Salomon parent company Amer Sports posted another strong quarter in the 2024 Q2 period ended June 30, with sales, margin, and EPS ahead of the company’s guidance – and Wall Street’s expectations.

“The momentum behind our unique portfolio of premium sports and outdoor brands continues, and we are generating top-tier growth and margin expansion within our industry, said Amer Sports CEO James Zheng on a conference call with analysts. “Our global end markets are healthy and growing, and we are taking market share, positioning us to deliver another record year in 2024.”

Zheng is now also serving as interim CEO of the Salomon business until a new CEO can be appointed.

“[After] over four months in the role, I am confident in the Salomon brand and our team, as we continue to optimize the go-to market strategy and sales structure to maximize the potential of Salomon footwear,” he said.

Zheng expressed that the company’s upside potential is built on a few key factors.

“First, we own and operate a unique and valuable portfolio of premium outdoor and sports brands,” the CEO noted. “Each one is fueled by technical innovation and positioned at the pinnacle of its respective segment. Our brands have high engagement, conversion, and satisfaction with consumers everywhere, but are still relatively small players on the global stage with significant room to grow.”

He went on to talk about the success story around the Arc’teryx brand but was quick to point out the other key elements of the company’s “Big 3” brands.

“Salomon, Wilson, and all of our other brands are also healthy,” he said. “They have long-standing authentic heritage, premium positioning, and high performance products. Both Salomon and Wilson have leading market share within their heritage equipment businesses, but still have very small soft goods franchises with large growth opportunities ahead, especially in Salomon footwear.”

Zheng noted that the company’s Outdoor Performance segment, which is dominated by Salomon Footwear & Apparel’s 66 percent share of the segment revenues, delivered upside to the company’s expectations in the second quarter, led by Salomon footwear, partially offset by softer trends in Winter Sports Equipment. Not surprising, given the timing of the quarter.

Outdoor Performance segment revenues increased 11 percent to $304 million in the second quarter, said to be driven by strong double-digit top-line performance in Salomon Footwear & Apparel and strong double-digit growth in the DTC channel, particularly in Asia Pacific and Greater China. Outdoor Performance sales also reportedly benefited from earlier-than-anticipated shipments that shifted from Q3 into the second quarter.

By channel, Outdoor Performance DTC grew 55 percent, while Wholesale sales declined slightly, said to be negatively impacted by slower pre-orders in the North America sporting goods and ski channels, which increasingly relies on replenishment orders.

Zheng explained that the Outdoor Performance segment is comprised of two businesses that operate in unique environments.

Winter Sports Equipment, which includes ski, snowboard, and snow sport equipment across the Salomon, Atomic, and Armada brands. “These are longstanding Winter Sports Equipment franchises that already have high market shares, a very strong competitive position, and industry leading scale and profitability — although less growth runway ahead given the already high market shares,” he said.

Salomon Footwear & Apparel, which he described as “a higher margin, faster growing business, but still with very low market share of the global sneaker market.” Zheng noted that the 66 percent segment share for this category was “up significantly” from 54 percent in 2022.

“We believe Salomon sneakers have an authentic and unique market position with technical features designed for the mountain, but also great for everyday use,” the CEO explained. “Salomon shoes offer consumers unique style and technical attributes at a time when consumers are more receptive than ever to wearing new sneaker brands. Looking forward, we expect Salomon Soft goods to grow double-digits annually over the long-term.”

In the second quarter, Salomon footwear reportedly saw especially strong traction in Greater China and in APAC, where Zheng said consumers love the Sportstyle offering that combines a distinct trendy look with high technical features.

“In China, we have created an entire new category, called Outdoor sneakers, which especially resonates with young consumers,” he said.

Amer opened 27 Salomon shops in Q2, including both owned stores and licensed stores, in Greater China, bringing the total count for the brand to 136 doors.

“We expect to end 2024 with about 200 owned and licensed Salomon stores in China, with the opportunity to grow to several hundred locations just in Tier 1 and 2 cities,” Zheng forecast. “In 2Q we also opened a new [Salomon] shop in Osaka, Japan, which has become one of our highest productivity stores, well received by both local consumers and tourists.”

The company also opened a Salomon flagship on the Champs Elysee in conjunction with the Summer Olympics, in addition to our recent store opening in Le Marais.

