The International Council of Shopping Centers (ICSC) released new report assessing the trends in product returns in the retail marketplace.

The ICSC report found that the average return rate for online purchases is 15.2 percent, three times higher than the 5 percent return rate for in-store purchases. In other words, for every $100 spent online, an average of $15 is returned, while an average of only $5 is returned for every $100 spent in-store. The trend line favoring the brick-and-mortar store should be expected when consumers buy anything without trying it on or for functionality.

Consumers tend to order multiple sizes, colors and styles online before making a decision, what or if to purchase that product. The same process occurs at retail, but only some things in the dressing room make it out the door.

However, the report’s takeaway was more about online versus brick-and-mortar than the reasoning and motivations behind returns and how a retailer maintains or possibly grows a customer relationship via the store’s return policy.

“We have known for some time the value of brick-and-mortar to a retailer’s strategy,” said Tom McGee, president and CEO of ICSC. “Our latest findings further prove this by showing that the return rate for in-store purchases is three times less than the return rate for online purchases. Additionally, consumers are becoming more mindful of changing return policies that result in fees and shortened return windows.”

ICSC said the most common reasons for returning online purchases are damaged item(s) (52 percent), item(s) did not fit (50 percent), item(s) was not as expected (42 percent), and the wrong item(s) was sent (37 percent).

The report suggests that the online return rate was higher than in-store across all categories of those retailers studied, though the gap was widest for discount department stores, where consumers returned just 6.2 percent of items bought in-store compared to 33.2 percent of items purchased online.

For apparel retailers, consumers returned 22 percent of products they bought online, more than three times that of in-store purchased items (6.2 percent).

ICSC found that among surveyed respondents, 87 percent who overbuy online do so with apparel to try things on at home and return what they don’t want. Eighty-two percent of respondents said that when shopping online, return policies influence their decision to purchase from a retailer.

According to the ICSC report, retailers are changing their online return policies to combat the growing challenge and returns costs, but they should be mindful of the impact on consumer behavior.

If retailers charge a return fee to ship back online purchases, nearly three-fourths (71 percent) of respondents said they would likely stop shopping with that retailer, while 6 in 10 respondents said they would likely stop shopping online with retailers that shortened the free return window altogether.

“Keep it” policies may be becoming more prevalent as retailers attempt to mitigate the additional cost of shipping back returned items. Sixty percent of respondents said they had received a full refund and were told to keep the merchandise they had purchased online.

While stricter online return policies might drive consumers away from shopping online, it might drive shoppers to shop brick-and-mortar. Seventy-nine percent of consumers said they would be more inclined to visit a retailer’s store to make a return if they were charged for returning items purchased online, while 77 percent also said that they would visit a retailer’s store to make a purchase if they were charged for returning items online.

Methodology

ICSC’s Consumer Returns Survey was fielded online between February 7 and February 9, 2024, and polled a demographically representative U.S. sample of 1,012 consumers about their motivations for returning online purchases compared to in-store. As part of ICSC’s The Halo Effect III report released in December 2023, ICSC partnered with strategy and research firm Alexander Babbage to conduct a returns analysis on $848.1 billion of in-store and online spending in 2022 across 69 retailers and 2,103 stores.

***

NRF Saw Merchandise Returns at 14.5 Percent in 2023

Online retailers have focused on mitigating returns, as total returns for the industry amounted to $743 billion in merchandise in 2023, according to a report released by the National Retail Federation (NRF) and Appriss Retail.* As a percentage of sales, the total return rate for 2023 was 14.5 percent.

According to the NRF’s December report, for every $1 billion in sales, the average retailer reportedly incurs $145 million in merchandise returns. The report noted that online sales see a higher return rate, with 17.6 percent, or $247 billion, of merchandise purchased online returned. That compares with 10.02 percent, or $371 billion, for brick-and-mortar returns, excluding online orders returned in-store.

“Retailers continue to test and implement new ways to minimize losses from returns, particularly fraudulent returns, while at the same time optimizing the shopping experience for their customers,” said NRF Executive Director of Research Mark Mathews. Retailers’ efforts include providing greater detailed descriptions of the sizing and fit of products for online purchases and requiring a receipt with returned items. As a whole, the industry is prioritizing efforts to reduce the amount of merchandise returned in stores and online.”

Last year, return fraud contributed $101 billion in overall losses for retailers, according to the NRF report. Moreover, for every $100 in returned merchandise, retailers are expected to lose $13.70 to return fraud.

“As concerns around return fraud continue to grow, retailers are bolstering their efforts to mitigate the related losses,” the report noted. “With increases in both in-store and digital traffic, many retailers are testing in-store policy changes and limiting the flexibility of online returns. Keeping customer satisfaction in mind, retailers are strengthening customer service operations through frictionless retail and a seamless end-to-end user experience.”

Among the types of return fraud retailers reported in the past year, the report said nearly one-half (49 percent) cited returns of used, non-defective merchandise, also known as wardrobing, and 44 percent cited the return of shoplifted or stolen merchandise. Over one-third (37 percent) of retailers said they experienced returns of merchandise purchased on fraudulent or stolen tender, and one-fifth (20 percent) said they had experienced return fraud from organized retail crime groups.

“The continued growth of online channels has had a significant impact on retail sales and returns,” Appriss Retail CEO Michael Osborne said. “One example is our tracking of claims and appeasements, which is a new category in online returns that covers reports for missed, late or damaged deliveries and is the fastest-growing category for return fraud.”

