The best news for Nike, Inc. on Friday morning, March 21 was the realization that FedEx also reported earnings on Thursday evening. That event may have taken some Wall Street heat off NKE shares, as many analysts cut the price target (PT) on FDX after a challenging outlook from the company.

Nike, of course, was not completely immune to the effects of its own outlook and progress against its Win Now plan Thursday evening. NKE shares were down in overnight trading and by midday Friday were down in the high singles percent versus the Thursday close amid analysts’ moves to reduce their PT on NKE shares. Nike settled back to a 5.5 percent decline at close of trading on Friday.

Company president and CEO Elliott Hill, who re-joined the company in October 2024 as the company’s new leader, laid out key moves the company was making to turn the business around. His focus was the new “Win Now” strategic priorities. He said he had visited each of the company’s geographic region and noted the team is now clear where they will focus to make an immediate impact.

“Through our Win Now strategic priorities, we’ll start with three key countries, the United States, China, and the United Kingdom, and five key cities, New York, Los Angeles, London, Beijing, and Shanghai,” he explained. “We’ll invest to make sure each has innovative and coveted products, a loud and proud locally relevant brand voice, a consumer-led and balanced integrated marketplace, and passionate Nike teammates on the ground. Each country has unique dynamics and is in a different state of development. China specifically is where we’re being the most proactive and cleaning up the marketplace. And we’ll get back to inspiring the Chinese consumer in a more meaningful way.”

The need to accelerate a complete product portfolio was also said to be top of mind.

“We’re fully committed to creating a more breadth and depth season after season,” Hill said. “While we added innovation across our five key fields of play this quarter, it’s not enough to offset the continued headwinds of our classic franchises.”

Elevate and grow the marketplace is also a key focus, described as a balanced approach where Nike is supporting wholesale partners to drive healthy growth and returning Nike Direct to a premium destination. “We’re in the early stages of repositioning Nike Digital and we’re restoring our sales organization and go-to-market processes,” Hill said.

“We, of course, also debuted So Win, our first Super Bowl ad in 27 years where we celebrated the winning mindset of the top athletes in the world.” he added. “The Nike brand created it’s Good to Be Green for the Eagles win, and for Jaylen’s MVP, the Jordan brand aired its first Super Bowl ad in history, Love Hurts.”

Hill added at the end of his opening remarks, “Our consumers and partners felt a different pace from Nike this quarter. We’re off to a solid start.”

Company CFO Matt Friend added some color to Hill’s broader remarks, focusing on key Q4 wins against the five Win Now priorities.

“Our Performance business grew in the [fiscal] third quarter, led by improving brand and business momentum in Training and Running, with new product launches, strong sell through of innovation, and a more complete offense across price points in footwear and apparel,” Friend said.

He said the momentum is encouraging as Training and Running represent the Nike brand’s largest performance businesses. “For [fiscal] Q3, this momentum was more than offset by declines in Nike Sportswear and the Jordan brand, led by a double-digit decline in our Classic footwear franchises,” he detailed. “These franchises again decelerated faster than the overall business, with a more pronounced impact on Nike Digital.”

Friend said the team has taken the initial steps to reposition Nike Digital as a full-price business. “We remained competitive and promotional in December, finishing with strong holiday results,” he noted. “However, in January and February, we significantly reduced days of promotion in North America and EMEA. This resulted in a several percentage point improvement in demand at full price.”

Friend gave a nod to Hill, sharing that the company is working as closely as ever with retail partners in the Wholesale business since his arrival. “We are creating confidence through the investments we are making in product engagement, commercial terms, and rebuilding the scale, talent, and capabilities of our sales organization,” Friend explained. “Within our fall order book in North America, EMEA, and APLA, we see the declines in Classic footwear franchises almost being offset by growth in Performance dimensions of our portfolio, such as Running, Training, and Basketball, as well as newness in Sportswear.”

Friend said the company supported several new product launches across “all three brands” (presumably Nike, Jordan and Converse) and also delivered outsized brand impact with emotional storytelling in the air and on the ground in key cities. He noted that demand creation expenses grew in high-single digits year-over-year to support the effort.

He also talked about inventory as a key focus as it is a key element of the outlined gross margin declines.

“Inventory declined 2 percent [at quarter-end] versus the prior year. But as I said last quarter, inventory remains elevated across all geographies as we implemented our Win Now actions after inventory was purchased and in transit,” the CFO noted. “While we are seeing some increases in customer cancellations, the larger driver of our inventory is the buys for Nike Direct. In addition, across the marketplace, we are beginning to see Air Force 1 inventory stabilized with current retail sales, while Air Jordan 1 and Dunk remain elevated with continued actions planned ahead.”

