The pandemic may have, ironically, breathed new life into what had been a dying concept, the country club, and the golf industry as a whole. That’s according to a new report from Placer.ai titled “Going For The Green: The Changing Dynamics Of Country Clubs,” which analyzes data from 12 total clubs in and around Long Island, NY; Atlanta, GA; Austin, TX; and Minneapolis, MN.

That report is supported by sales growth in the golf categories and rounds played over the last four years as reported by Golf Datatech, which indicated in a recent report that full-year 2023 golf equipment sales were up more than 39 percent since the 2019 pre-COVID year, despite being flat year-over-year compared with 2022. GDT recently reported that rounds played were up 7.2 percent year-to-date through November 2023, according to the research firm’s National Rounds Played Report.

The Placer.ai analysis believes that country clubs are changing with the times, moving away from the once-exclusive image of business dealings on the golf course, and noted that the more inclusive concept is taking root and attracting a growing number of young members.

The research firm, which measures foot traffic at retail, restaurants, shopping centers and malls, took a closer look at the location intelligence metrics of country clubs in the U.S. to understand how they are shifting and what could be driving these changes.

Putting Along: Country Club Foot Traffic Growth

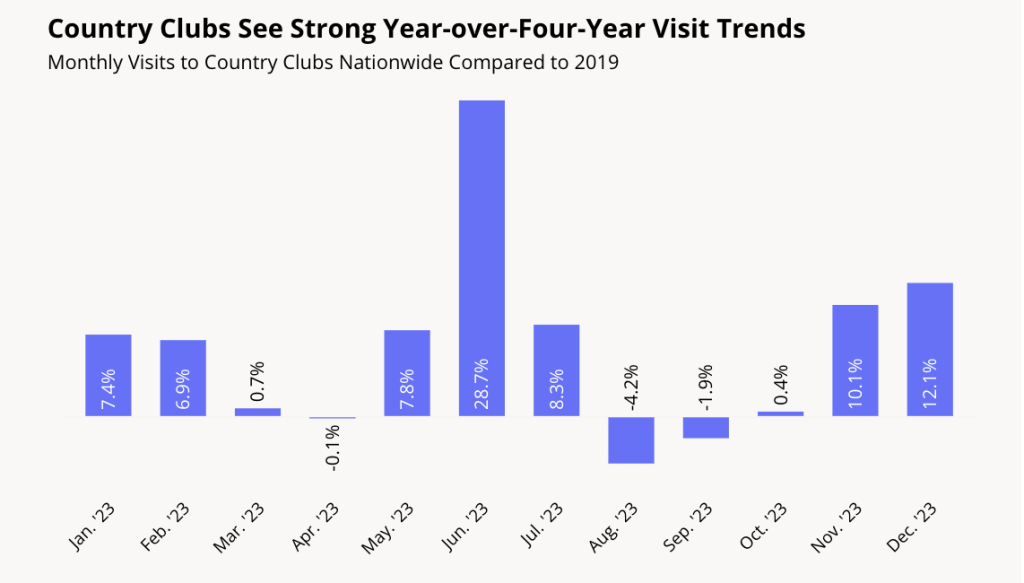

Golf and tennis, two country club stalwarts, surged in popularity during the pandemic, and that increase has sustained itself, with more people playing the game than ever before. Looking at year-over-four-year (Yo4Y) visits to country clubs suggests that country clubs are reaping the benefits from interest in tennis and golf, with elevated visits compared to the same period in 2019 for all but two months analyzed.

When the U.S. Open took place in June, country clubs saw the most impressive Yo4Y visit growth (+28.7 percent). The 2023 championship, the most-watched golf tournament since 2019, was held in the Los Angeles Country Club and likely contributed to a spike in visits to golf clubs, either for U.S. Open-related events or a U.S. Open-inspired desire to play golf. The year ended on a high, with December country club visits up by 12.1 percent Yo4Y, indicating that interest in membership clubs remains strong.

Par For the Generational Course

Millennials, a consumer cohort that has historically shown little interest in joining country clubs, seem to be changing course and may be driving some of the visit growth. This population is increasingly seeking spaces to socialize and network – and in response, many golf clubs are shifting their offerings to appeal to a younger demographic. Location intelligence indicates that the strategy is working. One key here may be the addition of Pickleball courts as that nascent sport continues to build dramatically – both with younger and older players.

