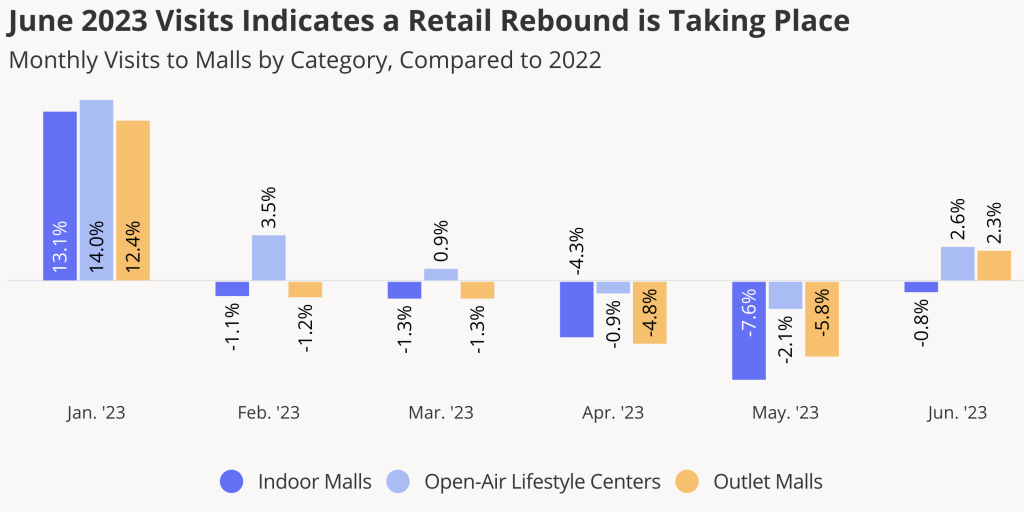

Following a rocky start to 2023, the latest U.S. mall foot traffic figures suggest a retail recovery, according to Placer.ai’s most recent Mall Index*.

After four straight months of year-over-year (YoY) visit declines, indoor malls, open-air lifestyle centers and outlet malls saw YoY visits rebound significantly in June 2023. Foot traffic at indoor malls was on par with June 2022 levels, while open-air lifestyle centers and outlet malls received YoY visit bumps of 2.6 percent and 2.3 percent, respectively.

Month-over-month (MoM) consumer visitation patterns to malls also provided a reason for optimism. Last year, MoM mall visits fell between May and June for indoor and open-air lifestyle centers and remained constant for outlet malls, likely because in 2023, May had more calendar days and special events, including Mother’s Day and Memorial Day. But this year, visits to all mall categories Placer.ai analyzed were up in June relative to May 2023, another sign that a recovery is on the horizon.

In another encouraging sign, median dwell times remained up. In June 2023, indoor malls, open-air lifestyle centers and outlet malls saw a 6.8 percent, 5.4 percent and 11.5 percent YoY increase in median dwell time, respectively. For indoor malls and outlet malls, this marked the largest YoY increase in median dwell time all year, while open-air lifestyle centers saw the largest YoY increase in median dwell times since January 2023, compared to the Omicron period in 2022 that impacted dwell times.

So even as the YoY visit gaps narrow and MoM visits grow, consumers continue to dedicate more time to each mall visit, which indicates that the tide could be turning with recent retail challenges, with consumers gearing up to spend money again after months of holding back. If the positive visitation trends to malls continue and median dwell times remain high, H2 2023 will likely bring substantial relief to the retail space in general and malls in particular, timed with back-to-school and the holiday shopping season.

