Placer.ai is reporting that mall traffic declined in June across all tracked formats, perhaps representing natural demand normalization after tariff-driven spring shopping rather than consumer weakness.

The company, which tracks foot traffic at mall and restaurants, said in its latest Mall Index that open-air shopping centers remain the only format to exceed pre-pandemic levels – though indoor malls are beginning to catch up.

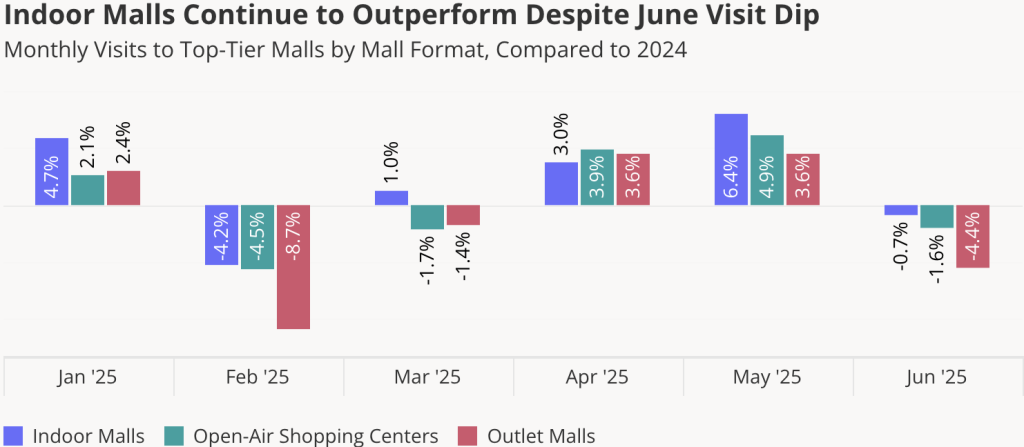

Visits Dip Slightly in June

Placer.ai noted that June 2025 shopping center traffic fell slightly following two straight months of year-over-year (YoY) visit growth – although indoor malls continued to show the strongest performance, with just a 0.7 percent drop in YoY June visits.

Open-air shopping centers and outlet malls saw YoY visit declines of 1.6 percent and 4.4 percent.

The company said the course reversal may suggest that the visit growth in April and May was at least partially driven by a pull-forward of consumer demand in anticipation of tariff-driven price hikes.

“By June, many of those purchases had likely already been made, and the resulting downturn in mall visits might represent a natural normalization of traffic rather than a new weakness in consumer demand,” the company said in its analysis.”

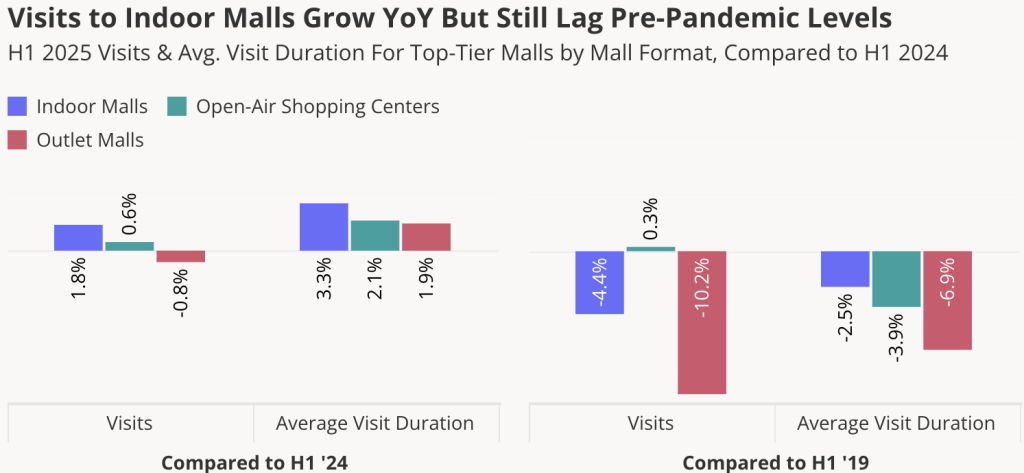

First Half 2025 Mall Performance Largely Positive

Despite the June slow-down, shopping center traffic was said to be mostly positive in the 2025 first half (H1).