While the holiday season is one of the biggest sales periods of the year for retailers, they only expect a slight uptick in the return rate compared with the rest of the year, according to the report.

The NRF report found that $148 billion in holiday merchandise is expected to be returned at 15.4 percent; however, retailers anticipate nearly $25 billion in fraudulent returns, representing 16.5 percent of total holiday returns. The holiday season, with increased foot traffic, could be exploited by those seeking to make fraudulent returns.

NRF partnered with Appriss Retail to pair its customer return data with NRF survey responses. Appriss Retail’s customers include 60 of the Top 100 U.S. retailers, allowing greater granularity in the data. Given the change in methodology, unless otherwise noted, 2023 numbers cannot be compared to the 2022 returns report.

To read the NRF and Appriss Retail 2023 Return Results, go here.

***

So, it’s only natural for merchants to seek ways to offset the cost of returned goods in the reverse logistics journey. But how can that be done without impacting customer satisfaction? What creates a dedicated customer?

Happy Returns is working to help retailers with the dynamics of the returns process. Suggestions from their website include the following.

1. Drive desired behavior by giving shoppers options. Shoppers have always valued brands that prioritize choice during shopping, which trickles down to returns. Merchants that use Happy Returns software and Return Bars reverse logistics maximize choice regarding how shoppers handle returns, whether dropping off returned items at a brick-and-mortar store, one of its 5,000-plus Return Bars, or returning by mail. Merchants can also capitalize on the cost savings that Return Bars deliver, slashing up to 40 percent of shipping costs by aggregating returned items.

1. Drive desired behavior by giving shoppers options. Shoppers have always valued brands that prioritize choice during shopping, which trickles down to returns. Merchants that use Happy Returns software and Return Bars reverse logistics maximize choice regarding how shoppers handle returns, whether dropping off returned items at a brick-and-mortar store, one of its 5,000-plus Return Bars, or returning by mail. Merchants can also capitalize on the cost savings that Return Bars deliver, slashing up to 40 percent of shipping costs by aggregating returned items.

Recommendations To Consider

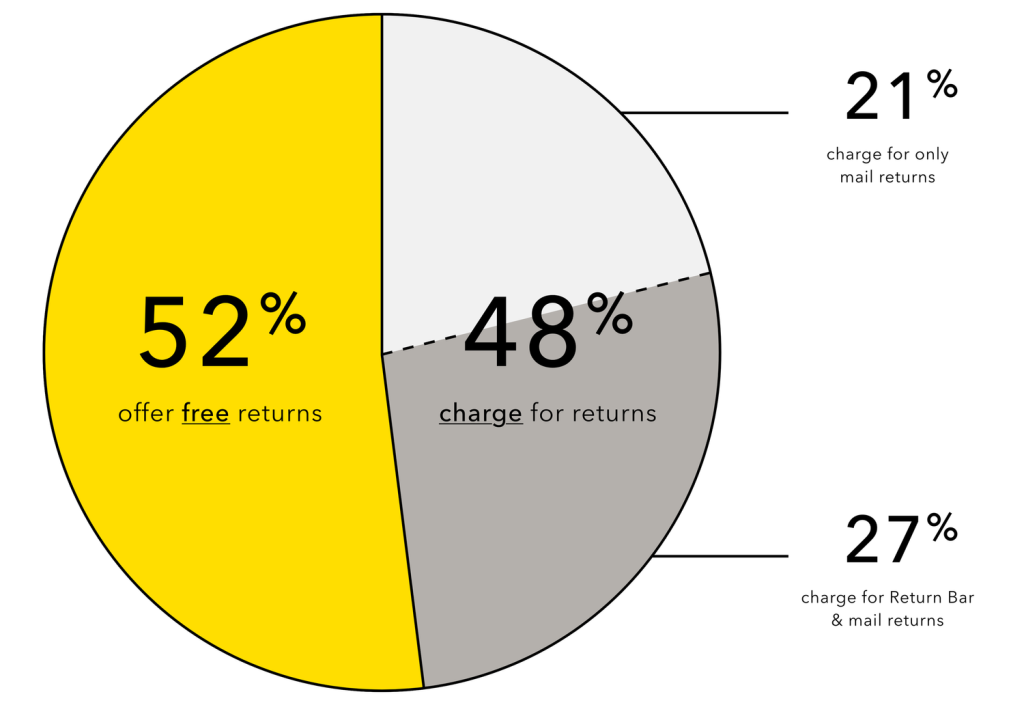

- Returns to a retail store: Make it Free

- Return Bar drop-offs: Make it Free

- Return by Mail: Charge a nominal fee

By charging for mail returns while keeping in-person drop-offs free, retailers will drive shoppers to select the return method with the lowest cost to them while providing a better customer experience through immediately initiated refunds and reducing fraud.

2. Set Fees Within Reason

Once a retailer decides to charge for mail returns, the return fee should be, at most, the cost of the carrier label to ship the goods back.

3. Communicate Return Policy Changes Early and Often

Finally, setting expectations with consumers who shop with you is essential. Return fee policies should be featured prominently on all product pages, on the final shopping cart page, at the time of checkout,

and featured on the FAQs return fee policy page within a retailer’s website and on all automated order and delivery confirmation emails.

Retail is a constantly changing business, and return policies should adjust accordingly. With the right strategy, recouping some or all increasing costs of return by mail, while maintaining an exceptional experience on in-person returns will ensure high customer satisfaction.

Image/graphic courtesy Happy Returns