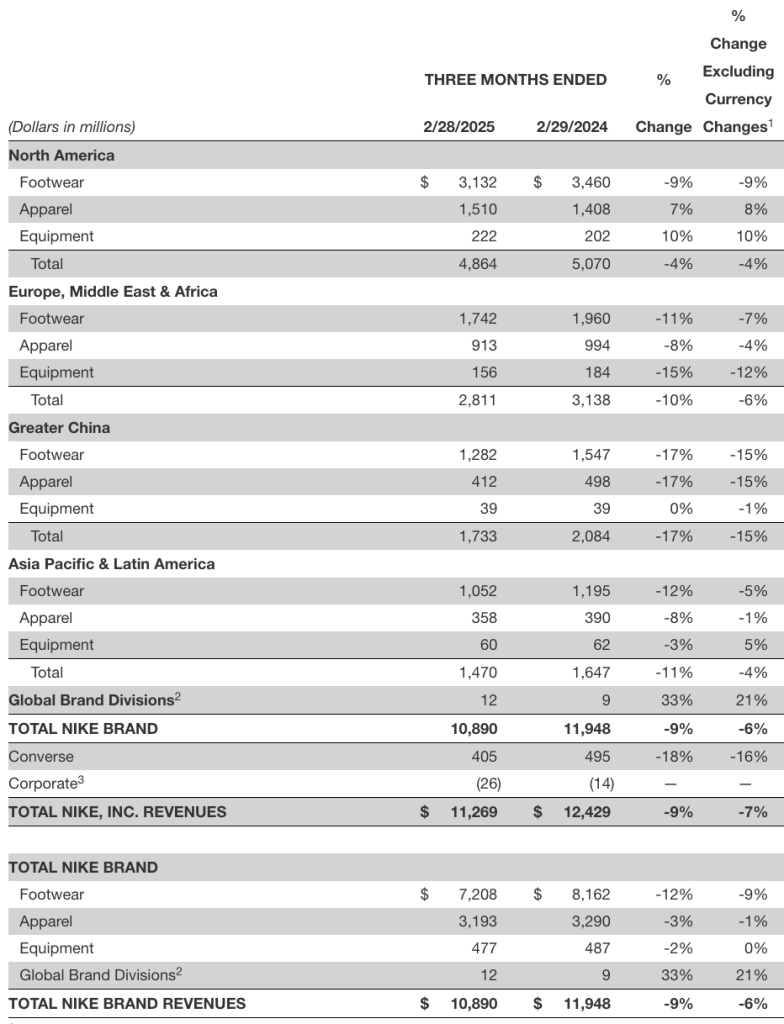

Fiscal Third Quarter Summary

Revenues for Nike, Inc. were $11.3 billion, down 9 percent on a reported basis compared to the prior year and down 7 percent on a currency-neutral basis. The top-line result surpassed Wall Street estimates of $11.03 billion. North America revenues retreated 40 percent year-over-year.

“The quarter benefited from strong holiday results in December, including a non-comp benefit from Cyber Monday, followed by double-digit declines in January and February,” added Friend.

- Nike Brand revenues were $10.9 billion, down 9 percent on a reported basis and down 6 percent on a currency-neutral basis, driven by declines across all geographies.

- Nike Direct revenues were $4.7 billion, down 12 percent on a reported basis and down 10 percent on a currency-neutral basis, primarily due to a 15 percent decrease in Nike Brand Digital and a 2 percent decrease in Nike-owned stores.

- Wholesale revenues were $6.2 billion, down 7 percent on a reported basis and down 4 percent on a currency-neutral basis, said to be largely due to declines in Greater China.

- Revenues for Converse were $405 million, down 18 percent on a reported basis and down 16 percent on a currency-neutral basis, due to declines across all territories.

