Thule Group President and CEO Mattias Ankarberg reported the company had a “good” third quarter of the year, with sales increasing, good profitability and cash flow reached a record high level.

“Our many new products continue to drive growth and the work to build market positions in the new categories continues as planned,” Ankarberg wrote in his note to investors the accompanied the company’s third quarter report.

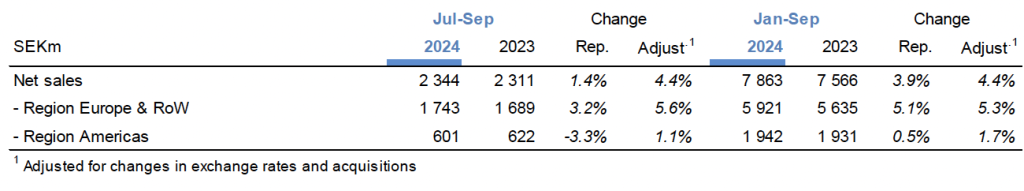

Sales in the third quarter increased 4.4 percent in constant-currency terms in the third quarter compared to the Q3 period last year.

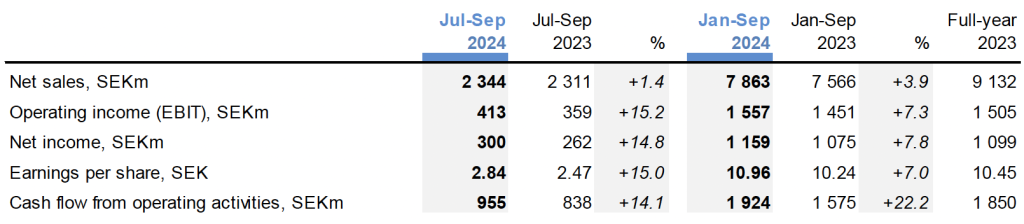

Net sales amounted to SEK 2,344 million, representing an increase of 1.4 percent in reported terms compared to SEK 2,311 million in Q3 last year. Adjusted for exchange rate fluctuations and acquisitions, net sales for the Group increased 4.4 percent. Ankarberg said sales growth was driven by many well-received product launches and by bike-related products.

E-Commerce

During the third quarter, sales through thule.com opened in two more countries, Finland and Portugal, which led to immediate growth in the DTC channel.

Regional Review

Net sales in Region Americas amounted to SEK 601 million, down 3.3 percent compared to SEK 622 million in Q3 last year, but sales increased 1.1 after currency adjustment compared with the third quarter of 2023. The North American market remained challenging. Sales of bike-related products and Juvenile & Pet contributed to growth for the quarter. Sales declined within Packs, Bags & Luggage and RV Products. Growth was positive in Canada. Sales declined in the U.S. market.

“The market continues to be challenging, with cautious consumers and retailers,” Ankarberg continued. “The North American market remains more challenging than its European counterpart.”

In Region Europe & RoW (Rest of World), net sales totaled SEK 1,743 million in the third quarter, up 3.2 percent compared to SEK 1,689 million in Q3 2023, and 5.6 percent adjusted for exchange rates and acquisitions.

Region Europe & RoW sales growth in the quarter was said to be mainly driven by bike-related products and new product launches in Juvenile & Pet. Sales increased somewhat in RV Products with the industry experiencing a weaker period. We continued to open own sales via thule.com in Europe, and launched in Portugal and Finland during the quarter. The DTC channel continued to grow. Markets that performed included all of the Benelux countries, the DACH region and France.

Category Review

Ankarberg said sales growth was driven by many well-received product launches and by bike-related products but growth was said to be strongest within Juvenile & Pet, which increased 15 percent. Sales reportedly remained unchanged in RV Products, not surprising given the state of that sector this year. Sales to manufacturers (OE) declined notably and were offset by good growth in sales to dealers.

Sports & Cargo Carriers

Sales increased 5 percent after currency adjustment in the third quarter. Sales in the largest subcategory, bike carriers, increased based on additional launches during the quarter, though sales in the winter category declined. Sport&Cargo Carriers accounted for 63 percent of total sales.

RV Products

Sales remained unchanged in RV Products with the industry experiencing a weaker period. Sales to retailers increased, while sales to manufacturers decreased. RV Products accounted for 16 percent of total sales with a focus on the European market.

Juvenile & Pet

Currency-adjusted sales increased 15 percent compared with the year-earlier quarter. The increase in sales of strollers was strongly driven by the launch of the upgraded version of our Thule Urban Glide 3 and Thule Urban Glide 4-wheel and the newly launched, next-generation series multisport and bike trailers, Thule Chariot. Thule Allax, the dog transportation crate that was launched in the first quarter, contributed to sales growth and in the third quarter Thule Bexey, a bike trailer for the dog transportation, was launched. Juvenile & Pet accounted for 12 percent of total sales.

Packs, Bags & Luggage

Currency-adjusted sales in Packs, Bags & Luggage declined 4 percent year-on-year. Sales have declined for legacy products, which we continue to actively phase out. The Thule brand range also posted weaker sales. Packs, Bags & Luggage accounted for 9 percent of total sales in the quarter.

Income Statement

Gross Margin

Gross income for the quarter totaled SEK 1,006 million, or 42.9 percent of net sales, in the third quarter, compared to grow income of SEK 918 million, or 39.7 percent, in Q3 last year. Gross income was said to be positively impacted by product mix, increased volumes and lower material costs.

Operating Income

Operating income (EBIT) amounted to SEK 413 million, or 17.6 percent of net sales, in the third quarter, up from SEK 359 million, or 15.5 percent, in Q3 2023. Operating income was said to be positively impacted by an improved gross margin, but costs for product launches were also reportedly higher year-over-year.

Net Income

In the third quarter, net income was reported at SEK 300 million, corresponding to earnings per share of SEK 2.84 before and after dilution. For the year-earlier period, net income totaled SEK 262 million, corresponding to earnings per share of SEK 2.47 before and after dilution.

Cash Flow

Cash flow from operating activities for the quarter was SEK 955 million, up from SEK 838 million in the year-ago period. Cash flow from operating activities before changes in working capital was SEK 333 million and cash flow from changes in working capital was SEK 622 million compared with SEK 535 million in the year-ago Q3 period. During the quarter, the cash flow was reportedly impacted by a payment amounting to net SEK 7 million for the acquisition of Reacha.

“Together with an already strong balance sheet, this provides us with a continued capability to invest for the future,” Ankarberg noted.

Acquisition

At the start of July, Thule Group acquired the German company Reacha (good goods tegernsee Gmbh). The company reportedly has an innovative product design that makes it possible for people to cycle to the sea or lake with a kayak, surfboard or SUP (stand up paddleboard ) carried on a bike trailer. Operations are based in Germany with the majority of sales in Europe. The company had sales of about SEK 9 million in 2023 and the purchase consideration was about SEK 11 million (including net debt) with the possibility of an earn-out payment of a maximum of SEK 4 million based on the outcome for 2024. Thule said bike trailers is an attractive and growing segment and operations will be integrated in Thule’s product portfolio and distribution channels.

Sustainability

“We continue to work towards our ambitious sustainability targets,” Ankarberg added. “In the third quarter we introduced several products designed with a higher share of recycled material and completed the installation of air-source heat pumps at one of our largest factories, both of which will help us reach our target of net zero emissions.”

Image courtesy Thule Group