The Outdoor Industry Association (OIA), National Retail Federation (NRF) and Retail Industry Leaders Association (RILA) all applauded the Trump administration’s move to postpone some tariff collections for 90 days amid the COVID-19 pandemic.

The order gives the Treasury Department the authority to direct Customs and Border Protection to delay collecting tariffs on those imports for the aforementioned 90-day period.

The relief does not apply to all tariffs imposed as part of Trump’s trade war. It excluded changes to antidumping and countervailing duties and tariffs under sections 201, 232 and 301 of the trade code, which the Trump administration used to ramp up import taxes in the trade war. Steel and aluminum imports also weren’t included in the tariff-deferral offering.

OIA’s director of international trade Rich Harper said in a statement, “This is welcome news for outdoor and frankly countless U.S. businesses as it helps businesses preserve cash and just as importantly US jobs. OIA proudly worked with industries across the spectrum to help get this done and will continue to work with other industry coalitions, congress and the administration to lift all China 301 tariffs and refund the billions of dollars in duties already paid to stimulate the economy and help outdoor manufacturers, retailers and suppliers manage this crisis.”

NRF’s President and CEO Matthew Shay said in a statement, “The White House announcement that the government is providing a limited duty deferral for importers is welcome news to retailers struggling to find any good news during this extremely difficult time. We encourage the administration to broaden these deferrals for additional relief. Retailers don’t build stores, buy products and hire associates only to close their doors for weeks at a time. The challenges to the retail industry brought on by this pandemic are severely acute, at best. This deferral provides some retailers with additional liquidity and better cash flow, giving hope for business continuity and a faster recovery once the pandemic has passed.”

Brian Dodge, president of RILA, said in a statement, “Allowing companies hit hardest by COVID-19 to defer certain duty payments for up to 90-days will improve liquidity and cash flow for those retailers who have closed stores during this crisis. As stores are closed and foot traffic has plummeted, retailers are taking extraordinary steps to keep their businesses running. This move will put these retailers in a stronger position to return to normal business operations as soon as it is safe to do so.

“While the deferral of select duty payments is helpful and warranted, the deferral of all duty payments for at least 180-days would do even more to assist retailers as they navigate this unprecedented pandemic. Millions of jobs are on the line, and we urge the Administration to consider further duty relief to help retailers put workers back on the payroll when this crisis abates.”

U.S. Chamber of Commerce Executive Vice President and Head of International Affairs Myron Brilliant said, “Providing some temporary tariff relief will help American businesses make payroll and retain employees in the coming weeks. With the current economic downturn, liquidity has become one of the top challenges for businesses of all sizes. Allowing U.S. companies to defer some tariff payments — like the tax relief provided in the CARES Act — will alleviate some of that strain.”

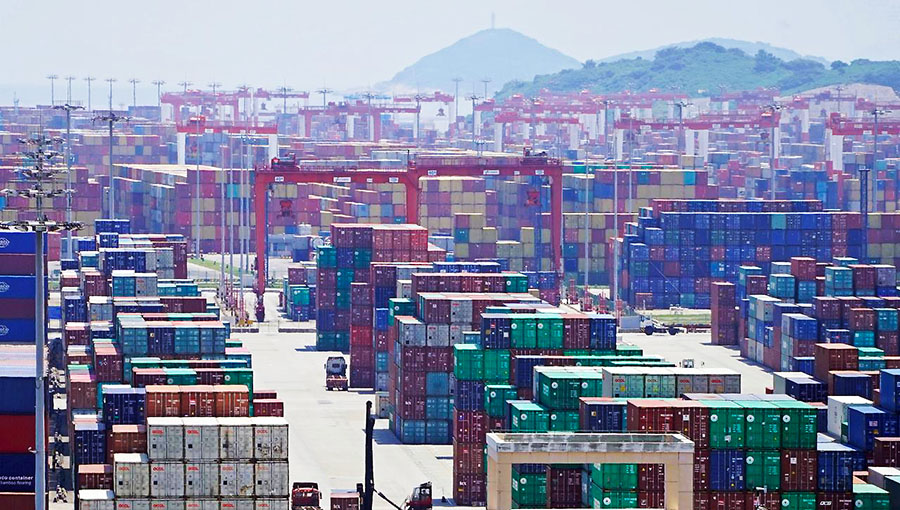

Photo courtesy Reuters