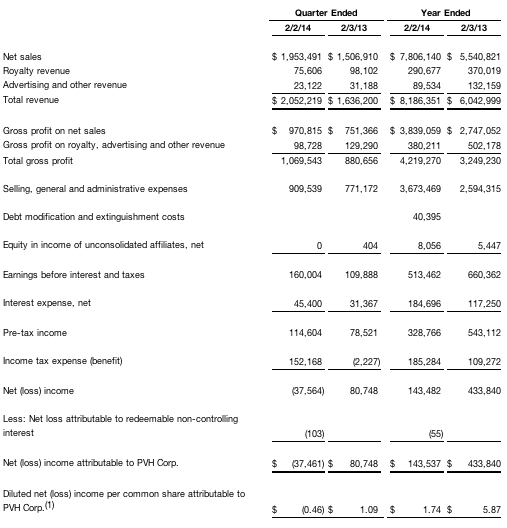

PVH Corp. reported fourth-quarter revenues increased 25 percent to $2.052 billion, boosted by the acquisition of Warnaco, which includes the Speedo brand. as compared to $1.636

billion in the prior years fourth quarter.

Highlights of the report include:

-

Fourth quarter non-gaap eps of $1.43 exceeded guidance of $1.40; gaap loss per share was $(0.46)

- Full year non-gaap eps of $7.03 exceeded guidance of $7.00; gaap eps was $1.74

- Company made $500 million of debt repayments during 2013

- 2014 non-gaap eps projected to increase to $7.40 to $7.50, despite ongoing investments and an uncertain macroeconomic environment

Overview of Fourth Quarter Results:

Earnings per share on a non-GAAP basis was $1.43, which exceeded the companys guidance of $1.40, as compared to $1.60 in the prior years fourth quarter.

GAAP loss per share was $(0.46) as compared to the prior years fourth quarter earnings per share of $1.09.

Revenue increased 25 percent to $2.052 billion, as compared to $1.636 billion in the prior years fourth quarter. The increase over the prior year was principally driven by the addition of approximately $479 million of revenue related to the acquired Warnaco businesses, net of the reduction in licensing revenue attributable to Warnaco. Also contributing to the increase was revenue growth of $18 million, or 2 percent, in the companys Tommy Hilfiger and pre-acquisition Calvin Klein businesses. Partially offsetting these increases was a revenue decline of $81 million, or 19 percent, in the companys pre-acquisition Heritage Brands businesses, of which $75 million was lost revenue resulting from the sale of the G.H. Bass & Co. business on the first day of the quarter.

CEO Comments:

Emanuel Chirico, Chairman and Chief Executive Officer, noted, 2013 was a transformational year for PVH, beginning with the February 2013 Warnaco acquisition, followed by the sale of our Bass retail business in November 2013. We believe that these strategic actions will strengthen our company over the long-term and position us to deliver improved financial returns, as we focus our efforts on our higher margin businesses.

Commenting on the fourth quarter and full year results, Chirico stated, We are pleased with our 2013 fourth quarter results, which exceeded our previous guidance for earnings per share, despite the difficult retail environment. Our pre-acquisition Calvin Klein and Tommy Hilfiger businesses performed well and continued to demonstrate their significant global growth prospects. We have also been pleased with the performance of our newly acquired Calvin Klein businesses in Asia and Brazil, as well as our global underwear business. While our newly acquired Calvin Klein jeans business, particularly in North America and Europe, struggled in 2013, we believe that our focused investments will drive future profitability.

Chirico further commented, The Warnaco integration continues to progress with strategic investments well underway and we have made significant progress towards building a solid foundation for our future across the global Calvin Klein jeans and underwear businesses. We began investing in areas such as filling key open positions, enhancing the existing operating infrastructure, restructuring our customer distribution in various regions, upgrading the quality and design of the Calvin Klein jeans product, and elevating the Calvin Klein presentation at retail. We believe that these investments, which will continue through 2014, will allow us to unlock the full global potential of the Calvin Klein businesses over the long-term.