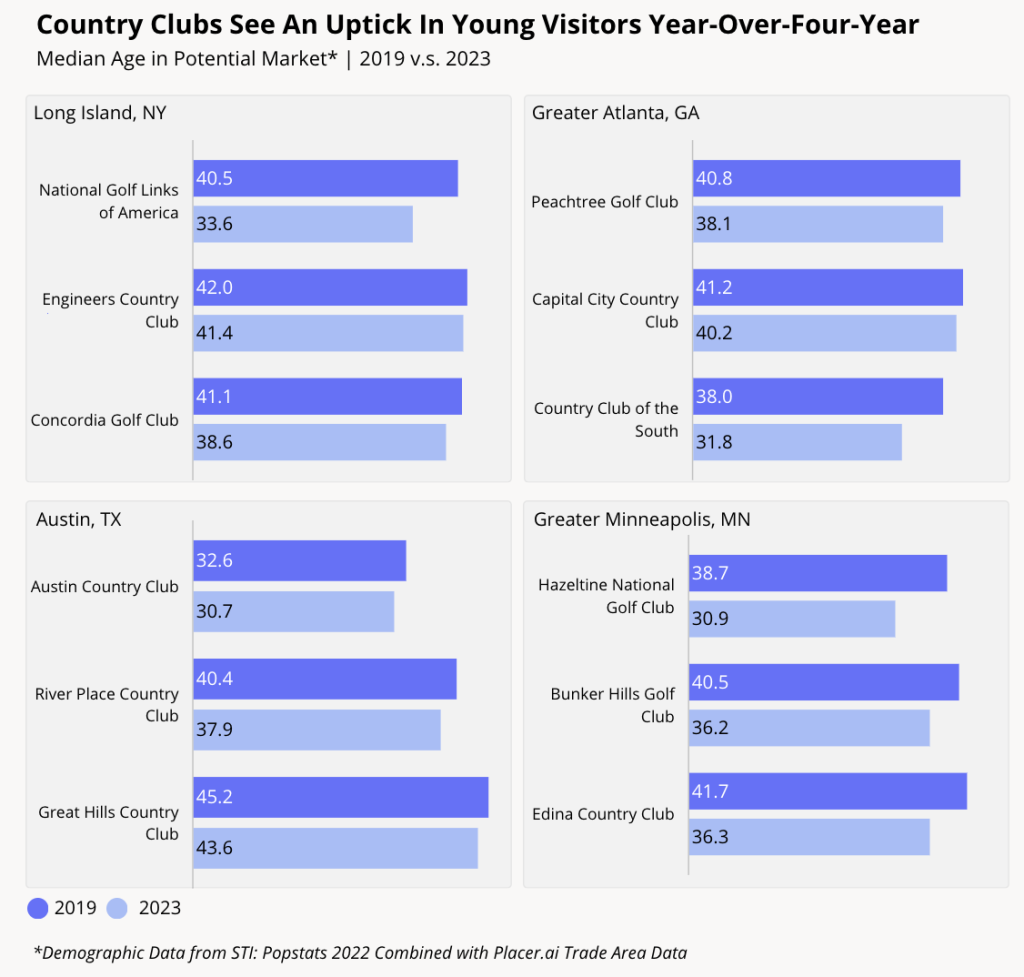

Examining country club demographics across the country – in Long Island, NY; Austin, TX; Atlanta, GA; and Minneapolis, MN – suggests a shift in membership makeup. Some of these areas have seen an influx of millennials in recent years, which likely expanded the pool of younger potential country club members. But the trade areas of many of the country clubs also skewed younger in 2023 than they did in 2019 – meaning that these clubs are attracting visitors from neighborhoods with lower median ages compared to the neighborhoods feeding visits to country clubs in 2019.

Some clubs, like the Capital City Country Club in Atlanta, GA, saw relatively small drops in median age – from 41.2 in 2019 to 40.2 in 2023. But other clubs saw much more pronounced drops – the Hazeltine National Golf Club near Minneapolis, MN saw its median age drop by 7.8 years between 2019 and 2023. The Country Club Of The South in Atlanta, GA, also saw a Yo4Y drop in median age – from 38.0 to 31.8 years of age.

