Shopping for second-hand clothes has become popular, especially among consumers who want to get more bang for their buck, hunt for vintage or reduce their environmental footprint; however, while many enjoy finding deals while thrifting, this is common among discount shoppers.

The luxury fashion resale industry is worth close to $50 billion, and ongoing CivicScience polling data shows that close to 35 percent of U.S. adults are at least “Somewhat Likely” to purchase second-hand luxury fashion and/or accessories in the next 30 days (n=2,140 responses from March 22 to April 2, 2024).

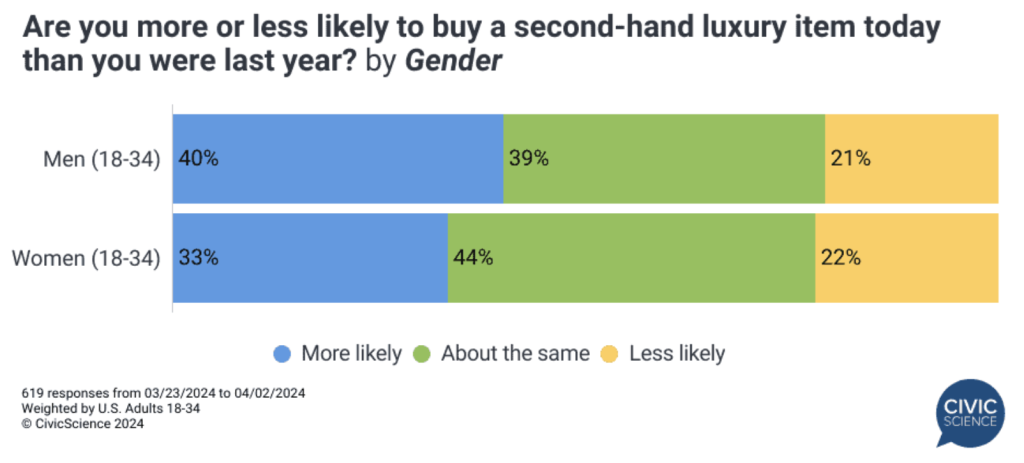

CivicScience said in a blog post that the greatest interest in second-hand luxury fashion is from the Gen Z generation, followed by Millennials. There is also a significant shift in consumer behavior, with 40 percent of men between the ages of 18 and 34 indicating they are more likely to purchase second-hand luxury today than in 2023, compared to 33 percent of women in this age group. CivicScience reported this is not a fad but a growing movement.

Convenience Matters

With increased interest in online thrifting, especially among the Gen Z demographic, CivicScience said some consumers are looking for more efficient thrifting methods in its latest report.

The market research firm’s data indicates that 37 percent of consumers purchase second-hand luxury online, with Ebay reigning supreme, and 57 percent of those who bought second-hand luxury fashion in the last year did so on Ebay, followed by 31 percent who purchased from Poshmark.

Trends and Social Media

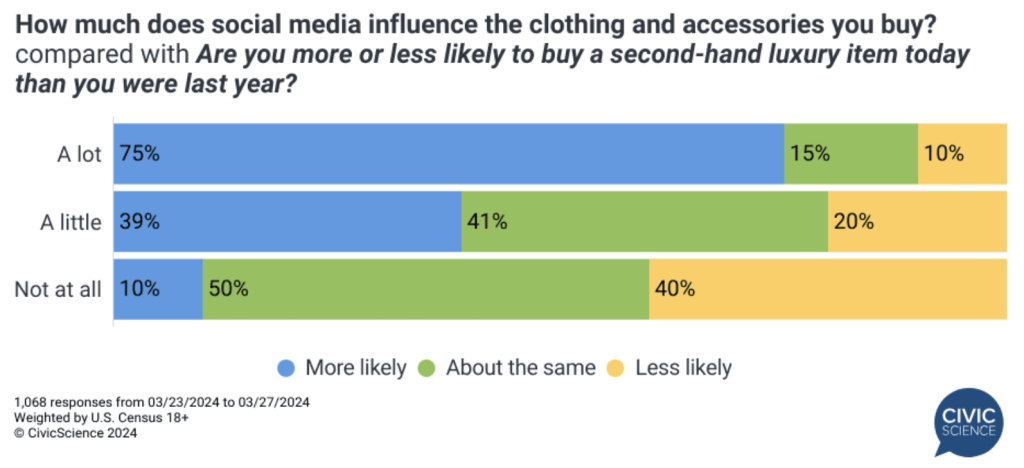

CivicScience reported that it is not surprising that consumers who follow fashion trends and styles are more likely to be interested in buying second-hand luxury goods.

- Forty-five percent of respondents who indicated they follow trends “very closely” also responded that they were “much more likely” to purchase a second-hand luxury item today than in 2023, compared to only 6 percent who said they were “much less likely.”

- CivicScience also reported that social media users showed greater interest in second-hand luxury fashion. The company examined ties between TikTok users and thrifting, with new polling data showing a connection between social media and the second-hand luxury fashion market.

- Seventy-five percent of respondents who were influenced “a lot” by fashion they saw on social media also indicated they were more likely to purchase second-hand luxury fashion today than they were in 2023, compared to only 9 percent of those who are “not at all” influenced by fashion they saw on social media.

High Risk, High Reward

While second-hand luxury fashion has gained popularity in some markets, many consumers remain weary of these items, especially those sold online.

Thirty-nine percent of respondents who indicated that they prefer buying new luxury items over second-hand items reported that they were “very concerned” about the risk of purchasing fake second-hand luxury goods online, with an additional 29 percent indicating they were “somewhat concerned.” Online buyers show less severe concern (1,887 responses from March 22-26, 2024).

Although many websites now offer authentication checking to ensure the legitimacy of online merchandise, 21 percent of respondents who prefer to buy second-hand luxury apparel and accessories versus new said that they are not familiar with the concept, indicating their lack of awareness could contribute to their hesitancy; however, 40 percent of respondents expressed some level of confidence in these checks (1,253 responses from March 22-26, 2024).

Additional Insights From CivicScience Polling Data

- 24 percent of respondents indicated that they prefer to purchase luxury apparel and accessories second-hand, compared to 22 percent who said they prefer to buy new (n=2,004 responses from March 22-26, 2024).

- More than 2 in 5 respondents who buy second-hand luxury goods are most interested in clothing. Handbags are the second most popular category, with 14 percent of respondents indicating interest (n=3,348 responses from March 22-26,2024.)

- Many respondents who shop at department stores that sell high-end or luxury items have turned to second-hand options, with 48 percent of Bloomingdale’s shoppers “very likely” to purchase second-hand luxury fashion in the next 30 days, compared to 45 percent of Saks shoppers and 38 percent of Nordstrom shoppers (n=888-905 responses as of March 30, 2024).

CivicScience has over 500,000 cross-able questions, allowing retailers to detect unexpected insights and gain a pulse on how their customers respond to the latest news and events. To learn more, go here.

Image courtesy Triple Pundit