Puma reported fourth-quarter earnings slightly more than doubled with the help of strong sales growth combined with an improved gross profit margin. Puma also said it expects currency-adjusted net sales will increase by approximately 10 percent in 2018.

2017 Fourth Quarter Facts

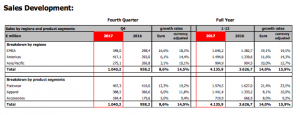

- Sales increase by 14.5 percent currency adjusted to €1,040 million (+8.6 percent reported) with double-digit growth in all regions and footwear being the main growth driver

- Gross profit margin improves by 250 basis points to 47.1 percent

- Operating expenses (OPEX) increase by 11.7 percent, mainly driven by higher marketing and retail expenses

- Operating result (EBIT) more than doubles from €14 million last year to €30 million

- Together with Lewis Hamilton Puma launched 24/7 training campaign featuring the new IGNITE Flash shoe

- Puma wins “Marketer of the Year” Award in the US by Footwear News magazine

2017 Full Year Facts

- Full-year sales increase by 15.9 percent currency adjusted to €4,136 million (+14.0 percent reported), passing the 4 billion sales mark for the first time, all regions with double digit growtH

- Gross profit margin up 160 basis points at 47.3 percenT

- Improved operating leverage with operating expenses (OPEX) increasing by only 11.7 percent

- Operating result (EBIT) improves significantly from €128 million to €245 million

- Net earnings more than double from €62 million to €136 million and EPS increase from €4.17 to €9.09

- Free cashflow improves strongly from €50 million to €117 million

- One-off total dividend of €12.50 per share for 2017 to be proposed

- New lacing technology (NETFIT) introduced for performance and sportstyle footwear

- Puma Future Football boot with NETFIT technology launched for customizable fit

- Women’s business continues to be strong, driven by HEART, FIERCE and PLATFORM footwear styles

Bjørn Gulden, Chief Executive Officer of Puma SE:

“2017 was a great year for us at Puma. We grew 16 percent and achieved for the first time in the history sales above €4 billion. We almost doubled our EBIT to €245 million and showed progress in almost all areas. This momentum together with positive feedback from consumers and our retail partners makes us look positive into 2018. We expect to increase our sales around 10 percent in constant currencies in 2018 and we expect to increase our EBIT to between €305 million to €325 million (€245 million in 2017). We are also pleased by Kering’s proposal to reduce their ownership in Puma by a distribution of dividend in kind to its shareholders. Puma will then be a public independent company with a much higher free float (55 percent) and with two strong anchor shareholders – Kering (16 percent) and Artemis (29 percent). This will allow us to continue our positive development and make Puma the fastest sports brand in the world.”

Sales

Puma’s sales growth continued in the fourth quarter of 2017. Sales increased by 14.5 percent currency-adjusted to €1,040.2 million (+8.6% reported), compared to €958.2 million in the previous year. All regions supported the sales growth with a double-digit increase. The Footwear segment continued to be the main growth driver.

Gross Profit Margin and Operating Expenses

The gross profit margin grew by 250 basis points from 44.6 percent to 47.1 percent in the fourth quarter. The increase was due to further improvements in sourcing, higher sales of new products with a higher margin, a higher share of own retail sales and selective price adjustments.

Operating expenses (OPEX) rose by 11.7 percent to €465.3 million in the fourth quarter, mainly caused by higher marketing investments to fuel both brand heat and sell-through. In addition, higher retail investments for new store openings and the modernization of existing stores supported the increase.

Operating Result and Net Earnings

The operating result (EBIT) more than doubled from €14.1 million to €29.8 million in the fourth quarter 2017. The improvement in profitability was due to strong sales growth combined with an improved gross profit margin.

Net earnings in the fourth quarter improved to €2.2 million (last year: €-4.6 million) and earnings per share increased correspondingly from €-0.31 last year to €0.14.

Full Year 2017

Sales

In the financial year 2017, Puma’s sales increased by 15.9 percent currency adjusted to €4,135.9 million (+14.0 percent reported), surpassing the 4 billion Euro sales mark for the first time in the company’s history. As a consequence, Puma exceeded the initial net sales guidance for 2017, which had anticipated a high-single digit increase.

