Smaller specialty retailers and manufacturers picked up a few pointers on leveling the playing field against e-commerce and other giants in a mid-May webinar on the State of Retail 2021 presented by Snowsports Industries America (SIA).

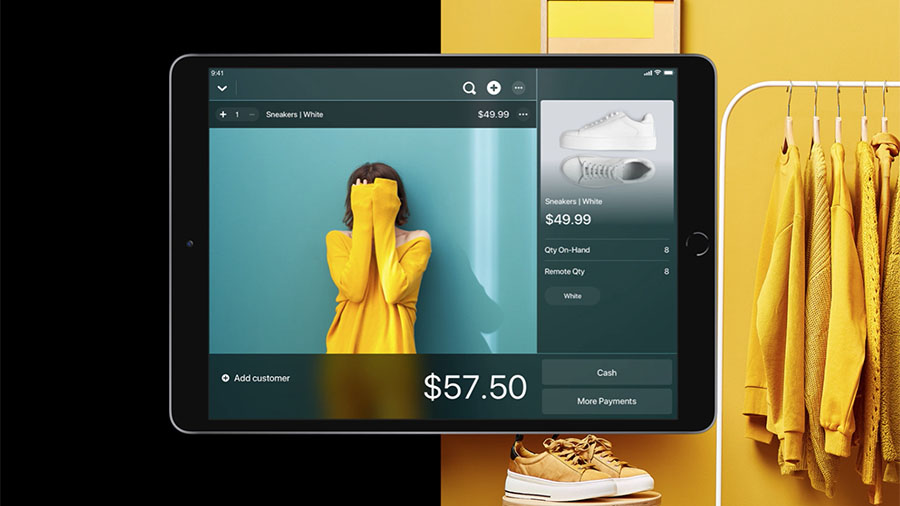

Hosted by Lightspeed senior partner Chloe Freeman, whose client expertise in the bike and sporting goods sectors transfers over into winter and other outdoor sports, the program covered trends shaping the future of commerce, including sales channels, acquiring customers, flexible business models, post-Covid predictions, and supply chain efficiency.

“Retailers are wanting to find everything from new ways to acquire customers to how to make their supply chains more efficient,” said Freeman, highlighting everything from increasing your number of suppliers to offering subscription programs as ways to address today’s rapidly changing business environment.

Over the past year, she added, there’s been a huge boom in consumers’ adoption of e-commerce compared to instore point of sale. Omnichannel retail sales, she added, grew 50 percent in 2020, with much of that coming from new online consumers—many of whom are now exhibiting a much greater trust in online shopping.

For retailers, she added, this means a bigger push to build a strong and unified online presence.

“More than a third of U.S. consumers used contactless payment for the first time last year,” she said, adding that when the pandemic began in March 2020 contactless payments grew by 20 percent.

This has led many retailers to invest in new forms of mobile payments and offer Buy Now Pay Later (BNPY) financing programs and subscription e-commerce purchase programs. More than 150 million U.S. consumers are expected to use BNPY programs at least once in 2021, she added.

Supply-side issues are also important, Freeman continued, citing a study that showed most retailers place orders on 40-to-50 different websites every year. “It’s important to have intuitive tools to make the ordering process easier,” she said.

Product delivery has also changed, led by curbside pick-ups that appear likely here to stay. A report by CNBC maintains that curbside pickup increased by 208 percent from April 2020 to April 2021 as far as the number of orders placed online but picked up at stores. “It’s become a must and a lifeline as a way for retailers to connect with their customers,” she said.

And brands looking to gain new customers can also pick up some momentum, whether you’re a retailer or manufacturer. “More than 75 percent of consumers bought from new brands that they hadn’t used before in the past year,” Freeman said. “And 80 percent of customers who switched brands will keep coming back to those brands.”

One other important behavioral change retailers should consider is that consumers’ expectations are higher and they have a lower tolerance for errors. Those expectations can range from optimized pricing and predictable and consistent delivery to communication and inventory levels. “It’s important to keep end-users happy and coming back,” said Freeman.

Photo courtesy Lightspeed