Zooming Into Open-Air Lifestyle Centers

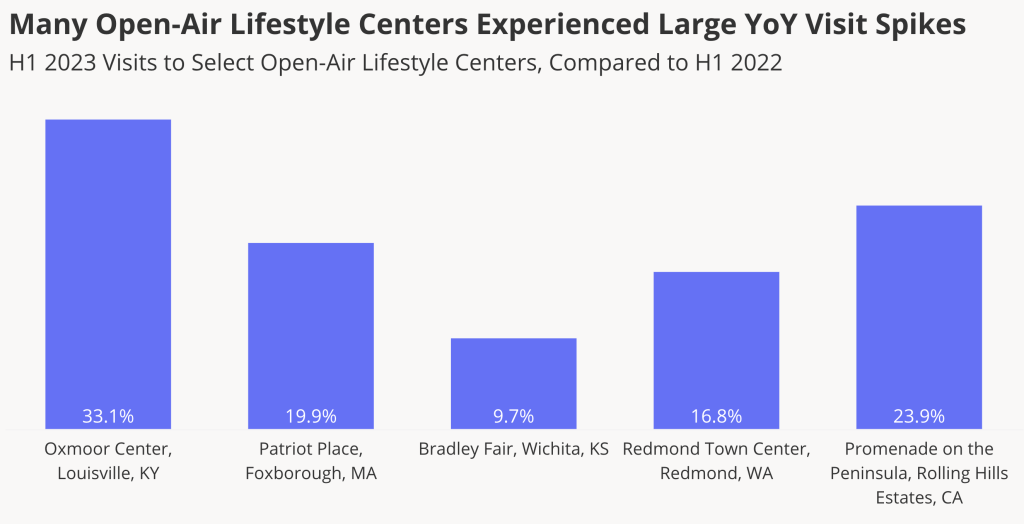

Although June 2023 brought marked improvement to the visitation trends of all mall categories analyzed, looking back on H1 2023, placer.ai data highlights the resilience of open-air lifestyle centers. While overall H1 2023 visits to indoor and outlet malls dropped slightly relative to the same period in 2022, traffic to open-air lifestyle centers increased 2.7 percent in the same period. And diving deeper into the company’s location intelligence data reveals which consumer segment is fueling this strength.

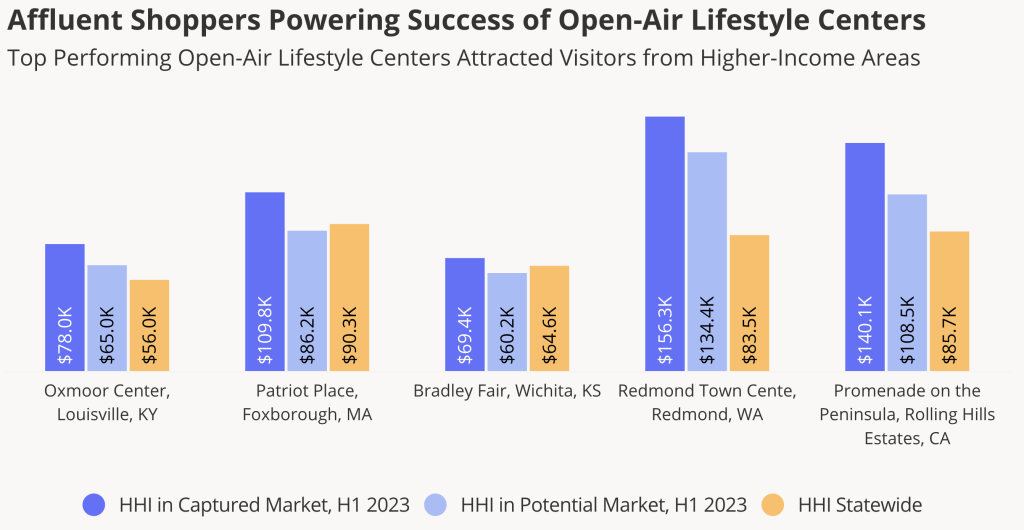

Successful Open-Air Lifestyle Centers Attract High-Income Shoppers

Analyzing visitor demographics for some of the top-performing open-air lifestyle centers across the U.S. indicates that affluent shoppers drive visits to the category.

In H1 2023, YoY visits to the Oxmoor Center in Louisville, KY, Patriot Place in Foxborough, MA, Bradley Fair in Wichita, KS, Redmond Town Center in Redmond, WA, and the Promenade on the Peninsula in Rolling Hills Estates, CA grew between 9.7 percent and 33.1 percent. And during the same period, the median Herfindahl–Hirschman Index (HHI) in the shopping centers trade areas captured market was higher than the median HHI in the centers’ potential market and the statewide median HHI.

A mall’s potential market consists of the areas where mall visitors reside, weighted according to the population size of each Census Block Group (CBG) of the trade areas. The captured market consists of where visitors to the mall venues reside, but weighted according to the actual visit share to the mall from each CBG.

A higher median HHI in a mall’s captured market, relative to the potential market, means that a disproportionate share of the mall’s visits comes from relatively high-income households. And the comparatively affluent clientele of many open-air lifestyle centers could, in turn, explain the category’s relative strength since this segment is likely not as impacted, though potentially more drawn to the value many outlet malls are oriented to, by the current economic headwinds as other consumer profiles.

Looking Ahead To H2 2023

As inflation begins to cool and with retail foot traffic rallying, malls appear poised for a strong summer sell season in 2023. And with the warm weather encouraging outdoor recreation, open-air lifestyle centers, which have pulled ahead of the pack, could continue outperforming their peers.

To read more of Placer.ai’s data-driven results, go here.

*The Placer.ai Mall Index analyzes data from 100 top-tier indoor malls, 100 open-air lifestyle centers, not including outlet malls, and 100 outlet malls in urban and suburban areas in the U.S. Placer.ai uses de-identified location information from a panel of tens of millions of devices and processes the data using AI and machine learning capabilities to make estimations about overall visits to specific locations.

Photo courtesy Oxmoor Center, Louisville, KY. Charts courtesy Placer.ai