Chirico concluded, While the global retail landscape continues to be volatile, we believe that through the power of our designer lifestyle brands led by Calvin Klein and Tommy Hilfige r, we can successfully navigate this uncertain market environment, improve the performance of the acquired Calvin Klein businesses and achieve our 2014 guidance. 2014 will represent a year of two stories Fall 2014 will reflect the first season of product from our newly established design and sourcing teams and presented in an enhanced retail presentation, while the first half will be pressured by our ongoing planned strategic investments and the continuing difficult macroeconomic environment. We remain firm in our belief that the investments in our newly acquired businesses, the sound execution of our business strategies and the expansion of our brands globally will position us to deliver long-term growth and stockholder value.

Fourth Quarter Business Review:

Due to the 53rd week in 2012, the companys fourth quarter of 2012 included fourteen weeks of operations, as compared to thirteen weeks in 2013. Fourth quarter 2013 comparable store sales are more appropriately compared with the thirteen week period ended February 3, 2013. All comparable store sales discussed in this release are presented on this shifted basis.

Calvin Klein

Revenue in the Calvin Klein business increased $371 million to $688 million from $317 million in the prior years fourth quarter. $364 million of the increase was attributable to the acquired businesses, net of the reduction in licensing revenue attributable to Warnaco. Total revenue for the pre-acquisition wholesale and retail businesses was relatively flat as compared to the prior years fourth quarter primarily due to flat retail comparable store sales and one less week of revenue in 2013. With respect to the newly acquired businesses, the North America underwear business performed well and exceeded plan, while the North America jeans business continued its weak performance, as the company focused on transitioning to elevated product for Fall 2014 and completed clearing excess inventory. Calvin Klein International comparable store sales increased 1 percent. The Calvin Klein businesses in Brazil and Asia continued to exceed expectations. Within Asia, the China business maintained solid growth and the Korea business again showed improving trends as compared to previous quarters. The Calvin Klein business in Europe remained under pressure primarily due to the companys initiative to restructure the sales distribution mix in this region and the business concentration in Southern Europe, in particular Italy.

Royalty revenue in the fourth quarter decreased $23 million from the prior year amount, primarily resulting from the loss of Warnaco royalties and the expiration of a long-term contractual agreement related to royalties in the North America womens sportswear business, which together totaled $29 million. Excluding these two items, royalty revenue increased 14 percent, driven by strength in womens apparel, watches, handbags and accessories.

Earnings before interest and taxes on a non-GAAP basis for the Calvin Klein business was $86 million as compared to $74 million on a GAAP basis in the prior years fourth quarter, due principally to the addition of revenue related to the newly acquired businesses, partially offset by the cost of strategic investments in those businesses.

GAAP earnings before interest and taxes for the Calvin Klein business was $23 million as compared to $74 million in the prior years fourth quarter. The decline was principally driven by the Warnaco integration and restructuring costs incurred during the fourth quarter of 2013, partially offset by the net non-GAAP earnings increase discussed above.

Tommy Hilfiger

Revenue in the Tommy Hilfiger business increased 1 percent to $902 million as compared to $891 million in the prior years fourth quarter. Flat revenue in the Tommy Hilfiger North America business relative to last year reflected relatively flat retail comparable store sales combined with one less week of revenue in the fourth quarter of 2013. Revenue in the Tommy Hilfiger International business increased 2 percent as compared to the prior years fourth quarter, driven by a 10 percent increase in each of the European wholesale and European retail businesses, including 7 percent retail comparable store sales growth. Also contributing to the European revenue growth was the positive impact of foreign currency translation resulting from a stronger Euro in the fourth quarter of 2013 as compared with the prior year period. These increases were partially offset by the continued underperformance in Japan, combined with the negative impact of foreign currency translation resulting from a weaker Yen as compared with the prior year period.