“Both new stores have performed extremely well in the first months, and represent the high demand consumers have to engage with the Salomon brand in its own environment,” Zheng suggested. “The Champs Elysee store has created a landmark presence to showcase the breadth and depth of Salomon’s unique offering in its home market, while Le Marais shop is a footwear-only concept store, which has proven to be a particularly successful model that we will replicate across EMEA with three more stores in Paris, two in London, and two in Milan.”

He also shared that Salomon will open a pop-up shop in New York City in Soho in October, which will seed the market with its first brand store in the city ahead of plans to open one or two permanent New York stores in 2025.

Amer Sports CFO Andrew Page said that 2024 will be a slightly softer year for Winter Sports Equipment due to slower trends in North America where ski equipment sales are rebasing after a strong run through and beyond COVID. He said this is in addition to cautious orders in EMEA after two tough snow seasons in Europe.

“Given our great brands and scale advantages, we expect to take market share,” Page suggested. “Although we don’t expect Winter Sports Equipment to be a high-growth business, the industry remains healthy, and consumer demand for ski vacations remains consistent and strong irrespective of weather, especially as resorts have become adept at making their own snow.”

Winter Sports Equipment now represents one-third of Outdoor Performance, and Page said long-term they expect the business to grow low-single digits annually.

“Regionally, Outdoor Performance sales growth was led by Greater China, APAC, and EMEA, offset by a decline in the Americas, which has been affected by softer pre-orders, as retailers increasingly rely on replenishment,” Page detailed.

The Outdoor Performance segment’s adjusted operating profit margin expanded 380 basis points to negative 2.1 percent in the quarter.

“This was driven by a combination of gross margin gains and SG&A leverage. Gross margin gains were mainly driven by a favorable region and channel mix, lower discounts, and we also leveraged expenses, including payroll, administrative, and IT costs,” the CFO explained.

Segment Outlook

Looking ahead Amer Sports sees the Outdoor Performance segment generating mid- to high-single-digit revenue growth in 2024, with segment operating margins in the high single digits for the year.

