Pacific Sunwear of California, Inc. narrowed it first quarter loss while handily exceeding the very conservative forecasts of most analysts. PSUN management said expense management and inventory control were the primary contributors to minimizing damage in an environment that has been especially harrowing for teen retailers.

On a GAAP basis, the company cut SG&A expenses by $19 million compared to the year-ago period. Additionally, merchandise margins improved 140 basis points while inventory levels were tightened by 31% on a square-foot basis.

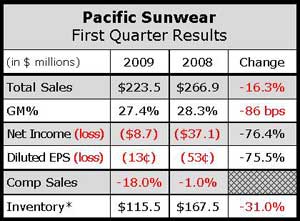

Total sales for PacSun declined 16.3% to $223.5 million from $266.9 million a year ago.

Total sales for PacSun declined 16.3% to $223.5 million from $266.9 million a year ago.

Comp sales, impacted by a 4% drop due to the companys 2008 exit from the sneaker business, fell 18% in the first quarter. In a conference call with analysts, management said total transactions for the quarter were down low-single-digits while average unit retail was down 19% for the period. Apparel represented approximately 88% of total sales versus 77% in Q1 last year. Apparel comps were down 7%, due primarily to a lower average unit retail that the company attributes to lower opening price points. Non-apparel comps plummeted 57% and represented 12% of total sales compared to 23% of total sales in the year-ago period. Juniors apparel comps slid 6% and represented 52% of total apparel sales. Strength from Bullhead denim was unable to offset weakness in swim and shorts, both of which performed “well below plan.” Young mens apparel comps slid 8% but showed improvement throughout the quarter on strength from Bullhead.

Management said weakness in Boardshorts dragged the category down for the quarter.

Management said in the call that the company had seen the swim business decline for about three years now, and added that in the current market some customers have turned to more value-oriented retailers like Wal-Mart and Target for their swimwear needs. Based on retail point-of-sale data compiled by SportScanINFO, the same appears to be happening to the boardshort business.

Regarding outlook, the company expects second quarter comps to decline in the range of 17% to 20% with a loss of 11 cents to 17 cents per diluted share for the period.