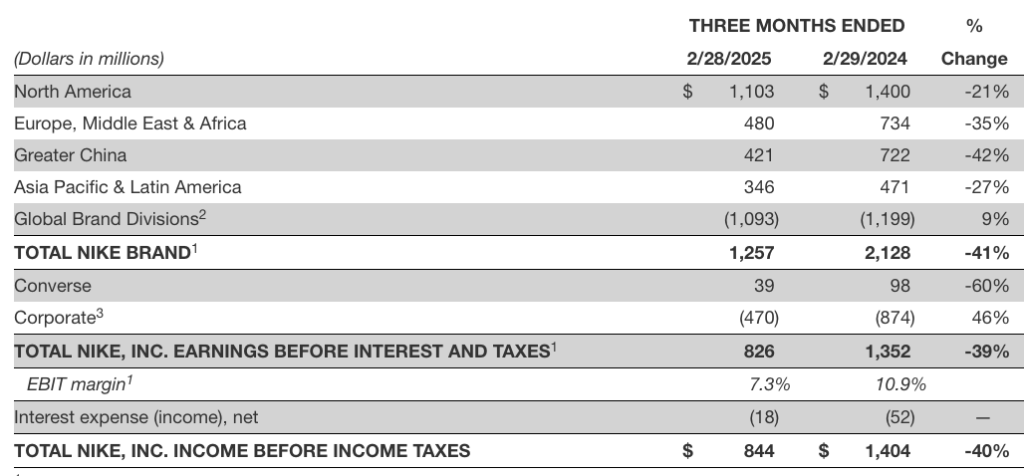

Income Statement Summary

- Gross margin decreased 330 basis points to 41.5 percent, primarily due to higher discounts, higher inventory obsolescence reserves, higher product costs and changes in channel mix, partially offset by restructuring charges in the prior year.

- Selling and administrative expense decreased 8 percent to $3.9 billion.

- Demand creation expense was $1.1 billion, up 8 percent, primarily due to an increase in brand marketing expense.

- Operating overhead expense decreased 13 percent to $2.8 billion, primarily due to the restructuring charges of $340 million in the prior year and lower wage-related expenses.

- The effective tax rate was 5.9 percent compared to 16.5 percent for the same period last year, primarily due to a one-time, non-cash deferred tax benefit provided by recently finalized US tax regulations related to foreign currency gains and losses.

- Net income was $0.8 billion, down 32 percent, and diluted earnings per share was 54 cents, a decrease of 30 percent year-over-year, but easily above consensus estimates for 30 cents per share.

Operating Segment Revenues

Friend focused on progress made in each of the company’s geographic regions on the Win Now actions.

North America Q3 revenue declined 4 percent. Nike Direct declined 10 percent, with Nike Digital down 12 percent, and Nike Stores down 6 percent. Wholesale increased 3 percent, due primarily to favorable shipment timing and increased shipments to our value partners in the third quarter. EBIT declined 21 percent on a reported basis.

“Throughout the quarter, we delivered bold and inspiring storytelling and key sports moments, as Elliott mentioned, which drove heat and energy for our brand,” Friend shared. “Training led Performance growth this quarter, and Running grew high-single digits. In Q3, we hosted dozens of key partners for product engagement and future growth planning, including a summit for partners serving core price points. We have taken initial steps to expand distribution to support our expanded core product offering, which is a meaningful market opportunity for Nike.”

EMEA (Europe, Middle East, & Africa) region Q3 revenue declined 6 percent year-over-year. Nike Direct declined 12 percent, with Nike Digital down 25 percent, and Nike Stores increasing 9 percent. Wholesale declined 3 percent. EBIT declined 35 percent on a reported basis.

In the marketplace, he said that in addition to taking steps to reposition Nike Digital, Nike also started a journey with JD Sports and Sports Direct to elevate the brand at physical retail with improved product positioning and visual merchandising.

Greater China Q3 revenue declined 15 percent year-over-year. Nike Direct declined 11 percent, with Nike Digital down 20 percent and Nike Stores down 6 percent. Wholesale declined 18 percent. EBIT declined 42 percent on a reported basis

“In Q3, traffic declined double digits, and retail sales underperformed our plan,” Friend said. “While the macro environment is challenging, sport is growing in China, and we must accelerate our pace. The market continues to be promotional, especially in consumer moments and in the digital channel. And we are taking aggressive steps to clean up the marketplace, with the priority being the health of our partners. These steps had a negative impact on our revenue and gross margin this quarter.”

He said at the same time, the Nike team is focused on creating brand distinction through sport and serving consumers with new innovation and hyper local product.

“We saw strong consumer response to the Peg Premium and Vomero 18 in Running,” he explained. “And in Basketball, we launched the year of the Mamba with strong growth in Kobe Protro. We continue to see locally designed Express Lane product resonate with strong sell-through of our Chinese New Year product. The opportunity in Greater China continues to be significant for Nike, notwithstanding the highly competitive and fast-moving dynamics in this marketplace. Our brand remains strong, but our actions to energize the marketplace will take some time.”

APLA (Asia Pacific & Latin America) Q3 revenue declined 4 percent year-over-year. Nike Direct declined 4 percent, with Nike Digital down 8 percent and Nike Stores up 1 percent. Wholesale was down 4 percent. EBIT declined 27 percent on a reported basis.

