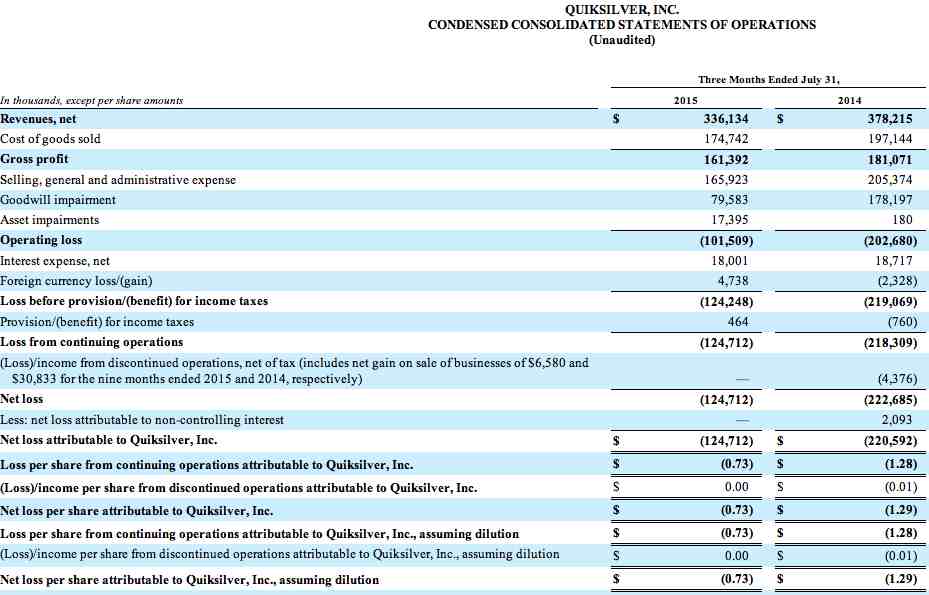

Quiksilver Inc., which filed for bankruptcy protection on September 9, reduced its losses in the third quarter ended July 31, to $124.7 million from $220.6 million a year ago. Revenues shrunk 11.1 percent to $336.1 million from $378.2 million, according to a filing with the Securities and Exchange Commission.

Brazil weighs on Americas segment

Net revenues in its Americas segment decreased $29 million, or 15 percent, basis during the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates contributed $7 million of this decrease. In addition, its licensing of peripheral product categories contributed $21 million of this decrease.

Net revenues on a constant currency continuing category basis decreased by $3 million, or 2 percent, primarily due to a decrease in footwear category net revenues in the Americas wholesale channel. Net revenues in the emerging market of Mexico increased by 20 percent on an as reported basis (44 percent in constant currency) while net revenues in the emerging market of Brazil decreased by 34 percent on an as reported basis (9 percent in constant currency) reflecting the combination of economic slowdown in Brazil in fiscal 2015 and the negative impact of logistics issues.

Net revenues in the Americas retail channel decreased 4 percent on an as reported basis due to negative growth in same-store sales and stores net closures. Net revenues in the Americas e-commerce channel decreased 5 percent on a constant currency continuing category basis in the third quarter of fiscal 2015, primarily due to reduced discounting resulting in lower revenues but improved gross margins.

In EMEA, Russia provides an unlikely boost

Net revenues in its EMEA segment decreased $11 million, or 9 percent, on an as reported basis during the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates contributed $25 million of this decrease. Its licensing of peripheral product categories did not materially affect the EMEA region.

Net revenues on a constant currency continuing category basis increased by $14 million, or 14 percent, primarily due to an increase in Quiksilver apparel and accessories net revenues of $6 million in the EMEA wholesale channel.

Despite the significant adverse impact of currency exchange rate changes, net revenues in the emerging market of Russia increased 18 percent on an as reported basis (85 percent in constant currency) mainly due to better performance in the wholesale business. Net revenues in the e-commerce channel increased 41 percent on a constant currency continuing category basis in the third quarter of fiscal 2015, combined with a 17 percent net revenue increase in the wholesale channel on a constant currency continuing category basis.

Retail expansion fuels APAC growth

Net revenues in its APAC segment decreased by $3 million, or 5 percent, on an as reported basis during the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates contributed $9 million of this decrease. Its licensing of peripheral product categories did not affect the APAC region.

Net revenues on a constant currency continuing category basis increased by $6 million, or 11 percent, primarily due to net new store openings in the retail channel and a 41 percent increase in e-commerce channel net revenues. Net revenues in the emerging markets of China, South Korea, Taiwan, and Indonesia increased by a combined 18 percent on an as reported basis (28 percent in constant currency).

Aggregate net revenues in its emerging markets, which include Brazil, Mexico, Russia, Indonesia, South Korea, China, and Taiwan, increased 5 percent versus the comparable prior year period on an as reported basis, but increased 30 percent in constant currency, reflecting the significant adverse impact of the strengthening U.S. dollar on local currency results.

