percent,” said Kevin Hall, chairman and CEO of Unifi. “An acceleration in the expansion of our PVA brands, like Repreve, drove PVA revenues to more than 45 percent of our consolidated net sales. We remain encouraged by the many brands, retailers and mills who have adopted Unifi’s differentiated products, and are finding value in partnering with our recycling, sustainability and innovation efforts.”

Hall continued, “At the same time, we experienced a rapid rise in raw material costs during the quarter, and we are seeking to counter this through appropriate price increases and improved sales mix through the balance of the fiscal year.”

Second Quarter Fiscal 2018 Operational Review

Net sales were $167.5 million for the second quarter of fiscal 2018, compared to $155.2 million for the second quarter of fiscal 2017. Revenue growth was driven by an overall increase in sales volume, led by recycled product sales in Asia and North America, together with continued momentum and strong performance in Brazil. Gross margin was 13.5 percent for the second quarter of fiscal 2018, compared to 14.3 percent for the second quarter of fiscal 2017, reflecting a lower-priced sales mix and cost pressures, primarily relating to raw materials.

Operating income was $7.8 million for the second quarter of fiscal 2018, compared to $9.0 million for the second quarter of fiscal 2017, as second quarter fiscal 2018 operating income reflected higher compensation and marketing expenses for expanded commercial efforts.

Net income was $11.8 million for the second quarter of fiscal 2018, compared to $4.6 million for the second quarter of fiscal 2017. Net income for the second quarter of fiscal 2018 benefited from a lower effective tax rate, but was unfavorably impacted by higher administrative expenses. Net income for the second quarter of fiscal 2018 included a $3.8 million tax benefit due to the reversal of a valuation allowance on certain historical net operating losses, while net income for the second quarter of fiscal 2017 included a loss on sale of business of $1.7 million. For the second quarter of fiscal 2018, Diluted EPS and Adjusted EPS were $0.63 and $0.43, respectively. For the second quarter of fiscal 2017, Diluted EPS and Adjusted EPS were $0.25 and $0.34, respectively. Adjusted EPS does not include separate consideration for the impact of the federal tax reform legislation signed into law in December 2017.

Adjusted EBITDA was $13.9 million for the second quarter of fiscal 2018, compared to $14.5 million for the second quarter of fiscal 2017. The decrease in Adjusted EBITDA resulted primarily from higher operating expenses in the second quarter of fiscal 2018. Adjusted EPS and Adjusted EBITDA are non-GAAP financial measures. This reconciles Adjusted EPS and Adjusted EBITDA to the most directly comparable GAAP financial measures.

Net debt (debt principal less cash and cash equivalents) was $84.9 million at December 24, 2017, compared to $94.0 million at June 25, 2017, as cash and cash equivalents grew from $35.4 million at June 25, 2017 to $48.6 million at December 24, 2017.

First Six Months of Fiscal 2018 Operational Review

Net sales were $331.7 million for the first six months of fiscal 2018, compared to $315.1 million for the first six months of fiscal 2017. Gross margin was 13.9 percent for the first six months of fiscal 2018, compared to 14.5 percent for the first six months of fiscal 2017. Operating income was $17.9 million for the first six months of fiscal 2018, compared to $21.6 million for the first six months of fiscal 2017. Net income was $20.8 million for the first six months of fiscal 2018, compared to $14.0 million for the first six months of fiscal 2017. Net income for the first six months of fiscal 2018 included a $3.8 million tax benefit due to the reversal of a valuation allowance on certain historical net operating losses, while net income for the first six months of fiscal 2017 included a loss on sale of business of $1.7 million. For the first six months of fiscal 2018, Diluted EPS and Adjusted EPS were $1.12 and $0.91, respectively. For the first six months of fiscal 2017, Diluted EPS and Adjusted EPS were $0.76 and $0.85, respectively. Adjusted EBITDA was $29.7 million for the first six months of fiscal 2018, compared to $32.4 million for the first six months of fiscal 2017.

Revised Fiscal 2018 Outlook

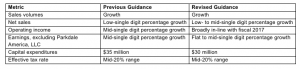

Based on the company’s most recent results and a rapid increase in raw material costs in connection with a greater than 30 percent increase in petroleum prices since July 2017, the company has updated its fiscal 2018 outlook, as reflected below:

- Revenue growth in the low to mid-single digit percentage range, driven by volume growth from continued strategic investments;

- Operating income broadly in line with fiscal 2017;

- Earnings, excluding Parkdale America, LLC, (i.e. Adjusted EBITDA) flat to mid-single digit percentage growth;

- Capital expenditures of approximately $30 million; and

- An effective tax rate for ongoing business, exclusive of significant fluctuations, in the mid-20 percent range.