Earnings before interest and taxes for the Tommy Hilfiger business increased 15 percent to $118 million (which was in accordance with GAAP) from $102 million (which was on a non-GAAP basis) in the prior years fourth quarter, principally driven by the net revenue increase discussed above, gross margin improvement in Europe and a reduction in operating expenses due, in part, to synergies achieved in Europe as a result of the Warnaco acquisition. GAAP earnings before interest and taxes for the Tommy Hilfiger business increased 22 percent from $96 million in the prior years fourth quarter for the same reasons as the non-GAAP earnings increase discussed above and the absence in 2013 of $6 million of costs incurred in connection with the Tommy Hilfiger integration and the related restructuring.

Heritage Brands

Total revenue for the Heritage Brands business increased $34 million, or 8 percent, to $462 million, as compared to $428 million in the prior years fourth quarter. The newly acquired Speedo, Warners and Olga businesses contributed $115 million of this increase, which was partially offset by the loss of $75 million of revenue related to the sale of the Bass business on the first day of the fourth quarter of 2013. Excluding the Bass impact, revenue for the pre-acquisition Heritage Brands businesses decreased 2 percent, as a 3 percent increase in the pre-acquisition Heritage Brands wholesale business was more than offset by a 7 percent decline in comparable store sales and a revenue reduction due to square footage contraction resulting from closing underperforming stores in the Heritage Brands retail business.

Earnings before interest and taxes for the Heritage Brands business was $29 million on a non-GAAP basis, as compared to $27 million (which was in accordance with GAAP) in the prior years fourth quarter. The increase was principally driven by the net increase in revenue discussed above, partially offset by gross margin pressure attributable to higher promotional activity in the fourth quarter of 2013.

On a GAAP basis, earnings before interest and taxes for the Heritage Brands business was $21 million as compared to $27 million in the prior years fourth quarter. This decrease was principally due to Warnaco integration and restructuring costs incurred during the current years fourth quarter, which more than offset the non-GAAP earnings increase discussed above.

Fourth Quarter Consolidated Earnings:

On a non-GAAP basis, earnings before interest and taxes increased 15 percent to $207 million from $180 million in the prior years fourth quarter.

Earnings before interest and taxes on a GAAP basis was $160 million as compared to $110 million in the prior years fourth quarter. The earnings increase was primarily due to (i) the same reasons as for the net non-GAAP earnings increase in the companys businesses discussed above; (ii) an $81 million increase due to retirement plan actuarial gains in 2013, as compared to actuarial losses in 2012; and (iii) the absence in 2013 of $6 million of costs related to the integration of Tommy Hilfiger and the related restructuring, partially offset by an increase over the prior year of $62 million of Warnaco integration and restructuring costs.

Net interest expense increased to $45 million (which was in accordance with GAAP) as compared to $28 million on a non-GAAP basis in the prior years fourth quarter, due to an increase in the companys total indebtedness incurred at the time of the Warnaco acquisition. GAAP net interest expense was $31 million in the prior years fourth quarter. During the fourth quarter of 2013, the company made debt repayments totaling $297 million on its outstanding term loans, which brought total 2013 debt repayments to $500 million.

Retrospective Adjustment of Warnaco Purchase Price Allocation:

During the fourth quarter of 2013, the company retrospectively adjusted the fair value of the order backlog recorded in connection with the Warnaco acquisition. The related order backlog amortization expense for the first and second quarters of 2013 was reduced as a result of this fair value adjustment. The companys non-GAAP results were not impacted by this adjustment, as costs incurred in connection with the acquisition, integration and related restructuring of Warnaco, including short-lived valuation adjustments and amortization, were excluded on a non-GAAP basis during 2013.

Full Year 2013 Consolidated Results:

On a non-GAAP basis, earnings per share was $7.03 as compared to $6.58 in 2012.

GAAP earnings per share was $1.74 as compared to $5.87 in 2012.

