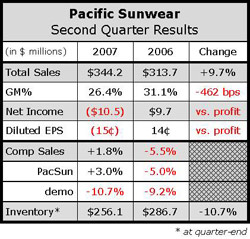

Pacific Sunwear of California, Inc. saw continued  soft results at its demo and One Thousand Steps concepts offset positive comps growth at the namesake PacSun chain. For the quarter, total transactions were up mid-single digits partially offset by low-single-digits decreases in average unit retail and average items sold per transaction. The decrease in AUR was primarily due to negative comps in footwear. The retail calendar shift caused weak results to finish out the month of July in Texas and Florida, where sales were down 20% and 34%, respectively, for the month. Excluding those two states, same-store sales were flat at the PacSun concept for the month, compared to actual comp results that were down 5% for the month. July sales at PacSun were planned to be $76 million, but ended up at only $63 million.

soft results at its demo and One Thousand Steps concepts offset positive comps growth at the namesake PacSun chain. For the quarter, total transactions were up mid-single digits partially offset by low-single-digits decreases in average unit retail and average items sold per transaction. The decrease in AUR was primarily due to negative comps in footwear. The retail calendar shift caused weak results to finish out the month of July in Texas and Florida, where sales were down 20% and 34%, respectively, for the month. Excluding those two states, same-store sales were flat at the PacSun concept for the month, compared to actual comp results that were down 5% for the month. July sales at PacSun were planned to be $76 million, but ended up at only $63 million.

On a conference call with analysts, one of the most telling comments made by management related to the demo business, which has struggled for some time as the urban trend has slowed. The demo lab stores were said to have seen comp sales that were 15 points better than the chain as a whole for July, but CEO Sally Frame Kasaks said, “If we can develop a profitable, scalable demo model, we believe we can make a positive contribution to earnings. If, however, we cannot get the metrics to work by fiscal year-end, we will reevaluate our commitment to the customer and to the business.”

Excluding the 74 closed demo stores, Q2 net sales increased 12.4% to $342.1 million from $304.4 million last year. Meanwhile, at the One Thousand Steps concept, Kasaks believes “there may be an opportunity to re-merchandise the store to target women exclusively with the exception of few athletic footwear styles for men.”

On a more apples-to-apples basis, net income was $4.8 million for the quarter, or 7 cents per share, when taking out the demo lease termination and inventory liquidation charges and the One Thousand Steps store impairment charge.

The company expects earnings per share of 10 cents to 13 cents for Q3, with comps flat to up low-singles. PacSun should comp up in the low-singles while demo will comp down in the mid-teens. Sales are expected to be $369 million, down 1.6% from last years $375 million.