Lululemon Athletica inc. announced financial results for the fourth quarter and fiscal year ended Feb. 2, 2014.

For the fourth quarter ended Feb. 2, 2014:

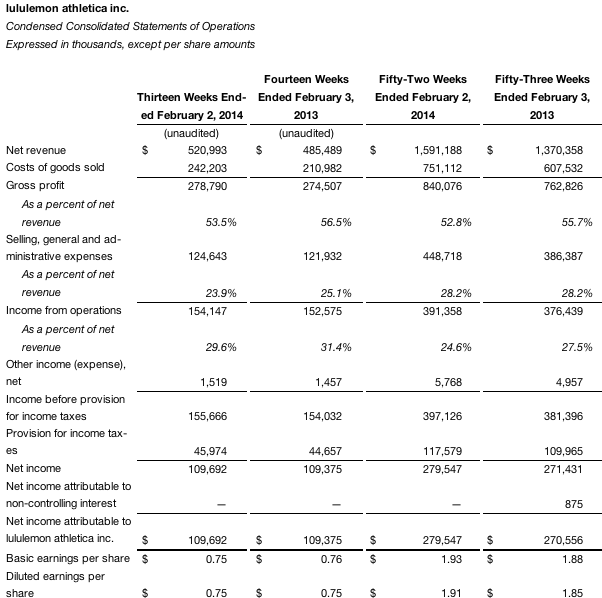

- Net revenue for the quarter increased 7 percent to $521.0 million from $485.5 million in the fourth quarter of fiscal 2012. The fourth quarter of fiscal 2013 consisted of 13 weeks while the fourth quarter of fiscal 2012 consisted of 14 weeks. Net sales for fiscal 2012 include the additional week; however comparable stores sales calculations exclude the 14th week.

- Comparable stores sales for the fourth quarter decreased by 2 percent on a constant dollar basis. Total comparable sales, including comparable stores and direct to consumer, increased 4 percent for the fourth quarter on a constant dollar basis.

- Direct to consumer revenue increased 25 percent to $97.8 million, or 18.8 percent of total Company revenues, in the fourth quarter of fiscal 2013, an increase from 16.1 percent of total Company revenues in the fourth quarter of fiscal 2012.

- Gross profit for the quarter increased by 2 percent to $278.8 million, but as a percentage of net revenue gross profit decreased to 53.5 percent for the quarter from 56.5 percent in the fourth quarter of fiscal 2012.

- Income from operations for the quarter increased by 1 percent to $154.1 million, and as a percentage of net revenue was 29.6 percent compared to 31.4 percent of net revenue in the fourth quarter of fiscal 2012.

- The tax rate for the quarter was 29.5 percent compared to 29.0 percent a year ago.

- Diluted earnings per share for the quarter were $0.75 on net income of $109.7 million, compared to diluted earnings per share of $0.75 on net income of $109.4 million in the fourth quarter of fiscal 2012.

For the fiscal year ended February 2, 2014:

- Net revenue for the fiscal year increased 16 percent to $1.6 billion from $1.4 billion in fiscal 2012. Fiscal 2013 consisted of 52 weeks while fiscal 2012 consisted of 53 weeks. Net sales for fiscal 2012 include the additional week; however, comparable stores sales and sales per square foot calculations exclude the 53rd week.

- Comparable stores sales for fiscal 2013 increased by 4 percent on a constant dollar basis, resulting in $1,894 annual sales per square foot for comparable stores for fiscal 2013. Total comparable sales, including comparable stores and direct to consumer, increased 9 percent on a constant dollar basis for fiscal 2013.

- Direct to consumer revenue increased 33 percent to $263.1 million, or 16.5 percent of total Company revenues in fiscal 2013, from 14.4 percent of total Company revenues in fiscal 2012.

- Gross profit for fiscal 2013 increased by 10 percent to $840.1 million, from $762.8 million in fiscal 2012. As a percentage of net revenue, gross profit decreased to 52.8 percent compared to 55.7 percent in fiscal 2012.

- Income from operations increased by 4 percent to $391.4 million, from $376.4 million in fiscal 2012. As a percentage of net revenue, income from operations decreased to 24.6 percent compared to 27.5 percent of net revenue in fiscal 2012.

- The tax rate for fiscal 2013 was 29.6 percent compared to 28.8 percent for fiscal 2012.

- Diluted earnings per share for fiscal 2013 were $1.91 on net income of $279.5 million, compared to diluted earnings per share of $1.85 on net income of $270.6 million in fiscal 2012.

- The Company ended fiscal 2013 with $698.6 million in cash and cash equivalents compared to $590.2 million at the end of fiscal 2012. Inventory at the end of fiscal 2013 was $186.1 million compared to $155.2 million at the end of fiscal 2012. The Company ended the quarter with 254 stores in North America and Australia.

Updated Outlook

For the first quarter of fiscal 2014, we expect net revenue to be in the range of $377 million to $382 million based on flat total combined comparable sales on a constant dollar basis. Diluted earnings per share are expected to be in the range of 31 to 33 cents for the quarter. This guidance assumes 146.2 million diluted weighted-average shares outstanding and a 30.0 percent tax rate. In the 2013 quarter, it earned 32 cents a share on sales of $345.78 million..

Analysts on average were expecting first-quarter profit of 38 cents per share on revenue of $389.4 million, according to Thomson Reuters I/B/E/S.

For fiscal 2014, we expect net revenue to be in the range of $1.77 billion to $1.82 billion based on a total combined comparable sales increase in the low to mid-single digits on a constant dollar basis. Diluted earnings per share are expected to be in the range of $1.80 to $1.90 for the full year. This guidance assumes 146.3 million diluted weighted-average shares outstanding and a 30.0 percent tax rate.