Puma AG saw its top-line results continue on a negative trend in the fourth quarter, but an improvement in gross margins and a reduction in one-time charges helped double earnings for the period. Still, the fourth quarter turnaround in bottom-line results could not bring the year into the black as net earnings fell nearly 45% for the full year.

Fourth quarter consolidated sales decreased 10.1% currency-adjusted and 12.8% in euro terms to €489.5 million ($723 mm) from €561.3 million ($740 mm) in the prior-year period. The company said sales were negatively affected by significantly reduced inventory leading to less close-out sales, but those lower sales actually helped boost gross profit margin to 51.0% of net sales, up 430 basis points from the fourth quarter last year. All regions and product segments reportedly contributed positively to the margin growth. Net earnings amounted to €16.2 million, compared to €8.1 million in the prior-year period. Diluted earnings per share were €1.08, up 80.0% from €15.15 in the previous year quarter.

Currency-adjusted sales in the EMEA (Europe, Middle East, Africa) region were down 10.9%, or down 10.7% in euro terms to €196.8 million ($291 mm). In the Americas, sales decreased 2.6% in currency-adjusted terms, but fell 10.6% in euro terms to €153.0 million ($226 mm) for the quarter. U.S. revenues inched up 0.9% to $132.7 million in the fourth quarter, compared to $131.5 million in the prior-year period. Asia/Pacific revenues declined 16.2% in currency-adjusted terms and fell 17.7% in euro terms to €139.7 million ($206 mm) for the quarter.

EMEA boosted its share of the overall business to 40.2% of total sales for the quarter versus 39.3% of the total in the prior-year period. The Americas picked up share, driven the increase in the U.S. business to 18.4% of the total versus 17.8% of the total in the prior-year quarter. Asia/Pacific lost share.

Fourth quarter consolidated footwear sales decreased 16.8% in currency-neutral terms, reflecting a 19.9% decline in euro terms to €241.9 million ($357 mm). Apparel revenues fell 10.9% in currency-adjusted terms, or a 12.6 decline in euro terms to €188.6 million ($279 mm).

Fourth quarter sales of accessories got a boost from the consolidation of some licensee businesses, increasing 36.5% (39.4% currency-adjusted) to €59.1 million ($87 mm) in the quarter. Accessories made up 12.1% of the total Puma business for the quarter, compared to just 7.7% on the business in the prior-year period.

Excluding the upside in Accessories sales tied the consolidation of licensees, Puma footwear and apparel revenues declined 16.9% to €430.5 million ($636 mm) in the fourth quarter.

Operating expenses decreased 9.2% to €209.7 million in the fourth quarter, but the cost ratio increased to 42.8% of sales versus 41.1% of sales in Q4 last year due to the lower sales basis in the most recent quarter.

The effects of the companys inventory reduction program were clearly evident, with inventories 26.5% lower on a worldwide basis to just €348.5 million ($500 mm) compared to €430.8 million ($607 mm) at 2008 year-end. EMEA inventories we down 26.5% to €203.7 million ($292 mm), down 9.8% in the Americas to €106.0 million ($152 mm) and down 37.4% in euro terms to €51.6 million ($74 mm) in the Asia/Pacific region. The reduction in inventories had the predictable effect on the cash line, which was up 29.5% at year-end to €485.6 million ($696 mm).

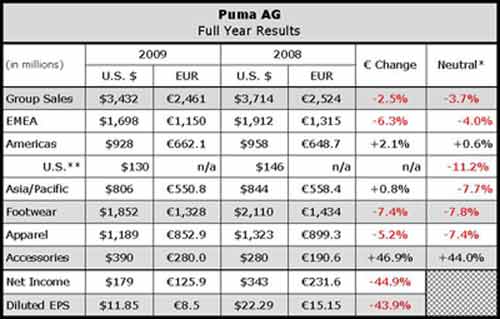

For the full year, Puma posted a 45.6% decrease in net earnings to €128.2 million ($179 mm), compared to €232.8 million ($343 mm) in 2008. Earnings per share and diluted earnings per share amounted to €8.50 ($11.85), compared to €15.15 ($22.29) in the prior year. Full year revenues were down 2.5% (-3.7% currency-adjusted) to €2.46 billion (3.43 bn) in 2009. Gross margins were down 50 basis points to 51.3% of sales.

Looking ahead, Puma management maintains that a quantitative estimate for 2010 is difficult to make, despite the current positive impetus from the FIFA World Cup in South Africa this coming summer, owing the uncertainty to consumer behavior in a tough economy.

Management did say increased marketing expenses are to be expected during the World Cup year, but the companys cost reduction program should provide for efficiency increases and cost savings to ensure the companys sustained earnings power. They indicated that a clear improvement in net earnings will be achieved, as no special items are expected for 2010.