Smith & Wesson Holding Corporation said net sales for the fourth quarter ended April 30 were $99.5 million, a 19.8% increase from sales of $83.1 million in the year-ago period. Management for the legendary gun-maker said strong sales of M&P (military and police) pistols and tactical rifles boosted sales.

Total firearms sales for the quarter were $93.9 million, and increase of 22.4% from the year-ago period. Pistol sales, driven by the law enforcement adoption of the M&P polymer pistol line and strong sales of the Sigma pistol line, were up 32.8% to $29.0 million. Total revolver sales decreased 2.8% to $20.8 million, which management said was a direct function of low finished goods inventory and the ensuing high degree of labor required to replenish that inventory. M&P tactical rifles increased by an astounding 195.1% to $17.4 million on strength from both the consumer and law enforcement channels.

Non-firearm sales totaled $5.7 million, a 12.1% decline from sales of $6.4 million in the year-ago quarter, while hunting firearms sales fell 21.7% to $8.1 million. Management attributed the decline in hunting firearms to their position in the consumer discretionary marketplace and a distribution channel that is buying cautiously. Management noted that blackpowder rifles account for a significant portion of hunting firearms. To combat slipping sales, the company has reduced costs at its Rochester plant and expanded its product offering with the January introduction of the TC Venture rifle, which is priced relatively conservatively at under $500.

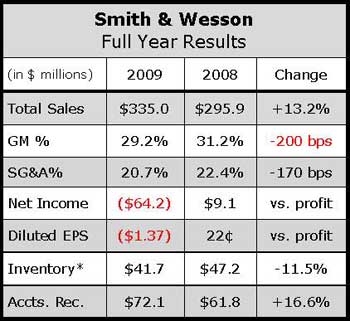

Gross margins were up 40 basis points to 31.0% of sales for the quarter. Net income for fiscal Q4 was $7.4 million, or 14 cents per diluted share, compared with $3.3 million, or 8 cents per diluted share, in fiscal Q4 2008.

Management noted that backlog, driven by recent consumer demand, reached a peak of $268 million by the end of April, a $218 million increase from of the comp period in 2008. Regarding outlook, management expects first quarter revenues to grow about 20% last from last years Q1 to a range between $92 million and $94 million.