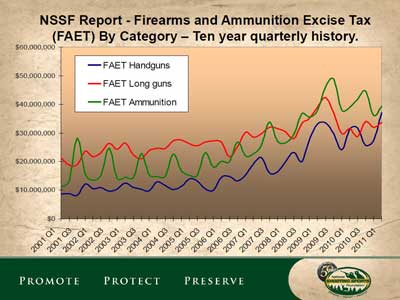

The latest Firearms and Ammunition Excise Tax Collection report released by the Department of the Treasury indicates that firearm and ammunition manufacturers reported tax liabilities of $110.1 million in the first calendar quarter of 2011, up 8.2 percent over the same period last year, according to a report by the National Shooting Sports Foundation (NSSF).

The report, which covers the time period of Jan. 1 through March 31, shows that $37.12 million was due in taxes for pistols and revolvers, $33.71 million for firearms (other)/ long guns and $39.27 million for ammunition (shells and cartridges).

Compared to the same time period in 2010, tax obligations were up 18.5 percent for pistols and revolvers, up 7.19 percent for firearms (other)/ long guns and up 0.74 percent for ammunition (shells and cartridges).