Puma SE nearly broke even in the fourth quarter. Revenues grew 6.3 percent on a currency-neutral (c-n) basis, led by a 15.0 percent gain on a c-n basis.

2014 Fourth Quarter Facts

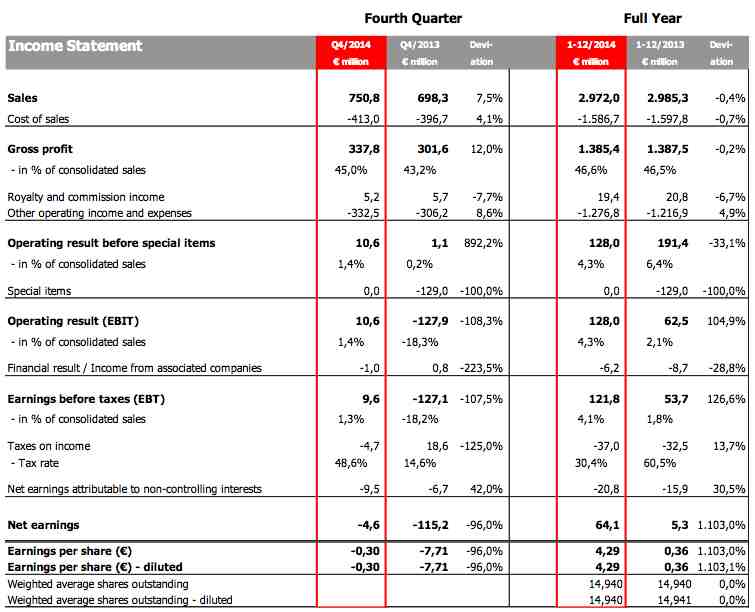

- Consolidated sales grow to €751 million, a currency adjusted increase of 6.3 percent

- Positive trend in Footwear continues in Q4, up 4.3 percent currency adjusted

- Improvement of gross profit margin from 43.2 percent to 45.0 percent

- OPEX increase mainly due to “Forever Faster” marketing campaign

- EBIT before special items improves to €11 million compared to €1 million in Q4 2013

- Strong rise of net earnings due to special items booked in Q4 prior year

- Rihanna announced as new Puma Brand Ambassador

2014 Full Year Facts

- Puma's full-year consolidated net sales increase by 3.3 percent currency adjusted to around €3 billion

- Slight improvement of gross profit margin to 46.6 percent despite adverse currency fluctuations

- OPEX rise as planned due to “Forever Faster” marketing campaign as well as new sponsoring contracts

- EBIT reaches 128 million

- Net earnings (2014: €64.1 million; PY: €5.3 million) and EPS (2014: 4.29; PY:

- 0.36) improved strongly; no special items booked in 2014

Bjørn Gulden, Chief Executive Officer of Puma SE: “The fourth quarter developed as we had hoped, with a solid increase in sales and even stronger improvement in EBIT and net earnings. We are especially pleased to see that we again, for the second quarter in a row, had growth in our footwear sales. Our full-year results are also in line with expectations. We stopped the decline in sales and made progress with all our strategic priorities. We now have a clear positioning, which will be strengthened through increased investment into marketing and a clear use and celebration of our assets. We are further focusing on communicating stories clearly. We have made strides in improving our product and are working with our retailers to further improve the quality of our distribution. Additionally, we have started to improve our IT foundation and operations, to ensure a faster, leaner, and more efficient set up in the coming years. In 2015, we will continue to work towards our mission of becoming the Fastest Sports Brand in the world while further improving our business along all strategic priorities. The addition of Rihanna, as a Brand Ambassador and as one of our creative directors, is a commitment to our increased focus on the female consumer segment, as we truly believe that the “future is female”. We know that the turnaround will take time but feel that 2014 was a turning point. We expect 2015 to confirm that we are moving in the right direction.”

Fourth Quarter 2014

Strong fourth quarter performance

In comparison with last year, consolidated sales in the fourth quarter of 2014 recovered and rose from €698.3 million to €750.8 million, which represents a currency adjusted increase of 6.3 percent. This was driven mainly by a stronger demand in the Americas as well as a considerable upwards trend in Accessories and further recovery in footwear sales.

In the EMEA region, sales increased slightly by 0.6 percent currency adjusted to €224.8 million, as economic conditions in some continental European countries remained challenging, while the UK enjoyed a very solid performance.

