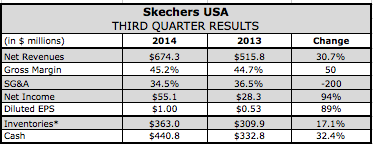

With double-digit increases in its domestic and international wholesale businesses and an 11 percent comp gain globally, Skechers USA, Inc. reported third-quarter earnings jumped 90.4 percent to $51.1 million, or $1.00 a share, exceeding Wall Streets consensus estimate of 91 cents.

With double-digit increases in its domestic and international wholesale businesses and an 11 percent comp gain globally, Skechers USA, Inc. reported third-quarter earnings jumped 90.4 percent to $51.1 million, or $1.00 a share, exceeding Wall Streets consensus estimate of 91 cents.

Revenues grew 30.7 percent to $674.3 million, the highest quarterly revenues in the companys 22-year history.

Highlights of the quarter included an 18.5 percent increase in its domestic wholesale business, with a 16.1 percent increase in pairs shipped and a 1.2 percent increase in average price per pair. Its international wholesale business jumped 60.6 percent with an 87.3 percent increase from its distributors and a 52.2 percent increase from its subsidiaries and joint venture partners. A 25 percent increase came from its company-owned retail stores, which included an additional 62 new stores opened in the last year, 22 of which opened in the quarter.

Backlogs were ahead over 50 percent as of Sept. 30, which David Weinberg, COO and CFO, on a conference call with analysts called a clear indicator that our momentum will continue well into 2015.

Breaking down its three segments, Skechers domestic wholesale business increased 18.5 percent, or $41.9 million for the quarter, with a 16.1 percent increase in pairs shipped and a 1.2 percent increase in average price per pair. Double-digit increases in women’s and men’s footwear offset a single-digit decreases in kids.

Strong sales came throughout its men’s and women’s Sport; women’s Sport Active; Skechers GO; women’s winter boots; and Skechers USA, which saw a triple-digit growth. Additional increases included double-digit gains in its men’s Skechers GO, women’s Skechers Active, and men’s and women’s Work lines.

The kids decline was partly due to the planned decrease within one account in the South and the shift of some BTS school product into the second quarter. Weinberg said Skechers expects its kids business to stabilize in the first quarter of 2015 with growth already coming from takedowns of its popular adult lightweight sport collections.

The consistent theme across all our product lines is comfort, said Weinberg of Skechers overall success. We are including comfort features in our lifestyle, lifestyle athletic, performance and kids footwear. We are continuing to see consumers asking for our comfort lines, and our accounts are embracing it by featuring our brand in their stores and websites, thus creating an omni-channel marketing approach with some of our key partners.

Both its men’s and women’s Skechers GO experienced double-digit sales growth in the quarter, driven by updates to its Skechers GOwalk platform, including the Super Sock slipon and integration of GOga Mat technology.

Weinberg also noted that a host of marketing campaigns will continue to support Skechers momentum in the U.S. These include several recent endorser signings to support distinct demographics, including Pete Rose and Joe Namath for the older male, Brooke Burke-Charvet for moms, Mariano Rivera to reach the younger male consumer, and Ringo Star to broaden its reach to the international male.

We are just beginning our Fall 2015 buy meetings with our domestic wholesale accounts, but are pleased with our double-digit backlogs and early reads on sales in the quarter to date, said Weinberg. This gives us confidence that the demand for our footwear will continue in the first half of 2015 with our key retail partners in the US.

Skechers international subsidiary joint venture and distributor sales climbed 60.6 percent. Its subsidiary and joint venture sales improved 52.2 percent, and its distributor sales ran up 87.3 percent despite headwinds from foreign currency exchange in some markets.

Skechers European subsidiaries generated 72 percent growth. Its Southeast Asia joint ventures saw combined growth of 48.8 percent for the quarter, which includes a 92.9 percent increase in China.

The 87.3 percent increase in its international distributor business was primarily the result of triple-digit growth in Australia, New Zealand, Taiwan and the Middle East, and double-digit growth in Mexico, the Panama region, South Korea, the Philippines, Turkey and Russia.

Worldwide sales in its company-owned retail stores increased 25 percent for the quarter, with domestic sales improving 16.9 percent and international sales up 74 percent. Comps grew 8.2 percent domestically and 28.9 percent internationally for an 11 percent increase worldwide. The combined double-digit comp increase is on top of double-digit comps in the third quarter of 2013.

Gross margins in the quarter improved to 45.2 percent from 44.7 percent. Operating earnings jumped 68.4 percent to $74.1 million.

Although the fourth quarter is historically the smallest sales quarter for its international division, Skechers remains comfortable with the analysts current consensus for both revenue and earnings for the quarter. Given the strength of its backlogs, it anticipates top-line growth to be between 15 percent and 20 percent for the first quarter in 2015. Weinberg added, Given our retail growth trajectory, accelerated backlogs, and incoming orders for October, we believe we are well-positioned for growth in the fourth quarter and well into 2015.