Consolidated Amer Sports Results

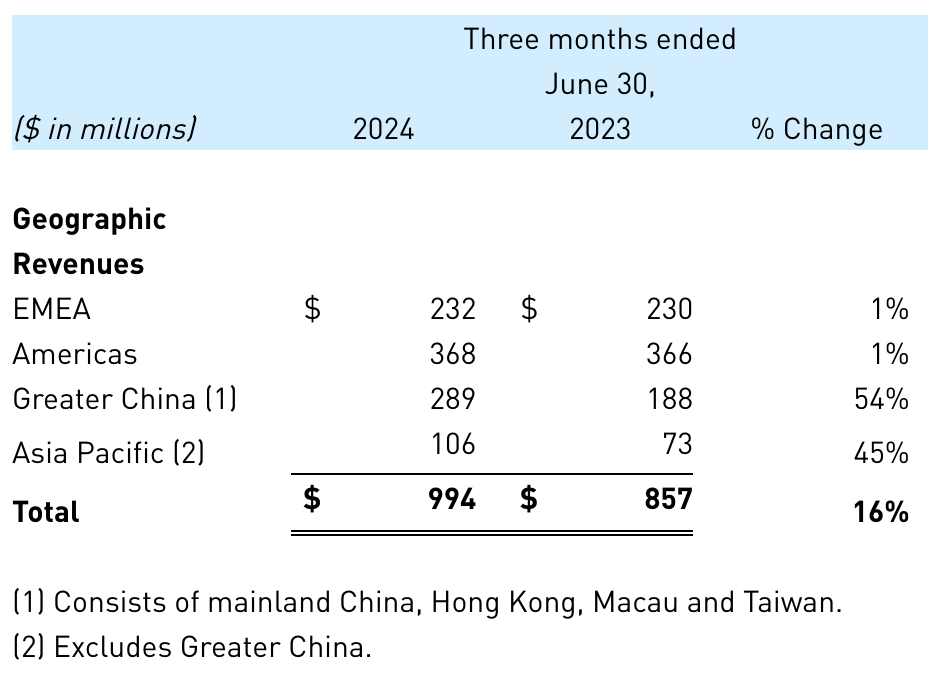

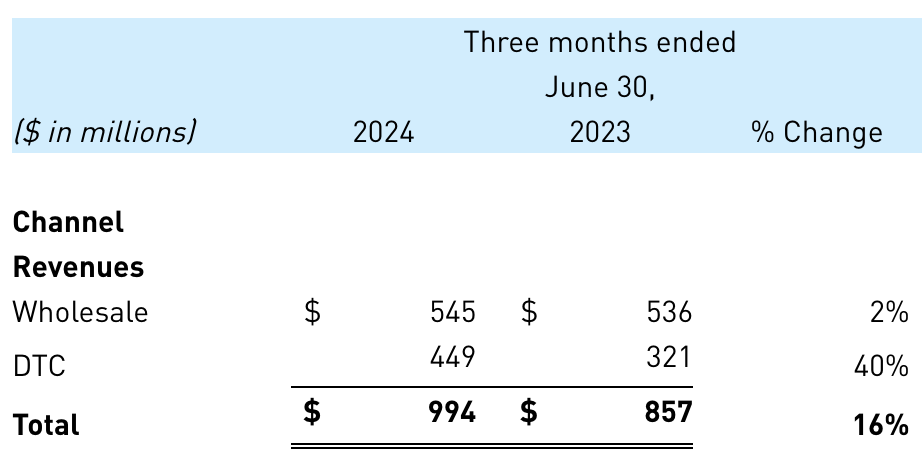

On a consolidated basis, Amer Sports Inc. reported that second quarter revenue increased 16 percent to $994 million, and increased 18 percent year-over-year on a constant currency (cc) basis.

“We generated 16.0 percent sales growth in Q2, or plus-18 percent on a constant currency basis led by our flagship brand, Arc’teryx,” concluded CEO Zheng. “Although we benefited from a 2-point shift of wholesale shipments from 3Q into 2Q, our underlying growth momentum is clear. We achieved nearly a 3 percent adjusted operating margin, also well above our expectations, as we continue to enjoy strong gross margin expansion driven by the pricing power of our brands and a healthy mix-shift toward our highest-margin franchise, Arc’teryx.”

Region Summary

Segment Summary

Technical Apparel, which primarily includes the Arc’teryx brand business, increased 34 percent (+38 percent cc) to $407 million in the second quarter, reflecting an omni-comp growth of 26 percent on top of the 80 percent omni-comp growth in Q2 last year. Omni-comp trends reflect the year-over-year revenue growth from owned retail stores and e-commerce sites open for at least 13 months.

Go Here for more details on Q2 performance for Arc’teryx.

Ball & Racquet Sports, primarily comprised of the Wilson Sports business, increased 1 percent (+2 percent cc) to $283 million. Segment operating margin decreased 160 basis points to 1.1 percent of sales in the Q2 period.

Go Here for more details on Salomon’s second quarter.

Channel Summary

Income Statement Summary

Gross margin increased 220 basis points to 55.5 percent; Adjusted gross margin increased 200 basis points to 55.8 percent.

Selling, general and administrative (SG&A) expenses increased 26 percent to $560 million in Q2, with Adjusted SG&A expenses increased 21 percent to $526 million for the period.

Operating loss was for the quarter was $9 million compared to operating profit of $8 million for the second quarter 2023. Adjusted operating profit increased 40 percent to $29 million for the Q2 period.

Operating margin decreased 180 basis points to negative 0.9 percent, with expansion un the Arc’teryx business offsetting weakness in the Salomon and Wilson Sports businesses. Adjusted operating margin increased 50 basis points to 2.9 percent of sales for the quarter.

The company’s net loss decreased 98 percent to $4 million, or a loss of one cent per diluted share, in the quarter. Adjusted net income increased 129 percent to $25 million, or 5 cents diluted earnings per share, in Q2, compared to a net loss in Q2 2023.

In the second quarter, Amer Sports recognized an incremental tax benefit of $20 million related primarily to the resolution of uncertain tax positions, which benefited Q2 diluted EPS by approximately 4 cents per share. Additionally, approximately $20 million of wholesale orders shipped earlier than anticipated, which benefited Q2 sales growth by approximately 2 percent and diluted EPS by 1 cent per share. These timing shifts do not impact the full year guidance.

Balance Sheet Summary

Inventories increased 2 percent year-over-year, below the 16 percent revenue growth for the quarter and are said to be in a healthy position.

“Our focus on inventory discipline is paying off as inventories finished Q2 in healthy condition, up only 2 percent year-over-year vs. 16 percent sales growth. Within our target to grow inventories in-line with, or slower than, sales,” Page noted.

