Stifel Financial’s NBA All-Star 2025 Athletic Footwear Survey found that the market’s “challenger” brands are again leading the trends in the fashion sneaker market.

The firm’s survey highlights the move by consumers to embrace newness across various trends and increase the popularity of challenger brands, which the company first underscored in its 2024 Back-To-School Athletic Footwear Survey. That shift in the market ultimately led to a change in top leadership at Nike, Inc. and has since given way to even more challenger brands taking shelf space and share in the lifestyle sneaker market.

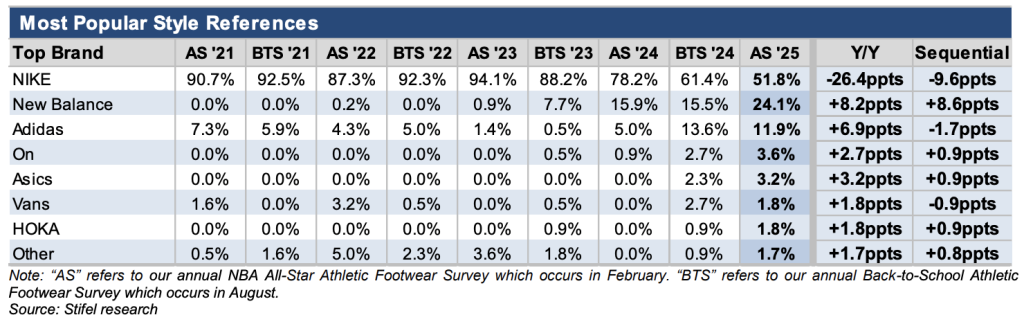

Stifel said that Nike remains the most popular brand, and the brand’s Dunk model remains the most frequently mentioned style “flattered by discounting.” However, the firm noted that Nike, including the Jordan brand, references as the most popular brand were down 26.4 percentage points (ppts) year-over-year (y/y) to 51.8 percent of total checks — an all-time low for the Nike brand.

The firm also noted that Nike styles represented three of the Top 5 styles this year vs. the 10-year historical average of 4.1 of the Top 5 in its previous survey reports.

The data in Stifel Financial’s NBA All-Star 2025 Athletic Footwear Survey (based on a survey fielded the week of the NBA All-Star game) shows increasing marketplace fragmentation, according to the company’s observations and analysis.

New Balance references as the most popular brand increased 8.2 ppts y/y to 24.1 percent, Adidas references increased 6.9 ppts y/y to 11.9 percent and On references increased 2.7 ppts to 3.6 percent of total references. Asics, Vans and Hoka collectively combined for 6.8 ppts of popularity reference share gain in the latest report.

Stifel said in the report that, helped by category growth, shelf space gains and the emergence of a DTC model, which affords more dollars for reinvestment, competing brands have a newfound scale.

“Nike dominates court styles, but fashion trends have shifted, and challenger brands each have a unique identity that, collectively, Nike has struggled to counter,” Stifel noted.

Most Popular References by Retailer

- Nike brand offerings, including Jordan and Converse, were referenced as the most popular styles in 51.8 percent of checks, a 26.4 ppts y/y decline and a 9.6 ppts sequential decline from Stifel’s Back-to-School checks in August 2024.

- New Balance styles were referenced as the most popular in 24.1 percent (+8.2 ppts y/y) of checks. Stifel said New Balance registering as the second most popular brand is notable given that in Back-to-School 2022, not one New Balance style registered a mention as most popular.

- Adidas styles were mentioned as the most popular in 11.9 percent of stores surveyed, up 6.9 ppts y/y, but down 1.7 ppts sequentially from an all-time high recorded in Back-to-School 2024. The popularity of Terrace styles (Samba, Campus, Gazelle) accounted for the year-over-year increase in Adidas brand’s most popular style mentions.

- On brand styles were referenced as most popular in 3.6 percent of checks, increasing +0.9 ppts y/y and +2.7 ppts from the Back-to-School 2024 checks. Most popular references were almost entirely concentrated at Dick’s Sporting Goods. Notably, employee education of specific On styles has improved, and Stifel suggested that employees are recommending specific On styles, including Cloudsurfer, Cloud 6, Cloudswift, and Cloudnova.

- Asics styles were referenced as most popular in 3.2 percent of checks compared to no references in the prior-year All-Star checks and 2.3 percent in the Back-to-School 2024 checks.

- Vans Knu Skool was referenced as the most popular style at 1.8 percent of stores but, as expected, was viewed in the survey as having limited penetration in the street lifestyle channels.

- Hoka received its first references as a most popular style during an All-Star check (had received references in BTS 2023 and 2024.

