Acushnet Holdings Corp., the parent of the Titleist and FootJoy golf brands, delivered a healthy first quarter with both earnings and sales exceeding analyst estimates. However, officials declined to raise the company’s outlook due to uncertainties in the marketplace tied to tariffs and expects some pricing actions to offset the related costs.

“We expect to mitigate a good portion of the current tariff impact by end of year and expect to realize further relief in 2026 from some of our actions that will take longer to materialize,” offered David Maher, president and CEO, on an analyst call. “With regards to pricing, we have not yet passed along increased tariff costs to consumers but do anticipate taking some regional pricing action on select products as we gain clarity on the extent and timing of our mitigation efforts.”

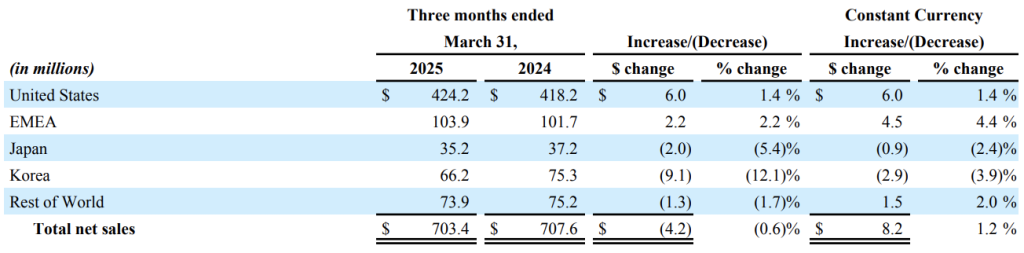

Consolidated sales for the first quarter decreased 0.6 percent year-over-year (y/y) to $703.4 million, reflecting a 1.2 percent increase in constant-currency (cc) terms. Sales topped Wall Street’s consensus estimate of $698.2 million, boosted by momentum in Titleist golf equipment and golf gear segments.

Adjusted EBITDA was $138.9 million in Q1, down 9.6 percent y/y. The decline was related to Acushnet’s decision to step up investment in its equipment segment in 2025. Adjusted EBITDA topped analysts’ average estimates of $136.8 million.

Net income increased 13.2 percent y/y to $99.4 million, or $1.62 a share, in the first quarter, primarily due to a non-cash pre-tax gain of $20.9 million related to the de-consolidation of the FootJoy golf shoe joint venture, partially offset by lower income from operations. EPS easily topped analysts’ consensus estimate of $1.32.

U.S. region sales grew 1.4 percent, driven by a 3.8 percent y/y increase in Titleist Golf Equipment, partially offset by a 5.5 percent y/y decrease in FootJoy Golf Wear. The increase in Titleist Golf Equipment was driven by higher sales volumes of GT drivers, hybrids and fairways and Scotty Cameron Studio Styleputters. Higher sales volumes were also seen in the latest generation Pro V1 and Pro V1x golf balls. These increases were partially offset by lower sales volumes of second model year wedges, irons and performance model golf balls. The decrease in FootJoy Golf Wear sales was reportedly due primarily to lower sales volumes, partially offset by higher average selling prices across all product categories.

Regions outside the U.S. decreased 3.5 percent (+0.8 percent cc) y/y in Q1:

- EMEA’s sales increased 2.2 percent (+4.4 percent cc) with gains across all product segments, primarily in Titleist Golf Equipment and Golf Gear.

- In Japan, sales declined 5.4 percent (-2.4 percent cc) due to lower net sales in FootJoy Golf Wear, primarily footwear.

- In Korea, sales decreased 12.1 percent (-3.9 percent cc) primarily due to lower sales in FootJoy Golf Wear, primarily footwear, and products that are not allocated to one of the company’s three reportable segments, partially offset by gains in Titleist Golf Equipment.

- In Rest of World, sales declined 1.3 percent (+2.0 percent cc) with the currency-neutral gain traced to higher net sales in Titleist Golf Equipment.

“The season started slowly in Japan and Korea due to poor weather, but we have seen improved conditions in March and April,” said Maher on the call. “With a solid first quarter in the books, we are now focused on executing a full slate of ball, club, and footwear fitting events across all markets. Despite poor weather and a slow start in the U.S. where rounds were off 2 percent, we project that total worldwide rounds of play were up slightly for the quarter, led by a nice start in EMEA and the UK, up 15 percent.”

Segment Summary

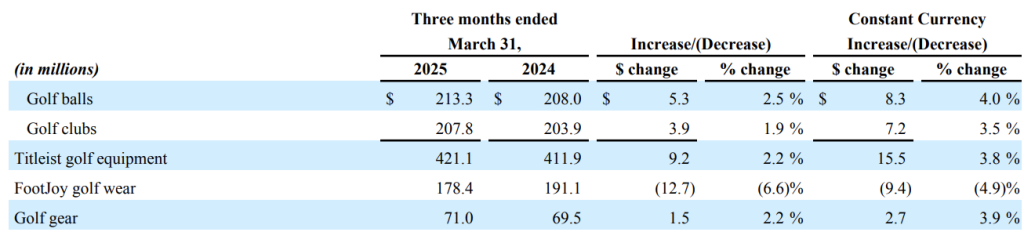

Titleist Golf Equipment net sales increased 2.2 percent (+3.8 percent cc) in the quarter with currency-neutral gains up 4.0 percent in golf balls and 3.5 percent in golf clubs.

