Tractor Supply Company reported that net sales for the second quarter increased 1.5 percent year-over-year to $4.25 billion from $4.18 billion in the second quarter of 2023. The increase was reportedly driven by new store openings, partially offset by the decline in comparable store sales.

Comparable store sales decreased 0.5 percent in Q2, cycling an increase of 2.5 percent in the prior-year second quarter. The comp store sales decline was driven by a comparable average transaction count decline of 0.6 percent, partially offset by a comparable average ticket increase of 0.1 percent.

Comparable store sales results reportedly reflect strength in seasonal merchandise, including big-ticket items, partially offset by declines in year-round discretionary categories. As expected, consumable, usable, and edible products were modestly negative, with positive unit growth offset by average unit price pressure.

Gross profit increased 2.7 percent to $1.56 billion, compared to $1.51 billion in the prior year second quarter. Gross margin increased 43 basis points to 36.6 percent of net sales from 36.2 percent in the prior-year second quarter. The gross margin rate increase was primarily attributable to ongoing lower transportation costs, disciplined product cost management and the continuance of an everyday low price strategy.

These improvements in gross margin rate were partially offset by growth in big-ticket categories, which have below chain-average margins.

Selling, general and administrative (SG&A) expenses, including depreciation and amortization, increased 4.1 percent to $994.2 million from $955.4 million in the 2023 second quarter. As a percentage of net sales, SG&A expenses increased 58 basis points to 23.4 percent from 22.8 percent in the second quarter of 2023. The increase in SG&A as a percent of net sales was primarily attributable to planned growth investments, which included onboarding a new distribution center, higher depreciation and amortization and modest deleverage of the company’s fixed costs given the decline in comparable store sales. Productivity improvements and strong cost control partially offset these factors.

During the second quarter, the company’s ongoing sale-leaseback strategy benefited SG&A by approximately 12 basis points, net of transaction and repair costs, from the sale of two Tractor Supply locations.

Operating income was $561.5 million in the second quarter, compared to $559.3 million in the second quarter of 2023.

The effective income tax rate was 22.7 percent in Q2 compared to 23.0 percent in the second quarter of 2023.

Net income increased 0.9 percent to $425.2 million, or $3.93 per diluted share, compared to $421.2 million, $3.83 per diluted share, in the 2023 Q2 period. Diluted EPS increased 2.6 percent.

The company repurchased approximately 0.5 million shares of its common stock for $139.2 million and paid quarterly cash dividends totaling $118.5 million, returning a total of $257.7 million of capital to shareholders in the second quarter of 2024.

TSCO opened 21 new Tractor Supply stores and three new Petsense by Tractor Supply stores in the second quarter of 2024.

Fiscal Year 2024 Financial Outlook

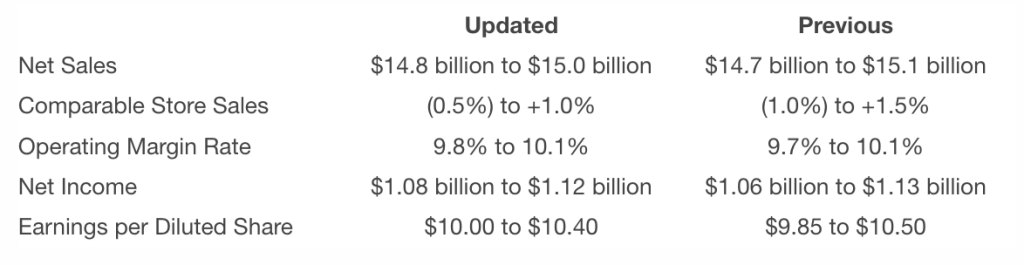

Tractor Supply is updating its financial guidance based on year-to-date performance and its outlook. For fiscal year 2024, the company now expects the following:

Image courtesy Tractor Supply Company