Revenues in the Americas region increased strongly by 15.0 percent currency adjusted to €319.3 million. Solid performances in the USA and Canada and strong growth rates in Argentina, Brazil and Mexico drove this performance.

Sales in the Asia/Pacific region rose slightly by 0.7 percent currency adjusted to €206.7 million. While China and India grew, Korea and Japan performed below last year's levels.

Puma's Footwear sales in the fourth quarter improved, up for the second quarter in a row, by 4.3 percent currency adjusted to €310.7 million. Apparel sales improved by 3.6 percent currency adjusted to €293.0 million, while Accessories saw its sales increase sharply, up 17.1 percent currency adjusted to 147.1 million despite adverse market developments in the Golf category.

Puma's gross profit margin increased from 43.2 percent to 45.0 percent in the fourth quarter of 2014. Lower price reductions supported by a better product mix in the quarter helped to improve the margin in Footwear and Apparel. Footwear gross profit margin increased from 39.5 percent to 41.6 percent. Apparel margin rose from 44.7 percent to 47.1 percent, while the margin for Accessories decreased slightly from 48.4 percent to 47.8 percent impacted by the current weakness within the Golf business.

After four consecutive quarters of decline, operating expenditures in the fourth quarter of 2014 increased as a result of the intensified marketing activities of Puma. As a consequence – although Puma maintained its focus on a strict cost management – total OPEX rose by 8.6 percent from €306.2 million to €332.4 million during the quarter. Combined with the increase in sales and the improved gross profit margin, this led to the higher EBIT (before special items) of

€10.6 million. As no special items were recorded in the fourth quarter of 2014 (prior year: €129.0 million), the Operating Result (EBIT) increased significantly. Earnings per share in the fourth quarter of 2014 came in at -0.30.

Full Year 2014

Puma's full-year sales increased 3.3 percent currency adjusted

Consolidated sales were in line with the guidance for 2014 and increased by 3.3 percent currency adjusted to around €3.0 billion, which corresponds to a slight decline of 0.4 percent in Euro terms, reflecting the currencies headwind registered throughout the year. All regions contributed to growth, posting currency adjusted growth rates in the year.

Sales in the EMEA region increased by 1.3 percent currency adjusted to €1.2 billion, where strong performance in the United Kingdom more than offset weaker French and Italian markets.

In the Americas, sales improved significantly by 6.7 percent currency adjusted to €1.1 billion thanks to a strong demand particularly from the U.S., Canada, Argentina and Mexico.

In Asia/Pacific, sales rose by 1.9 percent currency adjusted to €696 million, as a strong demand from India and China outbalanced a decline in Japan, which was mostly related to the weaker Golf category.

In 2014, Footwear sales decreased due to a weaker first half by 2.4 percent currency adjusted to

€1.3 billion, while the second half showed growth in the segment. Sales in Apparel rose by 7.6 percent currency adjusted to €1.1 billion. Sales in Accessories continued to improve and showed a significant increase of 9.3 percent currency adjusted to €586 million.

Sales growth continued in Puma's Retail Business

In line with Puma's strategy, Puma continued to optimize its retail network in 2014. While the company continued to open stores with a particular focus on profitable new locations in growth markets, it carried on its program of selective closures of unprofitable stores at the same time. As such, comparable store sales were positive in the year and full-year retail sales rose by 3.9 percent currency adjusted to €618 million in 2014, equaling 20.8 percent of total sales.

Slightly improved Gross Profit Margin

Puma's full-year gross profit margin increased slightly from 46.5 percent to 46.6 percent, driven by positive margin developments in Apparel and Accessories that were able to more than offset the decline in Footwear. Footwear margin for the full-year stood at 42.6 percent versus 43.7 percent in the previous year. Margin in Apparel increased significantly from 48.3 percent to 49.5 percent. Accessories gross profit margin also increased from 49.8 percent to 50.0 percent.

Marketing efforts drive OPEX

Due to the increased marketing expenses for the “Forever Faster” brand campaign, the football world cup in Brazil as well as the sponsoring of additional football clubs and athletes, the full-year OPEX increased by 4.9 percent from €1,216.9 million to €1,276.8 million. At the same time, savings were realized in other areas in line with the ongoing strict cost management.

Operating Result (EBIT) before special items in line with guidance

As a consequence of the effects outlined above, full-year EBIT before special items declined from €191.4 million to €128.0 million. This corresponds to a 4.3 percent margin on net sales.

No Special Items in 2014

Puma's 2014 results were not affected by any special items, while in the previous year, Puma recorded €129.0 million.