“Indoor malls led the pack, with YoY visits up 1.8 percent, while open-air shopping centers saw visits grow 0.6 percent YoY and outlet mall traffic remained relatively flat at -0.8 percent,” Placer.ai assessed. The company said all mall formats experienced a rise in average visit duration – with indoor malls once again seeing the largest average dwell time increase of 3.3 percent – suggesting an improvement in visit quality and consumer engagement.

placer.ai continued, “But while indoor malls led in terms of short-term growth, comparing current visitation to pre-COVID patterns revealed the longer-term strength of the open-air format – the only shopping center type to surpass pre-pandemic levels, with visits up 0.3 percent compared to H1 2019.”

The company said indoor malls’ average visit duration has recovered more closely to 2019 levels – perhaps suggesting that visit quality is improving at indoor malls faster than the visit quantity.

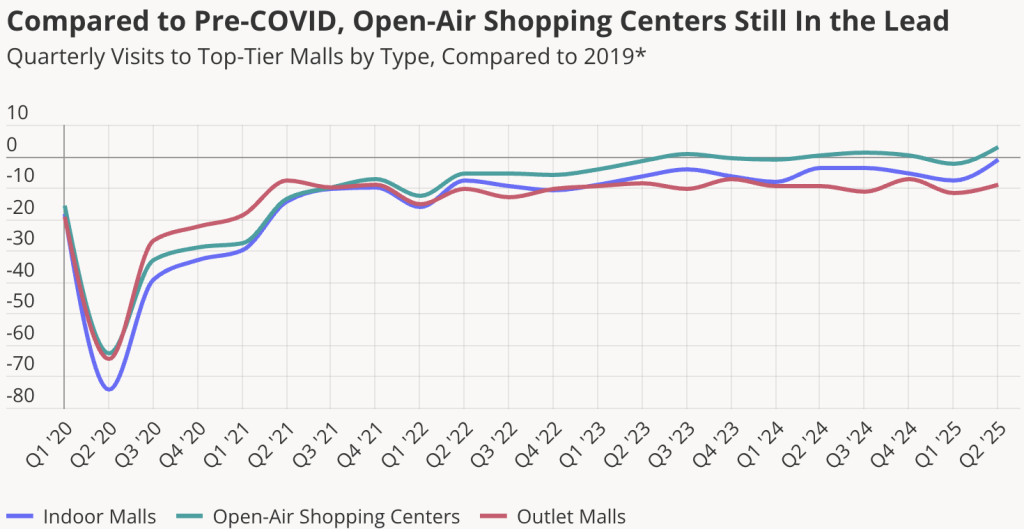

Quarterly Trends Point to Accelerating Indoor Mall Comeback

Looking at quarterly visit data since the pandemic also highlights the visitation success of open-air shopping centers and the recent comeback of indoor malls, according to the company.

“Open-air shopping centers are the only type of mall where visits consistently met or exceeded pre-pandemic levels over the past two years, with Q2 ’25 visits 2.7 percent higher than in Q2 ’19,” Placer.ai said.

But the firm also noted that indoor malls narrowed the gap significantly this past quarter – with Q2 2025 visits just 1.1 percent below Q2 2019, marking their strongest performance since 2020 – suggesting that the post-pandemic indoor mall story is still being written.

Mall Recovery Ongoing

Placer.ai continued its analysis of the data, suggesting that while June’s softness may reflect natural demand normalization after spring’s tariff-driven shopping surge, the broader YoY H1 2025 trends show shopping centers generally exceeding last year’s visit levels with average visit duration also on the rise. While visit quantity and quality is generally not quite back to pre-COVID levels, the data suggests that the recovery story is very much still being written.

Image courtesy Bal Harbar Shops/Data and Graphs courtesy Placer.ai