Growth was particularly strong in the EMEA region, where sales rose by 19.5 percent currency adjusted to €1,646.2 million (+19.1 percent reported). France, the DACH region (Germany, Austria and Switzerland) and the United Kingdom as well as Russia and South Africa delivered double-digit sales growth.

Sales in the Americas region went up by 14.3 percent currency adjusted to €1,494.8 million (+11.6 percent reported), with both North and Latin America contributing with double-digit growth rates.

In the Asia/Pacific (APAC) region, sales rose by 12.7 percent currency adjusted to €994.9 million (+10.0 percent reported). The main drivers of growth in the region were China, followed by Australia, both with double-digit sales growth.

Footwear continued to be the product segment with the strongest growth rate, showing an improvement of sales for the fourteenth quarter in a row. Sales were up 23.5 percent currency adjusted to €1,974.5 million (+21.4 percent reported). Running and Training as well as Sportstyle were the categories with the strongest growth rates.

In the Apparel segment, sales rose by 10.0 percent currency adjusted to €1,441.4 million (+8.1 percent reported). The Sportstyle category, and especially Women’s products, contributed to this increase.

Sales in Accessories grew by 9.2 percent currency adjusted to €719.9 million (+8.0 percent reported). This increase is mainly driven by socks, underwear and headwear as well as bags and backpacks, while Puma’s Golf hardware business remained stable.

Including eCommerce, Puma’s own and operated retail sales rose by 22.9 percent currency adjusted to €961.0 million. This represents a share of 23.2 percent of total sales in 2017 (21.9 percent in 2016). The reasons for this rise are a strong like-for-like sales growth in our retail stores, the extension of our retail store network and a strongly growing eCommerce business.

Gross Profit Margin and Operating Expenses

The gross profit margin improved by 160 basis points from 45.7 percent to 47.3 percent in 2017. This increase, despite negative currency impacts, was driven by further improvements in sourcing, higher sales share of new products with a higher margin, a higher share of own retail sales and selective price adjustments. This is particularly reflected in the Footwear segment, where margins increased from 42.5 percent to 45.5 percent. In addition, Apparel margins grew from 48.4 percent to 49.0 percent and the Accessories margins went up from 47.9 percent to 48.5 percent in 2017.

Operating expenses (OPEX) rose by 11.7 percent and amounted to €1,725.6 million in 2017. This is mainly because of intensified marketing activities and investments in their own retail store network. The OPEX ratio in percentage of total net sales decreased from 42.6 percent to 41.7 percent in 2017, reflecting an improvement of operating leverage.

Operating Result and Net Earnings

The operating result (EBIT) improved by 91.7 percent from €127.6 million to €244.6 million in 2017, which is at the upper end of the revised EBIT guidance of €235 million to €245 million. This result is significantly above their initial EBIT guidance for 2017, which had anticipated a range between €170 million and €190 million and reflects major improvements in Puma’s operating performance and profitability, gross profit margin and operating leverage.

The financial result decreased from €-8.7 million to €-13.4 million due to higher financial expenses related to currency derivatives, while the income from associated companies increased slightly.

The tax rate for the full year 2017 came in at a normalized rate of 27.4 percent compared to 25.7 percent the year before, while the total tax expense went up to €63.3 million in 2017 (2016: €30.5 million).

Net earnings for the full year 2017 more than doubled to €135.8 million (2016: €62.4 million). This translates into earnings per share of €9.09 compared to €4.17 last year.

Working Capital

Puma’s continued focus on working capital management and currency effects led to a decrease of 7.9 percent to €493.9 million. Inventories grew only by 8.3 percent to €778.5 million and trade receivables rose only slightly by 0.9 percent to €503.7 million. Trade payables were up 11.3 percent to €646.1 million.

Cashflow

The free cash flow improved significantly from €49.7 million in 2016 to €116.9 million in 2017. This achievement is a result of considerably higher earnings before taxes (EBT) combined with an improved working capital development in spite of the extended business volume and higher investments in fixed assets. As of December 31, 2017, Puma’s cash position amounted to €415.0 million compared to €326.7 million at the balance sheet date last year.