- Revenue on a non-GAAP basis increased $2.173 billion, or 36 percent, to $8.216 billion as compared to the prior years amount of $6.043 billion (which was in accordance with GAAP). Driving the increase was:

- A $1.646 billion increase in the Calvin Klein business as compared to 2012, driven by (i) the addition of $1.525 billion attributable to the acquired Warnaco businesses, net of the reduction in licensing revenue attributable to Warnaco; (ii) an 8 percent increase in the pre-acquisition North America wholesale business; and (iii) an increase in the North America retail business driven by 3 percent comparable store sales growth and square footage expansion. Royalty revenue decreased 31 percent as compared to the prior year, principally due to the loss of Warnaco royalties and the expiration of a long-term contractual agreement related to royalties in the North America womens sportswear business, which together totaled $105 million. Excluding the expiration of this contract and the loss of Warnaco royalties, royalty revenue increased 11 percent, driven by strength in womens apparel, handbags and accessories, as well as mens and womens outerwear.

- A 7 percent, or $216 million, increase in the Tommy Hilfiger business as compared to 2012. Revenue in the Tommy Hilfiger North America business increased 8 percent, principally driven by 4 percent retail comparable store sales growth, retail square footage expansion and double-digit growth in the North America wholesale business. Revenue in the Tommy Hilfiger International business increased 6 percent. Growth in Europe was driven by a 6 percent European retail comparable store sales increase, retail square footage expansion and a 9 percent increase in the European wholesale business, and also included a positive impact of foreign currency translation due to a stronger Euro compared with the prior year. These increases were partially offset by underperformance in Japan, where the company continued its efforts to reposition the brand. The business in Japan was also negatively impacted by foreign currency translation due to a weaker Yen in 2013.

- A 19 percent, or $311 million, increase in the Heritage Brands business compared to 2012, driven by (i) the addition of $450 million attributable to the newly acquired Speedo, Warners and Olga businesses; and (ii) a $19 million increase in the pre-acquisition ongoing wholesale businesses, partially offset by (a) the loss of $75 million related to the exited Bass business; (b) the loss of $42 million related to the Izod womens and Timberland wholesale sportswear businesses exited in 2012; and (c) a comparable store sales decline of 7 percent in the retail business due, in large part, to weak performance at Bass during the first three quarters of 2013.

- GAAP revenue of $8.186 billion was $30 million lower than non-GAAP revenue for the year. The difference is attributable to sales returns accepted from certain Warnaco Asia wholesale customers during the first quarter of 2013 in an initiative to reduce excess inventory levels.

- On a non-GAAP basis, earnings before interest and taxes increased $215 million over 2012 to $967 million due to:

- A $147 million increase in the Calvin Klein business, driven primarily by the addition of revenue related to the acquired Warnaco… businesses, partially offset by the cost of strategic initiatives in those businesses in the second half of 2013, combined with strong growth in the company’s pre-acquisition businesses.

- A $42 million increase in the Tommy Hilfiger business, principally due to the revenue increase mentioned above.

- A $40 million increase in the Heritage Brands business, driven by (i) the addition of earnings related to the newly acquired Speedo, Warner’s and Olga businesses; and (ii) growth in the company’s ongoing pre-acquisition wholesale businesses, partially offset by weakness in the Heritage Brands retail business.

- A $13 million increase in corporate expenses, due principally to the addition of Warnaco corporate expenses, net of savings and synergies realized from the acquisition.

- GAAP earnings before interest and taxes decreased $147 million to $513 million as compared to $660 million in the prior year. The earnings decrease was primarily due to (i) an increase over the prior year of $468 million of costs related to the acquisition, integration, restructuring and debt modification and extinguishment charges related to the Warnaco acquisition; and (ii) a $20 million loss recorded in connection with the sale of the Bass business, including related costs. These decreases were partially offset by (i) $24 million of income due to the amendment of an unfavorable contract, which resulted in the reduction of a liability recorded at the time of the Tommy Hilfiger acquisition; (ii) an $81 million increase due to retirement plan actuarial gains in 2013, as compared to actuarial losses in 2012; (iii) the absence in 2013 of $21 million of costs related to the integration of Tommy Hilfiger and the related restructuring; and (iv) the net non-GAAP earnings increase discussed above. Of the $510 million of acquisition, integration, restructuring and debt modification and extinguishment charges related to the Warnaco acquisition incurred during 2013, approximately $215 million were non-cash, most of which relate to short-lived valuation adjustments and amortization.

