By Carly Terwilliger

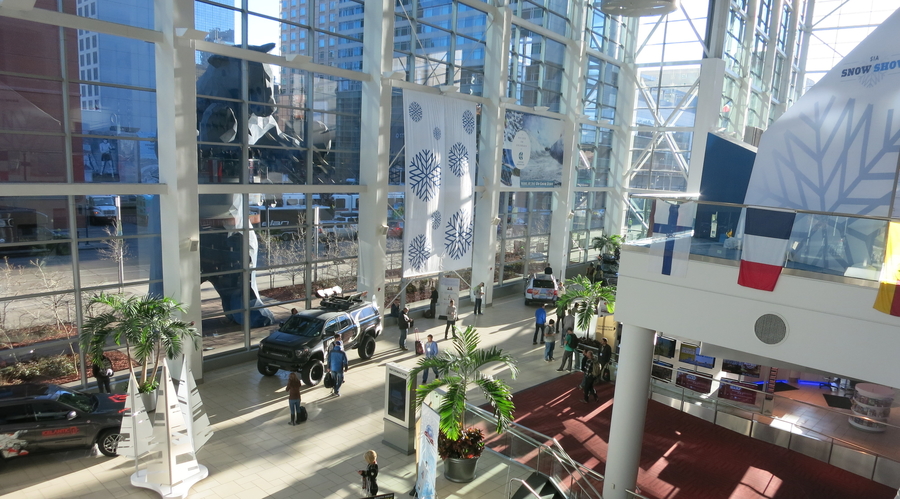

The 2017 SIA Snow Show kicked off in Denver yesterday with Industry + Intelligence, a pre-show day of seminars and keynote speakers. SGB was there to get a feel for what industry insiders will be talking about during the show.

The big news was SIA signing a 10-year extension with Denver that will keep the show in Colorado until 2030, but the day started with hardgoods and softgoods category overviews from SIA Director of Research Kelly Davis.

Here are some of the key takeaways:

“Programs designed to get kids involved are super-important to the industry,” said Davis, adding that if kids start skiing or snowboarding before age 12, they’re 80 percent more likely to keep doing it for the rest of their lives.

New materials, both in hardgoods and softgoods, are set to make a splash at the 2017 show. Carbon matrices and titanium are making skis lighter, while in apparel there’s talk of a super-strong biomimetic spider silk in the pipeline.

SIA has come out with its DCIP Consumer Identity Base made up of 28 specific identity profiles, from the “Work Hard, Play Hard” male to the “Balanced Warrior” female. They all have different needs and buying habits, and they’re all looking for something. The question is, how can brands win at the consumer/product matching game?

“We’re seeing more and more brands go direct-to-consumer,” said Davis. “There’s an Arc’teryx store. There’s a Burton store.” With internet sales here to stay and distribution models shifting, companies are considering brick-and-mortar locations are a way to invite customers to visit, see and touch their products.

Augmented reality and virtual reality – why haven’t they caught on in snow sports? “One thing I thought we’d be seeing more of is smart goggles. Smart eyewear in general didn’t do as well as I expected,” commented Davis.

Of Newell’s plan to shed its winter sports brands, including iconic K2, Marker and Volkl brands, Davis said, “Chances are they’ll have a buyer by the end of the season.”

Snowboards are getting new shapes and innovative bindings. “It’s going to make it easier for old ladies like me to snowboard,” joked Davis. In skis, “mega-fat has kind of died down,” she observed. “A lot of people are going back to skinnier skis.”

Sharing, whether it’s lodging, transportation or gear, is a concept that is gaining traction. For example, “In Salt Lake they have Uber Snow,” said Davis, which offers an affordable ride to the slopes and, more importantly, a convenient ride back.

On the gear side, it’s easy to sell the concept of getting the more expensive stuff from a sharing service to casual participants, and it might be worth it to get people started with snow sports. On the other hand, “If people own equipment, they tend to participate more,” said Davis. In addition, “We need to make sure people buy new gear when their old gear wears out.”

In terms of outerwear, the “gear of the year” styles have been pretty much the same no matter where you look. So where are consumers expressing themselves? According to Davis, they’re showing their style with accessories. “There’s crazy trends in face masks. You can have a skull face, you can have a dog face.” Meanwhile, anything that means you can use with your devices without taking your gloves off is “winning,” said Davis. Also in gloves, “Warm hands are always in, but high-end is selling,” she noted.

Staying with accessories, “Everyone’s into socks,” stated Davis, but “we’re going to see some interesting movement among brands” in the category. She also pointed out that with accessories in general, if you haven’t been skiing for several years, some of your gear has probably disappeared and needs to be replaced. And even for those who participate more regularly, baselayers are a place they’re willing to spend their dollars because, compared to new skis or a new jacket, the price points are friendlier.

Stay tuned to SGB for more show coverage.

Photo by Carly Terwilliger