Internet growth easily outpaces brick & mortar gains in the period ended July 1.

Outdoor footwear sales grew more than 2 percent in the calendar first half of the year, with strength in hiking boots, backpacking boots and approach footwear offsetting sales declines in outdoor casual footwear and fishing waders. The core functional hiking and backpacking categories posted a solid mid-single-digit increase in the 16-week period ended July 1, 2017, with hiking boots and backpacking boots each posting double-digit growth while sales of trail shoes slipped nearly 7 percent in the period. Performance trail running sales grew nearly 2 percent in the calendar first half.

These observations and many more are contained in the SSI Data 2017 First Half Report, detailing key trends in the outdoor active lifestyle market.

The measured Internet channels, which includes specialty Internet and general Internet retailers, saw outdoor footwear sales increase more than 6 percent in the first half of 2017 while the measured brick & mortar retailer business grew less than 2 percent. The independent outdoor specialty stores and big box sporting goods stores channels each posted mid-single-digit growth in outdoor footwear in the calendar first half period.

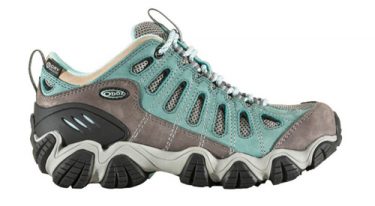

Men’s outdoor footwear sales increased 3.5 percent in the period while the women’s business was essentially flat. Key growth categories for the men’s business included outdoor sandals, performance trail running, hiking boots and approach footwear. In the overall measured market Merrell owned the Top 3 spots on the Top Sellers chart in the calendar first half period while Oboz and Salomon occupied those spots in the specialty retail channels.

- Oboz Sawtooth

- Salomon Quest

In brand share Merrell, Keen, Columbia, Hi-Tec and Salomon made up the Top 5 brands. In the specialty retail channels Oboz (#3) and Vasque (#5) move into the Top 5 brands, joining Merrell, Keen and Salomon. Keen had the biggest brand share increase in the Internet channels (+2.7 points) while Oboz picked up the most share in the specialty brick & mortar channels (+3.9 points).

For more information on how your brand performed in the first half (or just last week) stop by the SSI Data / SportsOneSource Booth #115 at OR Summer Market or email Matt Tucker at solutions@ssidata.com.

*SSI Data, managed by SportsOnesource, LLC, collects weekly retail point-of-sale data from over 20 retail channels of distribution and delivers timely sales trending reporting for footwear, apparel, essentials and equipment within 5 days of each fiscal week close, enabling retailers and brands to react to nearly real-time data to better manage their businesses.

Photos courtesy Merrel, Oboz and Salomon