“While we saw mixed performance across territories in APLA, Japan and Latin America each returned to growth this quarter. In Q3, we created energy on the ground in running communities. We launched the After Dark Tour with incredible response from female runners and executed disruptive race takeovers at the Hakone Ekiden in Japan, the Mumbai Marathon, and the Thailand Marathon. This fueled continued momentum in running with growth across footwear and apparel.

Regions Operating Profit Summary

Balance Sheet Summary

- Inventories for Nike, Inc. were $7.5 billion, down 2 percent compared to the prior year, reflecting product mix shifts, partially offset by an increase in units.

- Cash and equivalents and short-term investments were $10.4 billion, down approximately $0.2 billion from last year, as cash generated by operations was more than offset by share repurchases, cash dividends and capital expenditures.

Shareholder Returns

Nike continues to have a strong track record of consistently increasing returns to shareholders, including 23 consecutive years of increasing dividend payouts.

In the third quarter, the company returned approximately $1.1 billion to shareholders, including:

- Dividends of $594 million, up 6 percent from the prior year.

- Share repurchases of $499 million, reflecting 6.5 million shares retired as part of the company’s four-year, $18 billion program approved by the Board of Directors in June 2022.

As of February 28, 2025, a total of 119.3 million shares have been repurchased under the program for a total of approximately $11.8 billion.

Outlook and Building Blocks

Friend said the second half plan is in line with what was communicated last quarter, with some shifts occurring between the fiscal third and fourth quarters.

“Looking ahead, we believe that the fourth quarter will reflect the largest impact from our Win Now actions and that the headwinds to revenue and gross margin will begin to moderate from there,” the CFO said. “We are also navigating through several external factors that create uncertainty in the current operating environment, including geopolitical dynamics, new tariffs, volatile foreign exchange rates, and tax regulations, as well as the impact of this uncertainty and other macro factors on consumer confidence.”

He said the fourth quarter guidance includes the best assessment of these factors based on the data available to them today.

“We expect Q4 revenues to be down in the mid-teens range, albeit at the low end,” he detailed. “This includes several points of unfavorable shipment timing in North America, as well as 2 points of negative impact from foreign exchange headwinds.” The company also expects:

Fourth quarter gross margins be down approximately 400 basis points to 500 basis points, including restructuring charges during the same period last year, including the estimated impact from newly implemented tariffs on imports from China and Mexico.

Fourth quarter SG&A dollars to be up low- to mid-single digits, including restructuring charges in the prior year.

“We will continue to tightly manage expenses, while we increase investment to fuel our win now priorities, most notably demand creation,” Friend noted. “We expect other income and expense, including net interest income, to be $45 million to $55 million for Q4.”

The tax rate for the full year is expected to be in the mid-teens range.

Looking ahead, the CFO outlined four areas of focus to measure through fiscal 2026.

First, he said the company is accelerating its product portfolio transition, focusing more on Sport Performance and less on Classic Footwear. “We expect Sport Performance dimensions to lead our growth with a relentless flow of newness across each field of play,” Friend suggested. “We are focused on increasing the contribution of newness as a percentage of our overall seasonal assortment, including new models, new colors, and new materials. At the same time, we are moving fast to right-size the contribution of our classic footwear franchises.”

The CFO said that by the last quarter of this fiscal year they expect the Classic Footwear franchises will be down by more than 10 points as a percent of the total footwear mix. “We intend to drive this mix lower in fiscal 2026 with total units planned down double digits with the most aggressive actions on the Dunk,” he said.

“Second, we are repositioning Nike Digital within an integrative marketplace,” Friend continued. “To do this, we are reducing promotional days, reducing markdown rates, and shifting closeout liquidation to our Nike factory stores. Due to these actions, and as we continue to reduce investment in paid media, we expect digital traffic to be down double digits in fiscal 2026. Gradually, we expect organic traffic to stabilize and grow with new product launches and our increased brand marketing investments.”

Third, he said they are cleaning up the marketplace. “For Nike Digital, we are tightening our buys to support a full-price business model. For Nike factory stores, we are increasing markdowns to drive velocity of higher volumes of closeout inventory. And for our wholesale partners, we are making investments in sales-related returns, reducing forward supply, and providing higher wholesale discounts to liquidate aged inventory. We expect these actions will continue through the first half of fiscal 2026.”

Fourth, Friend said Nike expects the Wholesale business to return to growth once the company gets back to a steady flow of new product at scale, improve brand engagement, reposition the Nike Digital business to complement Wholesale partners, and return to a healthy and clean marketplace.

“Each of our geographies have made varying levels of progress on each of these actions, and as a result are working against different timelines,” he said. “But when taken all together, these are the building blocks for Nike to return sustainable, profitable growth.”

Image courtesy Nike, Inc.