Nordstrom Inc. on Thursday reported earnings per diluted share of 81 cents for the third quarter ended November 2, beating Wall Street’s estimates by 16 cents. Total company net sales decreased 2.2 percent to $3.7 billion in Q3, improving by more than 200 basis points from the first half of 2019 and ahead of targets by $10 million.

“Our market strategy is transforming our business model in how we’re serving customers. We have a unique mix of assets – Full-Price, Off-Price, stores, and online – and we are further linking our businesses to serve customers in new and differentiated ways. We achieved an important milestone with the opening of our New York City flagship store, significantly increasing our presence in the world’s top retail market. It’s a culmination of efforts across many teams, and we are grateful for their dedication and passion in bringing this store to life,” said Erik Nordstrom, co-president, Nordstrom, Inc.

“Our third quarter earnings exceeded expectations, demonstrating substantial progress in the delivery of our strategy and strength of our operating discipline. Through our customer focus, we drove broad-based improvement in top-line trends. The consistent strength of our inventory and expense execution contributed to increased profitability for the quarter.”

- Sales trends improved across Nordstrom’s Full-Price and Off-Price businesses through aggressive actions taken during the year related to loyalty, digital marketing and merchandise assortment.

- In Full-Price, the company improved the economics of its Anniversary event, which positively contributed to merchandise margins. Off-Price delivered positive sales and earnings growth, increasing inventory turns for the eighth consecutive quarter.

- In the third quarter, the company expanded EBIT margin through ongoing inventory discipline and progress in bending its expense curve. Nordstrom realized $170 million in expense savings year-to-date and expects to well-exceed its plan of $150 to $200 million for the year.

- Since scaling the company’s market strategy in Los Angeles, third quarter sales growth outpaced other markets by approximately 100 basis points. Nordstrom recently expanded its strategy to New York, San Francisco, Chicago and Dallas to offer customers a greater selection of product available for same-day pickup or next-day delivery.

- The Nordstrom NYC flagship opening reflected a strong customer response with 85,000 visits during the first weekend. Additionally, the corresponding sales lift in the Men’s store exceeded expectations.

Third Quarter 2019 Summary

- Third quarter net earnings were $126 million compared with $67 million during the same period in fiscal 2018. Prior year results included an after-tax estimated non-recurring credit-related charge of $49 million. Excluding this charge, earnings grew 9 percent over last year.

- Earnings before interest and taxes (“EBIT”) were $193 million, or 5.4 percent of net sales, compared with $105 million, or 2.9 percent of net sales, during the same period in fiscal 2018. Excluding a $72 million estimated non-recurring credit-related charge in 2018, EBIT margin expanded by approximately 50 basis points.

- In Full-Price, net sales decreased 4.1 percent compared with the same period in fiscal 2018. Off-Price net sales increased 1.2 percent. Total company digital sales grew 7 percent and represented 34 percent of the business.

- Gross profit, as a percentage of net sales, of 34.3 percent increased 100 basis points compared with the same period in fiscal 2018, primarily due to fewer markdowns from continued inventory discipline in Off-Price and higher sell-through of Anniversary product in Full-Price. Ending inventory decreased 2.7 percent from last year, maintaining a positive spread between inventory and sales for the third consecutive quarter.

- Selling, general and administrative expenses, as a percentage of net sales, of 31.8 percent decreased 132 basis points compared with the same period in fiscal 2018. Excluding the credit-related charge of $72 million in 2018, expenses deleveraged by approximately 60 basis points due to New York City flagship pre-opening costs.

- The company’s enhanced loyalty program continues to grow. The Nordy Club had more than 12 million active customers, which represented an increase of 13 percent over last year and nearly 65 percent of sales for the third quarter.

- During the nine months ended November 2, 2019, the company repurchased 4.1 million shares of its common stock for $186 million. A total capacity of $707 million remains available under its existing share repurchase authorization. The actual timing, price, manner and amounts of future share repurchases, if any, will be subject to market and economic conditions and applicable Securities and Exchange Commission (“SEC”) rules.

- On November 6, 2019, the company issued $500 million of senior unsecured 10-year notes. This is expected to be a leverage neutral transaction as the company expects to use these proceeds in early December to fully retire its May 2020 notes.

Expansion Update

During the third quarter of 2019, the company opened the following stores:

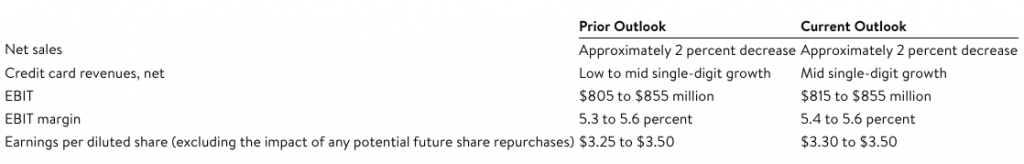

Fiscal Year 2019 Outlook

The company’s revised annual earnings per diluted share outlook of $3.30 to $3.50 does not include an estimated one-time charge related to its debt refinancing in the fourth quarter of approximately $0.04. The impact of tariffs is not expected to be material for the year.