Nike-Specific Analysis

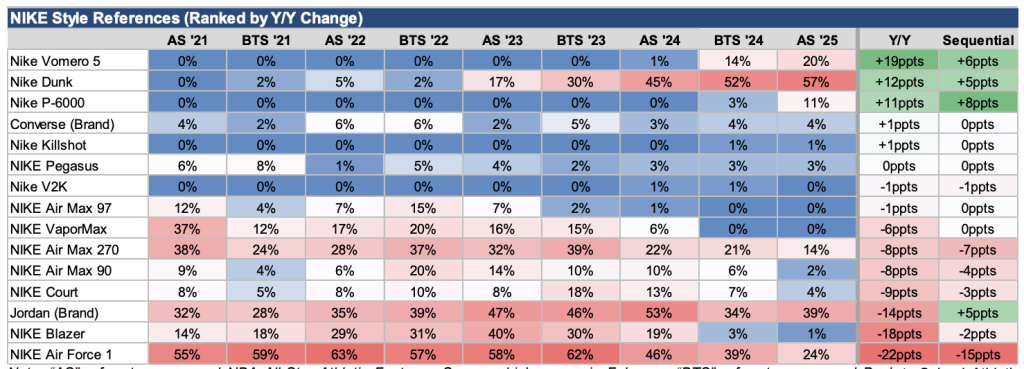

- Nike Dunks’ popularity mentions increased with scattered promotions across the marketplace and at Nike.com. The Nike Dunk increased its lead in the top style position and was mentioned in 58 percent of stores, a 13 ppts increase vs. the prior year and 6 ppts sequential increase from Back-to-School.

- Promotions were scattered with some stores selling primarily at full price and others, with certain colors, discounted. Notably, at Nike.com, key Dunk colorways, including the black-and-white Pandas, are discounted to $100 (vs. $115 regularly) when customers add to a cart.

- Jordan’s brand popularity is well below the prior-year levels. Jordan brand styles were mentioned in 39 percent of checks for All-Star 2025, declining from 53 percent in the prior year but an improvement from 34 percent in Back-to-School 2024.

- Observations for the brand are mixed. For specific styles, such as the Retro 3s, 4s, and 5s, inventory is becoming scarce. Jordan Retro 1s are becoming less visible in the marketplace, though store employees spoke discounts of specific Jordan 1 colorways,

- Notably, the Air Jordan Retro 1 High OG “Black Toe” Reimagined, released February 15, is easily available for purchase and is trading well below its original price at StockX.

- Nike Air Force 1 popularity is down sharply. The AF1 was mentioned in 24 percent of checks for AS 2025, falling from 46 percent in the prior year and 39 percent in the BTS 2024 checks. Conversations with store employees indicate the style is generally an afterthought and more of a safe recommendation.

- Just two non-court Nike styles resonate.

- Vomero 5, mentioned in 20 percent of stores (vs. 14 percent in BTS 2024 and 1 percent in AS 2024).

- P-6000, 11 percent of stores (vs. 3 percent in BTS 2024 and not mentioned in AS 2024).

- Nike newness not meaningfully resonating with store employees. Some key styles expected to gain popularity have not been visible in store checks.

- Nike Shox: never mentioned

- Air Max Dn: mentioned in 1 percent of stores (not previously mentioned)

- Pegasus Premium: never mentioned, though just released late January

- C1TY: never mentioned

- V2K: not mentioned (vs. 1 percent in BTS 2024 and 1 percent in AS 2024)

- Killshot: mentioned in 1 percent of stores (vs. 1 percent in BTS 2024 and not mentioned in AS 2024)

- Nike Legacy style relevance fading, suggesting popularity is more concentrated with its top styles.

- Nike Air Max 270: mentioned in 14 percent of stores (vs. 21 percent in BTS 2024 and 22 percent in AS 2024)

- Nike Court Styles: mentioned in 4 percent of stores (vs. 7 percent in BTS 2024 and 13 percent in AS 2024)

- Nike Air Max 90: mentioned in 2 percent of stores (vs. 6 percent in BTS 2024 and 10 percent in AS 2024)

- Nike Blazer: mentioned in 1 percent of stores (vs. 3 percent in BTS 2024 and 19 percent in AS 2024)

- Nike VaporMax: not mentioned (vs. not mentioned in BTS 2024 and 6 percent in AS 2024)

For access to the full survey results, contact Stifel Financial’s Jim Duffy.

Image courtesy Nike, data, analysis and tables courtesy Stifel

***

See below for more from SGB Media on Stifel’s 2024 BTS Survey:

EXEC: Stifel BTS Survey Reflects Nike’s Fading Popularity at Store Level