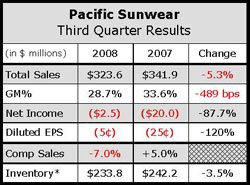

Pacific Sunwear of California, Inc. had total sales for the third quarter ended Nov. 1, 2008, of $323.6 million, a 5% decrease from total sales of $341.9 million for the third quarter ended Nov. 3, 2007. Total company same-store sales decreased 7% during the third quarter of fiscal 2008.

Company CEO Sally Frame Kasaks said the transition out of footwear has impacted same-store sales and performance in the short-term, but the company expects that a greater concentration of apparel should lead to improved merchandise margins over the long term.

Juniors apparel achieved same-store sales growth of 16% during the quarter, while young men's apparel business experienced a slight same-store sales decline during the quarter. The companys accessory business continued to be disappointing, with accessory same-store sales down 28%.

PacSun experienced “significant” deterioration in sales in the West Coast and Pacific Northwest regions, with the regions dropping 20% to 25% through the third quarter. The Midwest, Texas, the Northeast and Mid-Atlantic, however, were strong.

To battle this trying economic environment, the company is closely monitoring payroll, said CFO Mike Henry. Store payroll was down by over $620,000 year-over-year.

“[We are] making a very significant effort at trying to keep the store payroll number down as much as we can,” said Henry. “We do have a significant number of stores I would tell you already on minimum coverage We've run our home office down 15% in the headcount relative to what our original budget plan was, and our Executive Committee has looked at the open headcount list every week.”

The company has revised its guidance for the fourth quarter, expecting to report a Q4 loss of 3 cents to 8 cents per diluted share. This range includes an expected gain of approximately 11 cents per diluted share resulting from the previously announced sale of the Anaheim distribution center, which is expected to close shortly.