Sport Chalet Inc. cut its average inventory per store by 13.6% at fiscal second quarter-end compared to a year earlier as it dialed in tighter assortments, particularly in fitness, skate, cycling and snow categories. That has positioned the company to “take advantage of opportunistic buys on merchandise as other retailers pull back their orders,” said Chairman and CEO Craig Levra.

SPCH has also been canceling or pushing back purchase orders, Levra said. He said some apparel and footwear SKUs have also been soft as struggling retailers, including bankrupt Mervyns, liquidate inventory.

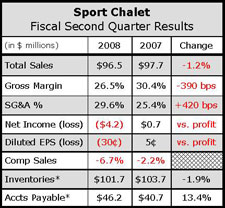

Levra shared the news while discussing SPCHs second quarter sales, which fell 1.2% to $96.5 million in the quarter. Sales of $6.4 million from seven new stores mitigated a 6.7% drop in same-store sales, which were dragged down primarily by the soft economy and, to a lesser extent, cannibalization from new stores opened by both SPCH and competitors.

Levra shared the news while discussing SPCHs second quarter sales, which fell 1.2% to $96.5 million in the quarter. Sales of $6.4 million from seven new stores mitigated a 6.7% drop in same-store sales, which were dragged down primarily by the soft economy and, to a lesser extent, cannibalization from new stores opened by both SPCH and competitors.

For the first six months of the fiscal year, total sales declined 3% on an 8.9% comps drop. Average ticket was down just over 2%.

Gross margins declined as the company marked down old merchandise to clear the floors for new goods for the holiday season. Higher rent costs from new stores and growing redemptions under the companys Action Pass customer rewards program shaved gross margins by about 70 basis points.

Action Pass membership has nearly tripled in the last year to 485,000 and the company expects to launch a co-branded Visa card with US Bank this week that will offer members an additional 5% back on purchases on top of the 3.3% they already get.

SPCH is on track to open three new stores in Q3. Executives said they were waiting for the real estate market to settle before signing any more leases, because they expect many choice locations to become available in 2009 as both competitors and other retailers close stores.