Shoe Carnival Inc. on Thursday raised its full-year earnings and revenue guidance after reporting a solid third quarter and nine months ended November 2.

Third Quarter Highlights

- Net sales increased 2.0 percent to $274.6 million compared to the third quarter last year

- Record earnings per diluted share of $0.94, a 23.7 percent increase over prior year quarter, surpassing the previous record of $0.91 achieved in the first quarter of this fiscal year

- Comparable store sales increased 3.5 percent

- Repurchased 521,800 shares of common stock at a total cost of $16.9 million

- Cash and cash equivalents were $33.7 million with no outstanding debt as of November 2, 2019

Cliff Sifford, Shoe Carnival’s Vice Chairman and Chief Executive Officer, commented, “We are very pleased with our broad-based strength across all product categories, geographies and sales channels in the third quarter. Our record earnings were fueled by solid comparable store sales growth throughout the quarter, including our seventeenth consecutive positive comparable store sales for the month of August. This demonstrates that Shoe Carnival remains a destination for back-to-school family footwear. Our customer-centric organization and fun, engaging shopping environment continues to resonate with consumers and gives us confidence in our raised outlook for fiscal 2019. Going forward, we believe our strong foundation, combined with the recent addition of new customer-data driven resources, positions us well for sustainable, profitable growth for many years to come.”

Third Quarter Financial Results

The Company reported net sales of $274.6 million for the third quarter of fiscal 2019, a 2.0 percent increase compared to net sales of $269.2 million for the third quarter of fiscal 2018. Comparable store sales increased 3.5 percent for the third quarter of fiscal 2019.

Gross profit margin for the third quarter of fiscal 2019 increased 0.7 percent to 30.9 percent compared to 30.2 percent in the third quarter of fiscal 2018. Merchandise margin increased 0.5 percent and buying, distribution and occupancy expenses decreased 0.2 percent as a percentage of net sales compared to the third quarter of fiscal 2018.

Selling, general and administrative expenses for the third quarter of fiscal 2019 increased $1.4 million to $66.6 million. As a percentage of net sales, these expenses remained flat at 24.3 percent compared to the third quarter of fiscal 2018.

Net income for the third quarter of fiscal 2019 was $13.7 million, or $0.94 per diluted share. For the third quarter of fiscal 2018, the Company reported net income of $12.0 million, or $0.76 per diluted share.

Nine Month Financial Results

Net sales for the first nine months of fiscal 2019 increased $1.7 million to $796.7 million compared to the first nine months of fiscal 2018. Comparable store sales increased 1.6 percent for the first nine months of fiscal 2019.

Net income for the first nine months of fiscal 2019 were $39.4 million, or $2.66 per diluted share, compared to net income of $36.8 million, or $2.36 per diluted share, in the first nine months of fiscal 2018. Included in the first nine months of fiscal 2019 was a tax benefit in connection with the vesting of equity-based compensation of approximately $1.9 million, or $0.13 per diluted share, that was recorded in the first quarter of this fiscal year. The gross profit margin for the first nine months of fiscal 2019 was 30.4 percent compared to 30.5 percent in the same period last year. Selling, general and administrative expenses for the first nine months decreased $1.5 million to $192.5 million. As a percentage of net sales, these expenses decreased to 24.2 percent compared to 24.4 percent in the first nine months of fiscal 2018.

Store Openings and Closings

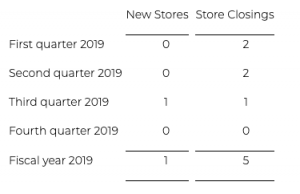

The Company opened its one new store for the fiscal year in the third quarter of fiscal 2019 and closed one store for a total of five store closures during the fiscal year compared to opening three stores and closing 14 stores during fiscal 2018.

Expected store openings and closings by quarter for the fiscal year are as follows:

The new store opened during the third quarter was located in:

The Company is raising its annual outlook based on its results year-to-date and its outlook for the remainder of the fiscal year. The Company now expects annual diluted earnings per share of $2.85 to $2.89 compared to its previous guidance of $2.77 to $2.83. This compares to diluted earnings per share of $2.45 in the prior fiscal year. Total net sales for the fiscal year 2019 are now expected to be in the range of $1.033 billion to $1.036 billion and the Company is reiterating its annual comparable store sales guidance of a low single-digit increase.