Strength across all categories and a healthy jump in comparable store sales carried Shoe Carnival, Inc. to 70% profit growth for the fiscal fourth quarter ended Jan 29, making it the second-highest Q4 earnings jumps in the company’s history. Management for the Evansville, IN-based footwear retailer said the best performing categories for the quarter were boots and women’s casual footwear, which drove profit margin to a 130 basis point improvement. SCVL also reported growth in total units sold, average unit retail and within every product category, including toning, which contributed 0.6 percentage points to the overall 4.6% comp growth. In a conference call with analysts, management said the company recorded strong boot sales throughout the quarter, although very strong sales in November yielded to somewhat-weaker sales in December and January due to weather in the Midwest and the lack of early tax refund loans. Comps were up double-digits in women’s non-athletic business, which was driven primarily by boots and sport casual categories with tailor casuals, molded footwear and vulcanized canvas also selling well. Within women’s boots, management noted “nice increases” in shearling or fur-lined boots as well as for tailored dress shoes, western-themed footwear and weather boots. In the men’s non-athletic category, comps were up low-single-digits on continued strength in boots, which benefitted from notable strength of sport boots, hikers and cold-weather boots. Vulcanized canvas and sandals also performed well in the men’s business. For the children’s business, comps grew mid-singles on strength from girls fashion canvas and girls/boys running and with double-digit growth in boys/girls boots, which benefitted from strength in fashion, casual, western and weather boots. In adult athletic, comparable store sales were “slightly positive” for the quarter as the weather during the month of December had a negative impact on overall athletic sales. Management said business for the quarter was driven primarily by men's and women's running with performance running and trail running categories for both men and women generating “strong increases.” In the toning category, the company recorded double-digit growth in sales, although at a substantially lower average unit retail than in the year-ago period. Management noted that the company’s focus is to continue to bring inventory position in line with customer demand and to “treat the category as we would all other important categories.” They noted that new toning styles incorporating running-based technology have delivered “great” sell-through at higher price-points so far. Looking ahead, the retailer’s strategy for the later-than-usual Easter shift was to move dollars from the men’s and women’s dress categories into the sport and sandal categories. Likewise, management said shifting dollars from toning to running has allowed it to maximize sales on lightweight running and other high-margin categories. Management expressed optimism about early reactions from sandals – particularly sandalized wedges – athletic sports sandals and slides. Regarding outlook, fiscal Q1 diluted EPS are forecast in the range of 72 cents to 75 cents per share. This assumes net sales in the range of $198 to $201 million and a comp store sales increase of 3% to 5% for the quarter. Shoe Carnival is launching its ecommerce business in the back half of the year.

Shoe Carnival Posts Record Fiscal Q4 Profit Growth on Strength Business

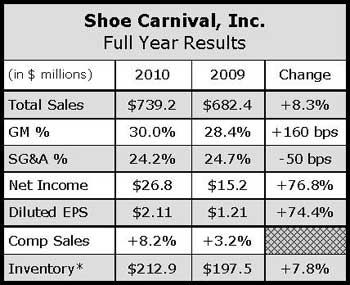

Total revenues for the quarter were up 5.3% to $179.9 million from $170.8 million in the prior-year quarter while comps improved 4.6% for the period. Net income soared 70.1% to $4.4 million, or 33 cents per share, from $2.6 million, or 20 cents per share, in the prior-year period. Traffic during the quarter increased 1.4% on a year-over-year basis and management said the retailer also recorded improvements in both conversion rate and average transaction side.