Revenues by brand

Quiksilver brand net revenues decreased $9 million, or 6 percent, on an as reported basis in the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates contributed $17 million of this decrease. Its licensing of peripheral product categories contributed $5 million of this decrease. Net revenues on a constant currency continuing category basis increased by $13 million, or 11 percent, primarily due to increased net revenues in the EMEA wholesale channel.

Roxy brand net revenues decreased $21 million, or 18 percent, on an as reported basis in the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates contributed $11 million of this decrease. Its licensing of peripheral product categories contributed $8 million of this decrease. Net revenues on a constant currency continuing category basis decreased $4 million, or 4 percent, primarily due to decreased footwear net revenues in the Americas wholesale channel.

DC brand net revenues decreased $12 million, or 11 percent, on an as reported basis in the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates contributed $11 million of this decrease. Its licensing of peripheral product categories contributed $7 million of this decrease. Net revenues on a constant currency continuing category basis increased $6 million, or 7 percent, primarily due to higher footwear net revenues in the APAC wholesale channel.

Wholesale and Retail post currency-neutral gains

Wholesale net revenues decreased $35 million, or 15 percent, on an as reported basis in the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates contributed $24 million of this decrease. Its licensing of peripheral product categories contributed $21 million of this decrease.

On a constant currency continuing category basis, wholesale net revenues increased $10 million, or 5 percent, compared to the prior year period, primarily due to wholesale net revenue increases in the Quiksilver brand.

Retail net revenues decreased $11 million, or 9 percent, on as reported basis in the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates contributed $15 million of this decrease. Its licensing of peripheral product categories did not affect its retail channel.

On a constant currency continuing category basis, retail net revenues increased $4 million, or 4 percent, versus the prior year. Global retail same-store sales were down 1.8 percent in the third quarter of fiscal 2015, which was more than offset by 52 net new store openings during the previous twelve months.

E-commerce net revenues increased $1 million, or 5 percent, on an as reported basis in the third quarter of fiscal 2015 versus the comparable prior year period. Changes in foreign currency exchange rates had a negative impact of $2 million. E-commerce net revenues increased in its EMEA and APAC segments as the company expanded its online service area.

Gross Profit

Gross profit decreased to $161 million in the third quarter of fiscal 2015 from $181 million in the comparable period of the prior year. Gross margin, or gross profit as a percentage of net revenues, increased slightly to 48.0 percent in the third quarter of fiscal 2015 versus 47.9 percent in the comparable prior year period. This 10 basis point increase in gross margin was primarily due to lower discounting in the wholesale and retail channels of all three regional segments (approximately 65 basis points), and a channel mix trend in favor of its higher margin direct-to-consumer channels (approximately 93 basis points), offset by the negative impact of the foreign exchange variation on the cost of goods sold (approximately 190 basis points).

Selling, General and Administrative Expense (“SG&A”)

SG&A from continuing operations decreased $39 million, or 19 percent, to $166 million in the third quarter of fiscal 2015 from $205 million in the comparable prior year period. Changes in foreign currency exchange rates contributed approximately $22 million of this decrease. The remaining $17 million decrease was primarily attributable to reduced employee compensation expenses.

Other Expenses

Goodwill impairment charges were $80 million and $178 million in the third quarter of fiscal 2015 and 2014, respectively. In the third quarter of fiscal 2015, goodwill impairment charges of $74 million and $6 million were recorded in its Americas and APAC reporting units, respectively. In the third quarter of fiscal 2014, a goodwill impairment charge of $178 million was recorded in its EMEA reporting unit.

Asset impairment charges were $17 million in the third quarter of fiscal 2015 compared to $0.2 million in the third quarter of fiscal 2014. In the third quarter of fiscal 2015, asset impairment charges included $16 million to write-down of the carrying value of the Quiksilver trademark and $1 million related to under-performing retail stores. In the third quarter of fiscal 2014, the asset impairment charges of $0.2 million related to under-performing retail stores.

Net interest expense for the third quarter of fiscal 2015 was $18 million compared to $19 million in the third quarter of fiscal 2014. This decrease was primarily due to the impact of changes in foreign currency exchange rates on its euro-denominated interest expense.

Its foreign currency loss was $5 million in the third quarter of fiscal 2015, compared to a gain of $2 million in the comparable prior year period.

Its income tax expense for the third quarter of fiscal 2015 was $0.5 million compared to a benefit of $0.8 million in the third quarter of fiscal 2014. The company generated income tax expense in the third quarter of fiscal 2015 as the company recorded tax expense in certain jurisdictions, but were unable to record certain tax benefits against losses in those jurisdictions where the company have previously recorded valuation allowances.