- On a non-GAAP basis, net interest expense increased to $184 million as compared to $114 million in the prior year, due to an increase in the company’s total indebtedness incurred in connection with the Warnaco acquisition. GAAP net interest expense was $185 million as compared to $117 in the prior year. During 2013, the company made debt repayments totaling $500 million on its outstanding term loans.

- On a non-GAAP basis, the effective tax rate was 25.8 percent as compared to 23.8 percent in the prior year. The GAAP effective tax rate was 56.4 percent as compared to 20.1 percent for the prior year. The increase in the GAAP effective tax rate as compared to the prior year was due principally to recording an increase to the company’s previously-established liability for an uncertain tax position related to European and U.S. transfer pricing arrangements.

2014 Guidance:

In 2014, the company expects its results to be impacted by the following: (i) approximately $25 million of incremental planned investments across the company’s acquired businesses focused on people, infrastructure, point of sale marketing, customer distribution restructuring and e-commerce in the first half of 2014; (ii) approximately $0.15 per share negative impact from foreign currency due, in large part, to changes in the Canadian Dollar and Brazilian Real; and (iii) approximately $0.10 per share negative impact from the exited Bass retail business.

Full Year Guidance

Earnings per share is currently projected to be in a range of $7.40 to $7.50 on a non-GAAP basis, as compared to $7.03 in 2013, or an increase of 5 percent to 7 percent.

Revenue in 2014 is currently projected to increase 3 percent to approximately $8.5 billion, inclusive of a negative impact of $176 million, or 2 percent, attributable to the exit from the Bass business. It is currently projected that revenue for the Calvin Klein business in 2014 will increase approximately 5 percent. Revenue for the Tommy Hilfiger business in 2014 is currently expected to increase approximately 7 percent. Revenue for the ongoing Heritage Brands business in 2014 is currently projected to increase approximately 4 percent. Including the negative impact related to the sale of the Bass business, revenue for the Heritage Brands business is currently projected to decrease approximately 5 percent.

Net interest expense is expected to be approximately $145 million in 2014, as anticipated debt payments of approximately $400 million in 2014, combined with the effect of debt payments made during 2013 and the recent refinancing of the company’s term loans and redemption of its 7 3/8 percent senior notes in the first quarter of 2014, are expected to result in a decrease to net interest expense as compared to 2013. The company currently estimates that the 2014 effective tax rate will be between 23.5 percent and 24.5 percent.

The company’s non-GAAP 2014 earnings per share estimate excludes approximately $100 million of pre-tax costs associated with the Warnaco integration and related restructuring and approximately $90 million of pre-tax costs associated with the refinancing of the company’s term loans and the redemption of its 7 3/8 percent senior notes due 2020. (Please see section entitled “Non-GAAP Exclusions” for details on these pre-tax items.)

First Quarter Guidance

In light of the difficult macroeconomic environment, the company is being cautious in its first quarter outlook. On a non-GAAP basis, earnings per share for the first quarter is projected to be in a range of $1.45 to $1.50, as compared to $1.91 in the prior year’s first quarter.

Revenue in the first quarter of 2014 is currently expected to be approximately $2.0 billion, which represents an increase as compared to 2013 of approximately 2 percent on a non-GAAP basis and approximately 3 percent on a GAAP basis. This estimate is inclusive of a negative impact of $47 million, or 2 percent, attributable to the exited Bass business. It is currently projected that revenue for the Calvin Klein business in the first quarter of 2014 will increase approximately 4 percent on a non-GAAP basis and approximately 9 percent on a GAAP basis. Revenue for the Tommy Hilfiger business in the first quarter of 2014 is currently expected to increase approximately 6 percent. Revenue for the Heritage Brands business in the first quarter of 2014 is currently expected to decrease approximately 8 percent, which includes a 9 percent negative impact related to the sale of the Bass business in 2013.

