Yeti remained the standout performer as it continued to gain brand share on top of being one of the few companies able to post significant gains in the trailing 13-week period.

Source: SSI Data

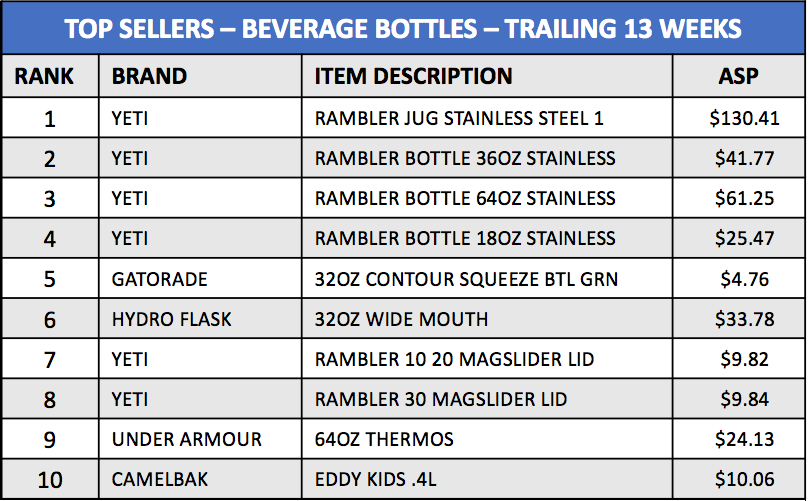

Unlike its notoriously elusive mythological namesake, Yeti was everywhere this summer. Although the Beverage Bottles category took a dip in the trailing 13-week period ended August 5, Yeti gained brand share and locked down six out of the top ten sellers in the SSI Data* Measured Market (see above).

Beverage Bottles experienced low- to mid-single-digit declines that have come heavily from the Big Box & Mall Specialty channel in the period, which is home to not only the most business for the category but also the lowest average selling prices (ASPs).

The General Internet channel experienced the greatest decline in ASPs during this period, dropping by almost 25 percent down to $19.73. The channels that make up the Specialty strata have been able to maintain stability in ASPs, but have not been spared from mid-single-digit declines.

Yeti remained the standout performer for the trailing 13-week period as the brand continues to gain brand share on top of being one of the few companies able to post significant gains during this down period. Smaller brands have taken the downturn the hardest, with recognizable players posting declines from ranging from mid single digits to strong double digits.

Lead Photo: Yeti Rambler Jug Stainless Steel One Gallon, courtesy Yeti

*SSI Data, managed by SportsOnesource, LLC, collects weekly retail point-of-sale data from over 20 retail channels of distribution and delivers timely sales trending reporting for footwear, apparel, essentials and equipment within 5 days of each fiscal week close, enabling retailers and brands to react to nearly real-time data to better manage their businesses.

For more information on how your brand performed in the 13-Week Period, email Matt Tucker at solutions@ssidata.com.