Get That Green: Median Household Income Shifts

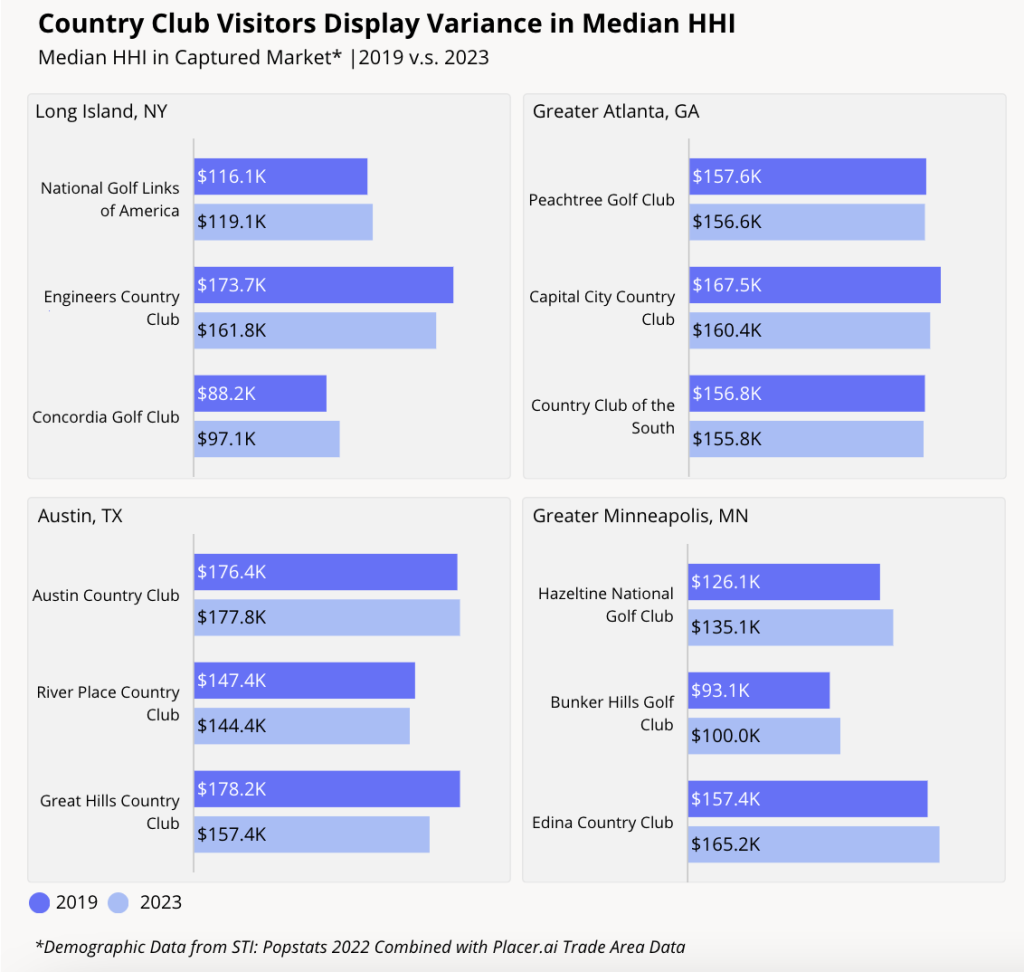

Country clubs tend to have a steep financial barrier to entry, with costs, including annual membership dues, initiation fees and expenses for food and beverages, and, perhaps unsurprisingly, most country club members boast a median household income (HHI) well above the national median, and although younger demographics generally have to have less income than their older counterparts, the drop in median age across many country clubs does not seem to be having an impact on the affluence of these clubs’ visitor bases.

Some clubs that experienced Yo4Y drops in the median HHI of visitors (Great Hills Country Club in Austin, TX, for example) did see the median HHI of its visitors drop slightly. But for the most part, the median HHI of visitors to country clubs remained stable Yo4Y, and some, like the Edina Country Club in Minnesota, saw the median HHI grow Yo4Y, suggesting that the decline in median age within membership clubs could be driven by a desire for socializing and new experiences rather than a shift towards increased financial accessibility for a broader range of members.

Tee Time Is Anytime

The shift in the demographics of country club visitors, marked by the rising number of younger members, is a trend that could solidify further. Clubs in tune with this demographic (young professionals and Millennials) might consider what is important to this demographic to continue the attraction.

For more data-driven leisure and entertainment insights from Placer.ai, go here. Images, data and graphics courtesy Placer.ai

***

For more SGB Media-related coverage, see the article below.

Golf Datatech Sees 2023 Golf Equipment Sales Trend Flat to 2022