The company projects that first quarter 2014 net interest expense will be approximately $40 million. The company currently estimates that the 2014 first quarter tax rate will be between 24.5 percent and 25.5 percent. The 2014 first quarter tax rate accounts for a decrease of approximately $0.10 per share versus the 2013 first quarter non-GAAP tax rate, which was favorably impacted by the timing of discrete items.

The company’s first quarter 2014 earnings per share estimate excludes approximately $40 million of pre-tax costs associated with the integration and related restructuring of Warnaco and approximately $90 million of pre-tax costs associated with the refinancing of the company’s term loans and the redemption of its 7 3/8 percent senior notes due 2020. (Please see section entitled “Non-GAAP Exclusions” for details on these pre-tax costs.)

Non-GAAP Exclusions:

The discussions in this release that refer to non-GAAP amounts exclude the following:

- Pre-tax costs of approximately $100 million expected to be incurred in 2014 in connection with the integration of Warnaco and the related restructuring, of which approximately $40 million is expected to be incurred in the first quarter.

- Pre-tax costs of approximately $90 million associated with the refinancing of the company’s term loans and the redemption of its 7 3/8 percent senior notes due 2020, which were incurred in the first quarter of 2014.

- A revenue reduction of $30 million in the first quarter of 2013, due to sales returns accepted from certain Warnaco Asia wholesale customers to reduce excess inventory levels.

- Pre-tax costs of $511 million incurred in 2013 in connection with the acquisition, integration and related restructuring of Warnaco, including costs associated with the company’s debt modification and extinguishment completed at the time of the Warnaco acquisition, and the sales returns mentioned above, of which $224 million was incurred in the first quarter, $128 million was incurred in the second quarter, $61 million was incurred in the third quarter and $99 million was incurred in the fourth quarter. Approximately $215 million of the acquisition, integration and related restructuring charges incurred in 2013 were non-cash charges, the majority of which were short-lived valuation adjustments and amortization.

- Pre-tax income of $24 million due to the amendment of an unfavorable contract, which resulted in the reduction of a liability recorded at the time of the Tommy Hilfiger acquisition.

- A pre-tax loss of $20 million, including related costs, incurred in 2013 in connection with the sale of substantially all of the assets of the Bass business, which closed on November 4, 2013, of which $19 million was incurred in the third quarter and $1 million was incurred in the fourth quarter.

- Pre-tax income of $53 million recorded in the fourth quarter of 2013 related to recognized actuarial gains on retirement plans.

- A tax expense of $120 million recorded in the fourth quarter of 2013 in connection with an increase to the company’s previously-established liability for an uncertain tax position related to European and U.S. transfer pricing arrangements.

- A tax expense of $5 million recorded in the fourth quarter of 2013 associated with various Warnaco integration activities and various adjustments to liabilities for changes in estimates in uncertain tax positions.

- 2012 pre-tax costs of $21 million incurred principally in connection with the integration of Tommy Hilfiger and the related restructuring, of which $3 million was incurred in the first quarter, $5 million was incurred in the second quarter, $7 million was incurred in the third quarter and $6 million was incurred in the fourth quarter.

- 2012 pre-tax costs of $46 million incurred in connection with the acquisition of Warnaco, of which $6 million was incurred in the third quarter and $40 million was incurred in the fourth quarter.

- A pre-tax expense of $28 million recorded in the fourth quarter of 2012 related to recognized actuarial losses on retirement plans.

- A $14 million tax benefit in 2012 related to the recognition of previously unrecognized net operating loss assets and tax credits, of which $5 million was recorded in the third quarter and $9 million was recorded in the fourth quarter.

- Estimated tax effects associated with the above pre-tax items, which are based on the company’s assessment of deductibility. In making this assessment, the company evaluated each item that it has identified above as a non-GAAP exclusion to determine if such item is taxable or tax deductible, and if so, in what jurisdiction the tax expense or tax deduction would occur. All items above were identified as either primarily taxable or tax deductible, with the tax effect taken at the statutory income tax rate of the local jurisdiction, or as non-taxable or non-deductible, in which case the company assumed no tax effect.