Shimano Group reported that net sales in the first nine months increased 3.2 percent from the same period of the previous year to ¥253.9 billion. Operating income increased 2.7 percent to ¥47.8 billion, ordinary income increased 35.2 percent to ¥54.8 billion and net income increased 42.4 percent to ¥40.0 billion.

Shimano said that during the first nine months of fiscal year 2018, in Europe, “moderate economic expansion continued with firm personal consumption backed by improvements in employment and income environments. In the U.S., the economy grew steadily, boosted by strong business confidence among companies against the backdrop of solid business conditions as well as a strong consumer sentiment due to an improved employment environment and the income tax reduction policy. In Japan, despite weakening of exports and production activities in the aftermath of disasters such as heavy rain, the overall economy remained on a gradual recovery track, as personal consumption has continuously recovered owing to improvements in employment and income environments. In these circumstances, inspired by our mission—“To promote health and happiness through the enjoyment of nature and the world around us”—the Shimano Group sought to attract consumers with a stream of captivating products designed to enrich the experience of cyclists and anglers around the world and moreover attuned to the contemporary emphasis on well-being and the environment.”

Bicycle Components

In Europe, with the stable weather continuing through the summer season, retail sales of completed bicycles, mainly sport E-BIKE, stayed robust and distributor inventories of bicycles remained at a slightly lower level, though they were in an appropriate range. In North America, retail sales of completed bicycles were on par with an average year and distributor inventories remained at an appropriate level. In China, retail sales of completed bicycles remained feeble and retail sales of low-end and middle-range bicycles continued to be sluggish. On the other hand, bike sharing is facing a period of realignment and the number of products supplied to the market has stabilized, thereby distributor inventories remained at an appropriate level.

With regard to the other emerging markets, Southeast Asia as a whole lacked vigor, although retail sales of completed bicycles showed signs of a gradual recovery in Indonesia. In South America, consumption showed signs of slowdown due to the effects of continuing currency depreciation and political instability in Brazil and Argentina. Distributor inventories were at an appropriate level both in Southeast Asia and South America. In the Japanese market, although retail sales of sports bicycles and community bicycles remained sluggish owing partly to the unseasonable weather conditions persisting since the beginning of the year, sales of E-BIKE as a whole increased, and particularly, sport E-BIKE has gained more attention. Distributor inventories remained at an appropriate level. Under these market conditions, the new 105 Series, which is one of the high-end road bike components, were well-received in the market. As a result, net sales from this segment increased 2.2 percent from the same period of the previous year to ¥199,961 million, and operating income decreased 0.1 percent to ¥41,052 million.

Fishing Tackle

In the Japanese market, retail sales were sluggish due mainly to heavy rains and typhoons since summer. Overseas, in the North American market, sales remained robust supported by a steady economic expansion despite the non-negligible impacts of the hurricane hitting the east coast. Distributor inventories remained at an appropriate level. Sales in Europe are recovering steadily, while distributor inventories remained at a slightly higher level in the U.K., one of the major markets. Sales in Asia continued to be robust, driven by further growing popularity of sports fishing.

In Australia, the market was booming and sales remained strong, since favorable weather continued. Under these market conditions, sales in Japan exceeded the previous year’s level, due partly to contributions from the new lure-related products which were continuously well-received in the market. Overseas, the new model of baitcasting reel, Curado DC, was highly acclaimed, particularly in North America, where sales exceeded the previous year’s level. Overseas sales on the whole exceeded the previous year’s level with sales in Europe and Australia on par with the previous year and sales in Asia as well as in North America exceeding the previous year’s level. As a result, net sales from this segment increased 7.3 percent from the same period of the previous year to ¥53,699 million, and operating income increased 24.7 percent to ¥6,827 million.

Other

Net sales from this segment decreased 7.4 percent from the same period of the previous year to ¥263 million, and an operating loss of ¥63 million was recorded following an operating loss of ¥32 million for the same period of the previous year.

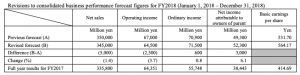

Shimano slightly revised its forecasts for the year in light of non-operating income recorded owing to relative weakness of major Asian currencies along with the progression of the U.S. dollar’s appreciation during the third quarter as well as the factor that the normalization of delivery time is carried over to the next fiscal year due to the shortage of supply for the products of which orders received are favorable.

Image courtesy Shimano