Proposal of One-Off Total Dividend of €12.50

Based on Puma’s positive business development with a significant improvement of profitability and cash flow, the managing directors and the administrative board will propose a one-off total dividend of €12.50 per share for the financial year 2017 at the Annual General Meeting. In the previous year, Puma paid €0.75 per share as a regular dividend.

Brand and Strategy Update

2017 was a good year both for Puma’s athletes and for their business. Since they implemented their turnaround strategy in 2014, their sales have grown almost 40 percent. For the first time in the company’s history, they managed to exceed the four billion Euro mark in sales. Product sellthrough, both in retail stores and those of key retail partners, has improved. They have received very positive feedback on our product ranges, particularly from retail partners. All this proves that Puma is heading in the right direction.

Their strategy has continued to focus on five priorities: increased brand heat, a competitive product range, a leading offer for women, improved quality of distribution and organizational speed.

In 2017, Puma’s credibility as a sports brand was strengthened by capitalizing upon partnerships with world-class athletes and teams. Their Teamsports business was marked by partnered teams winning some of the world’s most prestigious titles: BVB Borussia Dortmund claimed the German DFB Cup, Arsenal F.C. won the FA Cup and Mexico’s Chivas secured the 2017 Liga MX Clausura title, while Argentina’s iconic team Independiente 7 Buenos Aires celebrated the victory of the Copa Sudamericana. Puma’s roster of individual players also showed exceptional performances: Arsenal’s Olivier Giroud won the FIFA Puskas Award for “Goal of the Year” of 2017 and Sergio Agüero broke the goal scoring record for his club Manchester City. On the product side, they launched two completely new football footwear franchises, Puma ONE and Puma FUTURE, solidifying their status as a leading sports performance brand.

A major highlight in their Running category was the 2017 IAAF World Championships and Usain Bolt’s final race. The competition put the spotlight on other Puma athletes such as Frenchman Pierre-Ambroise Bosse, who won the gold medal in the 800 meters. They also delivered notable product innovations, such as the revolutionary NETFIT footwear range, whose unique customizable lacing system offers infinite performance and style options in one shoe. Puma also surprised with their brand-new JAMMING technology, whose e-TPU beads provide high comfort and energy return.

Motorsport celebrated another fantastic Formula 1 season, with three partnered teams MERCEDES AMG PETRONAS, Scuderia FERRARI and RED BULL RACING dominating the Constructors’ Championship and Puma brand ambassador Lewis Hamilton winning the fourth F1 champion title in his career. They also extended their long-term partnership with MERCEDES AMG PETRONAS as official licensing partner for MERCEDES AMG PETRONAS products and supplier of its F1 team.

2017 was also a successful year for Puma’s Golf business, where they continued to deliver stylish, performance-ready golf apparel, footwear and accessories to the market, while Cobra Golf introduced technology-rich, game-changing equipment. A real breakthrough was the launch of KING F7 & F7+, smart drivers with an embedded sensor, allowing golfers to automatically track the distance and accuracy of each drive. Rickie Fowler captured a win at the Honda Classic, and landed a record-breaking win at the 2017 Hero World Challenge, while Lexi Thompson won two LPGA tournaments together with the Vare Trophy for best scoring average and the season-long Race to the Globe.

Puma’s Women’s business, another focus of their strategy, was one of the best performers in the industry last year. Together with powerful ambassadors like Cara Delevingne and the New York City Ballet, they opened another chapter of their “Do You” campaign, which aims to inspire confidence in women around the world. Puma’s Women’s Creative Director, Rihanna, presented two exquisite seasonal collections of her “FENTY Puma by Rihanna” line, which has established itself amongst the most anticipated shows of the Paris and New York Fashion Weeks. And just recently, singer, actress and producer Selena Gomez presented the PHENOM and EN POINTE fitness footwear lines, which received positive media echo and already delivered promising results in retail.

