Poshmark Inc.’s shares more than doubled in its initial public offering debut Thursday.

The offering for the second-hand shopping platform was priced at $42. Shares opened Thursday at $97.50 and closed the day at $101.50. The IPO price valued the company at more than $3 billion, up from a $1.25 billion valuation in 2019.

The company, reported its first quarterly profit this spring, raised about $277 million in the Nasdaq listing. Proceeds from the offering will be used, in part, to fund Poshmark’s growth strategy, which includes expanding into new product categories.

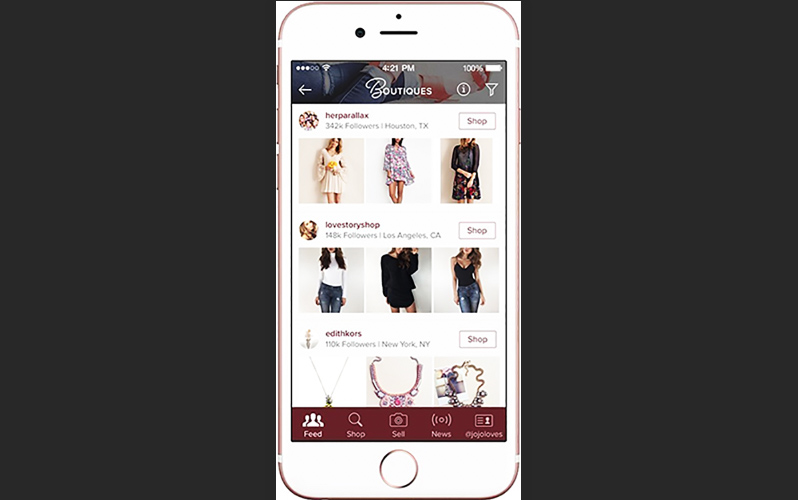

Focused on used high-end apparel and accessories, it provides a platform like eBay or Etsy that links buyers and sellers, mixing features from social media. It makes money by taking a 20 percent cut of each sale.

In filings with regulators last year, Poshmark said more than 30 million people had logged into the site over the last 12 months, with more than 6 million people buying at least one item. Over the 12 months ended September 30, it reported a $6.2 million profit on revenue of $250 million.

Photo courtesy Poshmark