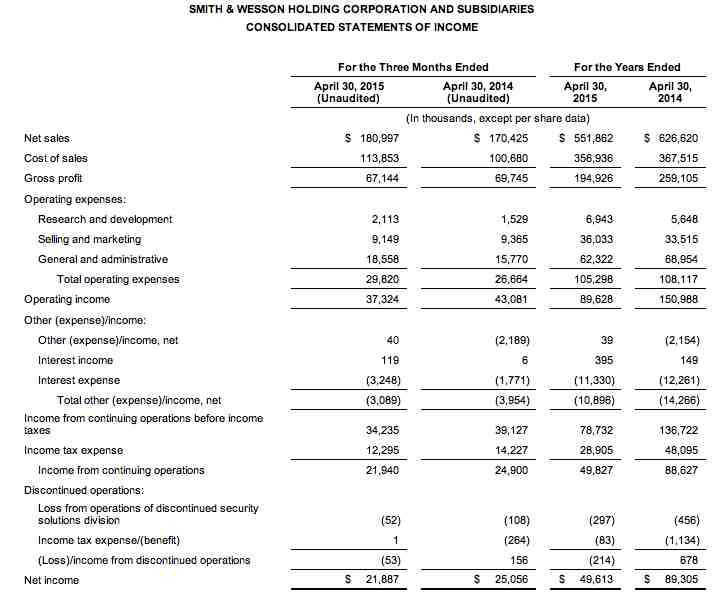

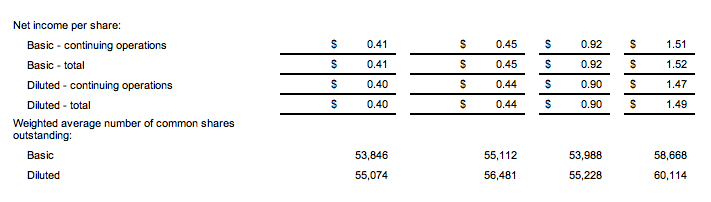

Smith & Wesson Holding Corporation reported net income in the fourth quarter slid 12.6 percent to $21.9 million, or 40 cents a share, from $25.1 million, or 44 cents, a year ago.

Quarterly non-GAAP income from continuing operations was $24.9 million,

or 45 cents per diluted share, compared with $26.5 million, or 47 cents

per diluted share, for the fourth quarter last year. Quarterly non-GAAP Adjusted EBITDAS from continuing operations was $50.8 million, or 28.1 percent of net sales.

Sales increased 6.2 percent to $181.0 million. Firearm division net sales of $166.4 million decreased by 2.4 percent from the comparable quarter last year, which was more than offset by $14.6 million of net sales related to the company's new accessories division, which was established in connection with the acquisition of Battenfeld Technologies, Inc. (BTI) on December 11, 2014.

Full Year Fiscal 2015 Financial Highlights

Full year net sales totaled $551.9 million, a decrease of 11.9 percent from last year. Firearm division net sales were $531.2 million, a decrease of 15.2 percent from last year, and accessories division net sales were $20.6 million. The accessories division consists entirely of the recently acquired BTI. Therefore, the accessories division had no sales in the prior year and less than five months of net sales in fiscal 2015.

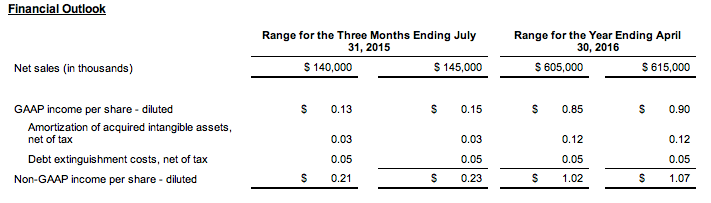

Full year GAAP income from continuing operations was $49.8 million, or $0.90 per diluted share, compared with $88.6 million, or $1.47 per diluted share, last year.

Full year non-GAAP income from continuing operations was $1.02 per diluted share, compared with $1.55 per diluted share last year.

Full year non-GAAP Adjusted EBITDAS from continuing operations totaled $132.5 million, or 24.0 percent of net sales.

James Debney, Smith & Wesson Holding Corporation president and CEO, said, “We are very pleased with our fiscal 2015 results, particularly our fourth quarter performance. During fiscal 2015, we marked a number of achievements as we remained focused on executing our long-term strategy. We moved further into the hunting and shooting accessories market by acquiring BTI and we strengthened our supply chain with the vertical integration of our principal injection molding supplier. Both acquisitions were accretive to gross margins. Our focus on gross margins resulted in a 37.1 percent gross margin for the fourth quarter (38.4 percent when the 1.3 percent accounting-related impact of the BTI acquisition is excluded), which was within our targeted range. Looking forward, we anticipate further sales and earnings growth in fiscal 2016 as we continue to position our company for long-term success.”

Jeffrey D. Buchanan, Smith & Wesson Holding Corporation executive VP and CFO, said, “Earlier in the fiscal year, we had stated that a company focus was to reduce inventories and we succeeded in reducing those inventories by $20.2 million during the fourth quarter. As a result, robust cash flow from operations during the fourth quarter of $84.9 million allowed us to fully pay down the $100.0 million revolving credit line we had used to facilitate the purchase of BTI and still end the quarter with $42.2 million in cash. Earlier this week, we redeemed all of our 5.875 percent Senior Notes using the proceeds of a new $105.0 million five-year term loan, which has a favorable interest rate. These combined actions are focused on creating value for our shareholders by optimizing our capital efficiency, lowering our weighted average cost of capital and strengthening our balance sheet to support future growth initiatives.”