Puma has continued to improve the quality of its distribution and expanded its presence in key Sports Performance and Sportstyle accounts around the world. They have further strengthened their relationships with key retailers and proven to be a reliable partner and one that maximizes the brand’s contribution to their business. It is their clear objective to create win-win situations for their partners and themselves, enabling their retail partners to make money with Puma’s products. Through improved sell-through, Puma gained more shelf space in retail stores in 2017. Furthermore, they continued to upgrade their owned and operated retail store network with further openings and refurbishments. They relaunched their eCommerce presence ‘www.Puma.com’ into a more modern and mobile-friendly format, which initially went live in Europe in June.

They have continued to speed up their operational processes and systems by further enhancing Puma’s International Trading Organization, which manages global order and invoice flows centrally, the roll-out of new product development tools, further standardization of ERP systems and improvements to the overall IT infrastructure.

Their achievements on and off the pitch last year have laid solid foundations for a successful year to come.

Their global marketing activities will again be centered around our brand ambassadors and fastest athletes, including sprinters André de Grasse, Jimmy Vicaut and Asafa Powell; star footballers like Sergio Agüero, Antoine Griezmann and Marco Reus; Formula One Champion Lewis Hamilton and Golfstars Rickie Fowler and Lexi Thompson. Key ambassadors featured on the entertainment side will be Rihanna, top model Cara Delevingne, the R&B star and style icon “The Weeknd” and the newest addition to their roster, singer, actress and producer Selena Gomez.

We are looking forward to the upcoming World Cup in Russia, where three of their sponsored national teams–Switzerland, Uruguay and Senegal–along with many individual players, will make sure that the brand will be very visible on the pitch. Not to mention two new clubs that will join Puma starting the 2018/19 season: Olympique de Marseille and Borussia Mönchengladbach. Both teams are great assets to strengthen their position in the French Ligue 1 and the German Bundesliga.

Puma is also excited that they have just announced an official long-term partnership with one of the most legendary and iconic football clubs in the world: AC MILAN. Effective July 1, 2018, Puma will become the global technical supplier and official licensing partner of AC MILAN. Through its 119-year-old heritage, AC MILAN won 18 officially recognized UEFATM and FIFATM titles, including seven UEFA European Cup/Champions LeagueTM titles. AC MILAN is the most successful Italian club at international level and one of the best in the Football history.

In 2018, Puma will also continue to work very closely with retail partners. Their improved product offerings include recently launched lines such as the NETFIT, TSUGI, MUSE and PHENOM as well as their key 2018 launches, HYBRID, DEFY, MANTRA and RS-0.

2018 will also mark two important anniversaries: 70 years of Puma and 50 years of its iconic Suede sneaker. The latter will be celebrated through unique drops representing the varied cultures of which the iconic sneaker has been a significant par,t such as music, fashion, street and pop culture.

Outlook 2018

Based on the positive business development in 2017 with strong sales growth and a significant improvement in profitability, the management is confident that 2018 will be another positive year for the company and that Puma is well-positioned to carry forward the brand’s momentum.

For the full year 2018, they expect that currency-adjusted net sales will increase by approximately 10 percent. The gross profit margin is forecasted to improve slightly (2017: 47.3 percent). Operating expenses (OPEX) are expected to increase at a mid to high single-digit rate, as Puma will continue to invest in marketing, retail and IT.

At the current exchange rate levels, Puma’s management expects that the operating result (EBIT) in 2018 will improve significantly due to higher sales and a slightly improved gross profit margin. The EBIT is therefore expected to come in between €305 million and €325 million (2017: €244.6 million). Net earnings will also continue to improve significantly in 2018.

Planned Proposal to distribute in kind Puma shares to Kering shareholders

On January 11, the Kering Board of Directors unanimously proposed to its shareholders to distribute in kind around 70 percent of Puma shares outstanding, out of the 86.3 percent currently owned by Kering. Post transaction, Kering would retain approximately 16 percent of Puma shares outstanding. Artémis, which holds 40.9 percent of Kering’s shares, would become a long-term strategic shareholder of Puma with an ownership of about 29 percent. Puma’s free float would be increased to approximately 55 percent. Puma Capital Markets Day Puma will hold a Capital Markets Day on March 20th, 2018 in London. At this occasion, Puma intends to provide further details on its future strategy.

Photo courtesy Puma