Operating Result (EBIT) after special items increased

As a result, Puma's EBIT after special items for the full year improved from €62.5 million to €128.0 million, equivalent to an increase from 2.1 percent to 4.3 percent as a percentage of sales.

Financial Result improved

For the full year, Puma's financial result improved from €-8.7 million to €-6.2 million.

Net Earnings / Earnings per share increase

Full-year consolidated net earnings rose from €5.3 million in 2013 to €64.1 million in 2014, with earnings per share increasing from €0.36 to €4.29.

Net Assets and Financial Position

Working Capital position continues to improve

The Group's working capital significantly declined by 13.8 percent from €528.4 million to €455.7 million. Inventories increased from 521.3 million to 571.5 million at the end of 2014, while trade receivables rose from €423.4 million to €449.2 million. As per the balance-sheet date, trade liabilities increased from €373.1 million to €515.2 million as a result of higher inventories and because of timing of payments.

Cashflow / Capex

Puma's Free Cashflow improved from €29.2 million at the end of 2013 to €39.3 million at the end of 2014. This was mainly due to lower Working Capital requirements and was achieved despite an increase in CAPEX.

Cash Position improved

Puma's year end Cash Position improved to €401.5 million compared to last year's €390.1 million.

Dividend

The Administrative Board will propose a stable dividend of 0.50 per share for the financial year 2014 at the Annual General Meeting on 6th May 2015.

Strategy Update

To be the Fastest Sports Brand in the world

In 2013, Bjørn Gulden (CEO) introduced Puma's new mission statement: To be the Fastest Sports Brand in the world. The company's mission not only reflects Puma's new brand positioning of being Forever Faster, it also serves as the guiding principle for the company expressed through all of its actions and decisions. Our objective is to be fast in reacting to new trends, fast in bringing new innovations to the market, fast in decision-making and fast in solving problems for our partners.

Strategic priorities

Our strategy encompasses five strategic priorities: the repositioning of Puma as the World's Fastest Sports Brand, the improvement of our product engine, the optimization of our distribution quality, increasing the speed within our organization and infrastructure, and renewing our IT infrastructure. In 2014, we continued to make further progress on all our key strategic priorities to ensure that the year marks the start of a turnaround.

In terms of our brand repositioning, August 2014 saw the successful launch of our worldwide Forever Faster brand campaign – the biggest marketing campaign in Puma's history. This marked the start of our repositioning as a true sports brand to our consumers and retail partners. The objective of the campaign is to demonstrate that Puma is back in sports and that our brand has great assets and a distinctive attitude: Brave, confident, determined, and joyful. We achieved this goal by focusing our campaign on customers in 35 countries. In the first three months after the start, our advertising generated 1 billion TV impressions in our target group as well as 31 million online views. The market surveys showed a very positive consumer reception. The launch of this campaign marked the start of a long-term marketing strategy, which will be continued in 2015 and run through the Rio de Janeiro Olympic Games in 2016 and beyond.

To improve our product engine, we initiated key projects to enhance our product designs, develop more innovative technologies and increase the commercial appeal of our product range. The first results have already been implemented for the 2015 collections, and the feedback from our retail partners make us very confident that we are heading in the right direction.

In order to improve the quality of our revenues and distribution, we have developed joint product and marketing programs with our key retailers to showcase our brand in the right retail environment and drive sell-through with our partners. In February 2014, together with our partner Foot Locker USA, we introduced the jointly developed retail concept “Puma Lab” and successfully rolled it out in the US market. The success of the Puma Lab has not only improved our business with Foot Locker USA but also generated a positive spill-over effect onto other key retailers in the US marketplace – both with performance and lifestyle accounts. In 2015, we will continue to foster collaborations and launch further product and marketing programs with our most important key accounts in every region.

In 2014, we also continued to optimize our organizational structure and setup by making them leaner and faster. With the finalization of the relocation of our Global and European Retail Organization from Oensingen, Switzerland, to our Headquarters in Herzogenaurach as of September 30th, we completed the last out of our three major consolidation projects in 2014. This relocation followed the closure of our Puma Village Development Center in Vietnam in May and the relocation of our Lifestyle Business Unit from London to our Headquarters in Herzogenaurach in June. In 2015, we will be focusing on standardizing and optimizing processes between Puma and its partners. The key projects in this area are the implementation of a sourcing organization to manage global order and invoice flows and the conceptual design of a European trading company to optimize regional flows of goods.