Net debt was $1.820 billion at quarter-end, and Cash and equivalents totaled $256 million at June 30, 2024.

“Using the midpoint of our 2024 implied adjusted operating profit guidance, our net-debt-to-adjusted-non-IFRS-EBITDA ratio is already approximately 2.6x,” Page explained. “Deleveraging our balance sheet remains a priority, and our goal is to reduce our leverage ratio to 1.5x or better over the next few years through both EBITDA expansion AND debt pay down.”

Outlook

Digging into the outlook, CFO Page said, “Our strong financial performance in Q2 reinforces my confidence in our near- and long-term path forward. Organic revenue growth in the high-teens and significant gross- and operating-margin expansion reflects the combination of great brands, strong management execution, and a disciplined approach to expenses and working capital. These outstanding results give us the confidence to raise our full-year sales and earnings guidance.”

Zheng is confident in the company’s forecast in part because of its focus on China growth, a concern for some analysts that fear the slow-down in that market could have negative implications for Amer, and Arc’teryx in particular, due to its reliance on that market. But the CEO tackled that question head on.

“While other consumer companies are having challenges in Greater China, we generated more than 50 percent growth there as we continue to well outperform the market. Importantly, we are seeing strong momentum across all of our Big 3 brands,” Zheng noted.

“A few reasons I would like to highlight, why we are doing so well in China:

“Number one: Our brands compete in one the healthiest and fastest-growing consumer segments in China: the premium sports and outdoor market. The outdoor trend in China is very strong. Even beyond the traditional male consumer, the outdoor category is attracting younger consumers, female consumers, and we also see more luxury shoppers spending in our categories.

“Second: The China consumer landscape today has evolved into a market of winners & losers, with some brands doing extremely well, and others underperforming. Our still small, specialized brands with deep expertise and high quality and performance resonate strongly with Chinese shoppers.

“Thirdly and most important: We believe we have the best team in China. Our deep expertise and unique, scalable operating platform gives us a significant competitive advantage across the portfolio,” he concluded.

Full-Year 2024

For the full year, Amer Sports now expects revenue growth of 15 percent to 17 percent which incorporates greater than 30 percent growth in Technical Apparel, mid- to high-single-digit revenue growth in Outdoor Performance, and low- to mid single-digit growth in Ball & Racquet Sports.

“We are increasing our adjusted gross profit margin guidance from approximately 54.0 percent to approximately 54.5 percent,” Page said. “We also are raising our guidance for our full-year operating margin, and now expect adjusted operating margin toward the high-end of our previous 10.5-11.0 percent range.”

On an adjusted basis, Amer Sports sees Full Year 2024:

- Reported revenue growth: 15 percent to 17 percent

- Gross margin: approximately 54.5 percent

- Operating margin: toward high-end of 10.5 percent to 11.0 percent

- D&A: approximately $250 million, including approximately $110 million of ROU depreciation

- Net finance cost: $200 – $220 million, including approximately $15 million of finance costs in the first quarter 2024 that will not be recurring

- Effective tax rate: approximately 38 percent

- Fully diluted share count: 500 million

- Fully diluted EPS: 40 cents to 44 cents per share

Third Quarter 2024

Amer Sports expects third quarter consolidated revenue to grow 12 percent to 13 percent, led by Technical Apparel.

“A reminder that in Q3, we will face our most challenging growth comparison of the year,” Page noted. “We expect Q3 adjusted gross margin to be approximately 54 percent driven primarily by the mix shift towards Technical Apparel, and an adjusted operating margin between 11.0 and 12.0 percent.”

On an adjusted basis, Amer Sports sees Third Quarter 2024:

- Reported revenue growth: 12 percent to 13 percent

- Gross margin: approximately 54.0 percent

- Operating margin: 11.0 percent to 12.0 percent

- Net finance cost: $45 million to $50 million

- Effective tax rate: 50 percent to 55 percent

- Fully diluted share count: 510 million

- Fully diluted EPS: 8 cents to 10 cents per share

Image courtesy Salomon/Amer Sports

***

For additional SGB Media coverage and Q2 performance for Wilson Sports, the Arc’teryx brand and Technical Apparel segment, click on the headline below.

EXEC: Arc’Teryx Was Still Firing on All Cylinders in Q2 as DTC Led the Way

EXEC: Wilson Sports Returns to Growth in Q2, but Sees Bigger Gains Ahead