Maher said the golf ball growth was “led by the successful launch of new Pro V1 and Pro V1x golf ball models and continued momentum across our Titleist GT metals franchise, which was expanded in Q1 with the launch of new hybrids and GT1metals,” said Maher. Regionally, the gains in golf balls were led by the EMEA region, which was up double digits as favorable weather contributed to an early start to their golf season. He noted that for context, golf ball revenues were up 11 percent on a reported basis versus two years ago, its most recent Pro V1 launch quarter.

The gains in golf clubs were supported by higher average selling prices in golf clubs. In addition, higher sales volumes of recently introduced GT drivers, hybrids and fairways and Scotty Cameron Studio Style putters were reportedly more than offset by lower sales volumes of second model year wedges, irons and performance model golf balls. Golf club sales were up 15 percent on a reported basis when compared to the similar product launch cycle in Q1 2023. Maher said, “In most cases, we would expect Q1 club sales to be down in an odd year given the challenging comp against even year bulky wedge launches. This was obviously not the case in 2025 as GT Metals and Scotty Cameron putters contributed to our growth over last year.”

FootJoy Golf Wear posted a 6.6 percent decrease in net sales (-4.9 percent cc) in Q1. The decline was attributable to lower closeout footwear sales and some targeted product line rationalization across the brand. Maher said, “We are pleased with the initial responses to new HyperFlex, Premier, and Quantum footwear models.”

FootJoy gloves “had a nice start in the quarter” and benefited from higher average selling prices. Said Maher, “As noted on our last call, we characterized 2025 as a year of stability and improving profitability for FootJoy with a higher percentage of premium sales as we exit what has been a two-year period of correction in the global footwear space.”

Golf Gear delivered a 2.2 percent increase (+3.9 percent cc) in net sales, supported by higher average selling prices across all product categories, partially offset by lower sales volumes in golf bags. Growth was seen in all major markets, led by EMEA and Japan. Titleist gear posted “steady gains” while the combined Club Glove and Links & Kings business was up double digits. Golf Gear margins and operating income trends “were also favorable as our team is doing good work generating operating leverage across the segment,” said Maher.

Tariff Update

Acushnet is actively working on mitigating tariff impacts, projecting a $75 million gross impact at the current tariff rates for 2025. The largest impact, or about 70 percent, relates to the China import tariff rate that’s particularly impacting the club and Footjoy segments. Through mitigation steps including adjusting its global supply chain footprint, initiating cost and productivity programs both internally and externally with suppliers, and considering selective price increases, Acushnet expects to offset greater than 50 percent of the $75 million gross tariff impact during 2025.

Acushnet CFO Sean Sullivan said price increases will be “probably the last lever we would pull.”

Maher said Acushnet’s diverse supply chain and vertical integration in golf balls, golf clubs, footwear, and golf gloves will help in efforts to mitigate the impact of tariffs.

In golf balls, roughly two-thirds of worldwide output is produced in the U.S. and its two Massachusetts-based ball plants supply the majority of its U.S. golf ball demand. Acushnet’s Thailand plant supplies Pro V1 models to all other regions, now including Canada. The golf ball business has a small exposure to tariffs from China-sourced raw materials, which is expected to be mitigated by end of the year. Titleist also ships U.S.-produced golf balls into Canada and Mexico, which are presently incurring a 25 percent tariff. Maher said, “We have not yet reacted to this temporary rate. However, if this becomes permanent, we will likely take pricing measures.”

In clubs, components are sourced from China, Taiwan, Vietnam and Acushnet operates its own assembly centers in most major regions. All of its U.S. club demand is assembled in its Carlsbad, CA facility. The primary golf club tariff exposure currently is from China-sourced clubheads shipped into the U.S. Said Maher, “Over time, we will reroute these heads to our international facilities and supply our U.S. production center with components sourced from the U.S., Taiwan, and Vietnam.”

Footwear sourcing was recently relocated from China to Vietnam, although Vietnam still faces the threat of significant tariffs. Vietnam continues to face a 10 percent broadline tariff but had initially faced a 46 percent tariff rate that was paused for 90 days during negotiations. FootJoy apparel also faces some exposure to China production. Finally, a standalone glove facility in Thailand produces both FootJoy and Titleist gloves.

2025 Outlook

Given the current macroeconomic uncertainty, the company said it is not updating its previously issued consolidated full-year outlook. When it released fourth-quarter results in February, the company said it expected full-year consolidated net sales to be approximately $2.49 to $2.54 billion on a reported basis, up 2.2 percent at the midpoint. On a constant currency basis, sales are expected to be up between 2.6 percent and 4.6 percent. Full year adjusted EBITDA is expected to be approximately $405 to $420 million compared with $404.4 million in FY24.

Acushnet reiterated that it expects first-half sales to be up low-single digits y/y. Most of the additional tariff impact is projected to fall in the second half based on current inventory levels. For Q2, an approximately $4 million tariff impact is projected. Including this impact, first-half adjusted EBITDA is projected to be down low-single digits compared to last year’s first half.

In the Q&A section of the call, Maher said Acushnet doesn’t typically adjust its outlook in the first quarter as it uses the second quarter to gain a better read on demand. He said, “We feel really positive about our consumer and the structural health of the industry. Certainly, we’re careful and cautious with regards to what’s happening from a tariff perspective. But our guide, I’m not sure it’s a pause as much as this is how we generally play it this time of year.”

Image courtesy Titleist