Another strategic priority is the renewal and expansion of our IT infrastructure to create a basis for more extensive optimization measures. In 2015, we will focus on three areas: optimize our basic IT infrastructure, start the implementation of a standard ERP system to support sourcing and trading functions, and set-up platforms to improve the design, development and planning processes. We are very confident that our investments in these areas will lay the foundation for a lean and efficient company in the future.

Brand and Marketing Update

At the end of 2014, we added global cultural icon Rihanna to our roster. Through this new multi-year partnership, Rihanna will serve as a global brand ambassador. She will play a key role in Puma's brand campaign Forever Faster, featuring along Puma's world-class athletes such as Usain Bolt and Sergio Aguero. From Spring/ Summer 2016 on, she will serve as one of the Creative Directors for Puma, specially focusing on Women. Rihanna will directly influence our Women's collections with her fresh, forward thinking and non-traditional approach to sports, fitness and lifestyle. This marks the start of a renewed focus on Women for the Puma brand. In 2015, we will further underscore our increased focus on female consumers by launching an extended training range, starting with the Pulse XT, which will be endorsed by Rihanna.

Our Autumn/Winter 2014 collection in Lifestyle saw a star reborn, when we reissued the Becker OG, the classic mid top shoe that 17-year old Boris Becker wore during his famous and groundbreaking Wimbledon win in 1985. A timeless silhouette originally made for the tennis court, the Becker OG merges the best of Puma's performance heritage and design language.

In Motorsports, Lewis Hamilton of the Puma-partnered Mercedes AMG Petronas F1 team clinched his second drivers' World Championship ahead of his teammate Nico Rosberg in the season-ending Abu Dhabi Grand Prix. Hamilton wore the Puma F1 Pro SLW, weighing only 99 grams. It is the lightest Formula 1 shoe that currently exists.

The year 2015 has started very positively for Puma as the 2015 Africa Cup of Nations proved to be a fantastic stage for our football products with Ivory Coast beating Ghana 9:8 in a thrilling penalty shootout, with both teams being outfitted by Puma. Led by their captain and Puma star player Yaya Touré, the “Elephants” put on a brilliant performance to claim their second Africa Cup of Nations title after 1992. On the pitch in Equatorial Guinea, Touré sported the next generation of our evoPOWER football boot, designed to bring Power and Accuracy to a higher level. The innovative shoe was launched at the beginning of this year through a “Head to Head” campaign featuring Puma key assets Mario Balotelli and Cesc Fàbregas.

In February 2015, a further innovation was launched in our running category. Our most innovative running footwear technology to date, introduced by the World's Fastest Man, Usain Bolt on New York City's Times Square: IGNITE. Developed together with BASF over multiple years, IGNITE is revolutionary to the business. Puma's best ever, PU foam provides the highest return of energy we have ever created, step-in comfort and long-lasting durability with ForEverFoam. In subsequent seasons, additional styles will be introduced and the IGNITE line will be expanded further within our Running and Training category. In the second half of 2015, we will continue our training and Ignite story with IGNITE XT trainer.

Outlook for the Financial Year 2015

After the successful launch of Puma's Forever Faster campaign in autumn 2014, Puma will continue its marketing investments in order to reposition Puma as the fastest sports brand of the world. The objective of Puma's brand repositioning is to increase brand heat and further replace lower tier distribution with higher tier distribution in order to improve sales quality and sell-through.

Together with improvements in the product offering, Puma expects an increase of its currency-adjusted net sales in the medium single-digit range for the full year 2015, with sales in the first half expected to be flat and growth occurring in the second half. The gross profit margin is anticipated to improve slightly based on lower discounts and a favorable product mix.

For 2015, Puma is planning further strong investments in the “Forever Faster” marketing campaign as well as in the upgrade of our current IT. We are very confident that our investment in IT will lay the foundation for a lean and efficient company in the future. As a consequence, Puma's OPEX will increase while management will continue to put a strong emphasis on strict control of other operating costs.

The recent adverse developments of foreign exchange rates, particularly the strengthening of the US-Dollar versus nearly all other currencies, could lead to a significant negative impact on the reported gross profit margin and the overall reported EBIT and net earnings of the Puma group.

Because of these negative currency developments, Puma has already taken and will continue to take countermeasures, which should support a slight increase in reported EBIT and net earnings.

Last year, Puma has successfully taken the first steps to re-establish the brand in the market place. 2015 will be the year to further enhance and reinforce this brand positioning and to take a further step in getting Puma back to a path of profitable and sustainable growth.