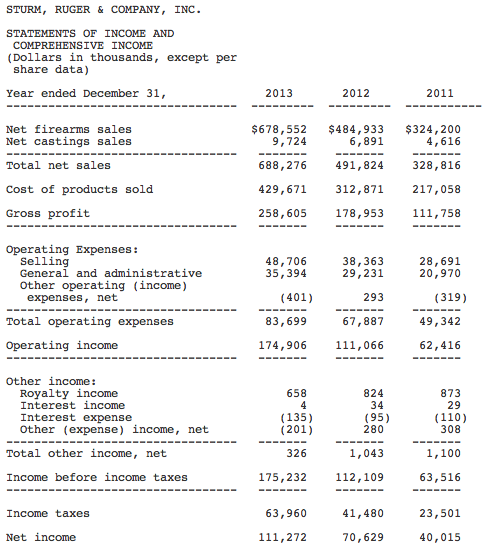

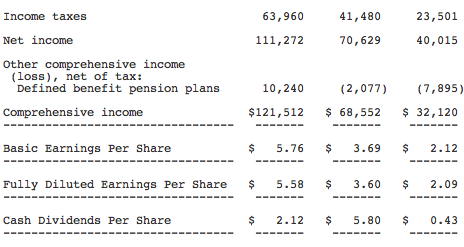

Sturm, Ruger & Company, Inc. reported sales rose 28.3 percent in the fourth quarter, to $181.9 million from $141.8 million a year ago. Earnings grew to $1.33 per share from $1.00 a year ago but missed the average analyst estimate of $1.38 per share.

Chief Executive Officer Michael O. Fifer made the following observations related to the Company's results:

— Our earnings increased 55% in 2013, driven by the 40% growth in sales and our ongoing focus on continuous improvement in our operations.

— Our EBITDA of $195.7 million increased 54% from our 2012 EBITDA of $127.1 million.

— New product introductions were a significant component of our sales growth as new product sales represented $195.8 million or 29% of firearm sales in 2013. New product introductions in 2013 included the LC380 pistol, the SR45 pistol, the Ruger American Rimfire rifle, the SR-762 rifle, and the Red Label II shotgun.

— Demand for our products outpaced the growth in industry demand as measured by the National Instant Criminal Background Check System (“NICS”) background checks (as adjusted by the National Shooting Sports Foundation) for 2013 as illustrated below:

Increase in estimated Ruger Units Sold from Distributors to Retailers 18%

Increase in total adjusted NICS Background Checks 7%

— Cash generated from operations during 2013 was $120 million. At December 31, 2013, our cash totaled $55 million. Our current ratio is 1.8 to 1 and we have no debt.

— In 2013, capital expenditures totaled $54.6 million, much of it related to machinery and equipment for new products, the purchase and building improvements of the Mayodan, North Carolina facility, and the expansion of production capacity for products in greater demand. We expect to invest approximately $35 million on capital expenditures during 2014 as we continue to prioritize new product development.

— In 2013, the Company returned $41.1 million to its shareholders through the payment of dividends.

— At December 31, 2013, stockholders' equity was $179.1 million, which equates to a book value of $9.26 per share, of which $2.85 per share was cash and equivalents.

— During the fourth quarter of 2013, we began to manufacture a limited quantity of rifles at our 220,000 square foot facility in Mayodan, North Carolina that we acquired in September of 2013. Firearm production at the During the fourth quarter of 2013, we began to manufacture a limited quantity of rifles at our 220,000 square foot facility in Mayodan, North Carolina that we acquired in September of 2013. Firearm production at the Mayodan facility is expected to increase during 2014.