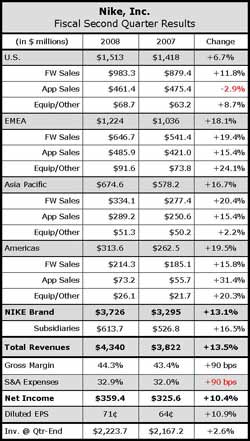

Nike, Inc. reported that the Nike brand posted a mid-single-digit revenue increase in the U.S. region for the fiscal second quarter through November, but the real energy continued to come out of the international business as emerging markets in both Europe and Asia helped fuel high-teens growth in all other regions. Every region, including the U.S., posted gains in revenues, operating profits and futures backlog. The gains outside the U.S. were also aided by the weakening U.S. Dollar, which contributed roughly four points of the growth for the overall Nike, Inc. business. Still, revenue growth outpaced earnings improvement by more than 300 basis points for the quarter.

Second quarter gross margins improved 90 basis points from the year-ago period due to “better in-line pricing margins in footwear, better close-out management, and faster revenue growth in high margin businesses.” Management said that currency fluctuations had a “minimal impact” on gross margin for the quarter.

Nike brand futures backlog was up in double-digits, with about three points of the gain coming from the weaker U.S. Dollar, but the U.S. trailed the rest of the world due to a weaker “sports-inspired” apparel business.

Management said that the company had $738 million of free cash flow from operations over the first two quarters of fiscal 2008, while managing to pay out $185 million in dividends and repurchasing $614 million of NKE stock.

Nike, Inc.s balance of cash and short-term investments totaled over $3 billion at period-end, or nearly $5.00 a share net of debt. To put it in perspective, thats roughly double the amount that UBS wasnt able to come up with to fund the merger of Genesco and The Finish Line.

Nike, Inc. clearly spent to show up bigger in the market, with a 12% increase in demand creation expenses attributed primarily to investment in retail presentation with retail accounts, brand events such as the Nike + holiday campaign, and sports marketing investments in soccer and basketball. The total demand creation spend came in at roughly $557 million for the quarter, or about 12.8% of total revenues.

Growth in operating overhead was driven primarily by “investments in strategic growth initiatives such as Nike owned-retail, China and Converse as well as normal wage inflation and performance based compensation.”

Total Nike brand footwear sales were up 15.7% to $2.18 billion in the fiscal second quarter from $1.88 billion in the year-ago period. Apparel sales growth lagged footwear worldwide, growing 8.9% to $1.31 billion for the quarter from $1.20 billion in Q2 last year, with management calling out Nike Pro and Nike Sport Essentials as key contributors. They see “tremendous opportunity” in their sportswear business, but continued to see challenges in the sports-inspired apparel business in the U.S. in the quarter and in futures.

Nike, Inc. CEO Mark Parker said that sportswear is one of the companys six key growth categories and expects the success in performance apparel to carry over into the sportswear category. They expect to use the 2008 Olympics as a platform to launch sportswear in a bigger way.

“In Beijing, we will deliver what I would consider to be the most significant performance in sportswear apparel initiatives in Nike history,” said Parker. “It really shows how the power of design and the art of merchandising can work together to create premium consumer experiences in apparel.” Nike brand President Charlie Denson added, “The competitive uniforms you'll see in Beijing represent some of the biggest advancements we've seen in performance apparel in quite awhile.”

Equipment sales increased 13.8% to $238 million.

The Nike brand saw most of the upside from the weaker U.S. Dollar in the EMEA region, which includes Europe, the Middle East and Africa, as currency fluctuations added 10 full points of growth to the results for the quarter. The 8% increase in currency-neutral sales is a sharp contrast to the 1% decline posted in the year-ago period. On a currency-neutral basis, “virtually every country” in the EMEA region reported higher revenues. As a group, the emerging markets were up 30% for the period, driven by “strong results” in Turkey, Russia and Greece.

In Western Europe, revenues in the U.K. and Germany  each grew at a double-digit rate, while revenues in France grew in the high-single-digits. Revenues in the CEMEA sub-region, which includes Central and Eastern Europe, the Middle East and Africa, were up 30% led by Russia (+45%) and Turkey (+39%). CEMEA is on track to surpass $1 billion in revenue this fiscal year.

each grew at a double-digit rate, while revenues in France grew in the high-single-digits. Revenues in the CEMEA sub-region, which includes Central and Eastern Europe, the Middle East and Africa, were up 30% led by Russia (+45%) and Turkey (+39%). CEMEA is on track to surpass $1 billion in revenue this fiscal year.

Futures orders for the EMEA region grew 13% in constant dollars reflecting continued growth in nearly every country in the region. Second quarter pre-tax income for the European region grew 37% to $230 million driven by “revenue growth, improved gross margins, SG&A leverage, and stronger European currencies.”

In the Asia Pacific region, Nike is setting the stage for the upcoming Summer Olympics in Beijing as they continue to expand their retail presence in what they call Tier 1 and Tier 2 cities. Management said they are seeing “very solid” double-digit year-over-year comp sales growth across their retail base in China. They cited their flagship store in Beijing as now “one of the most productive and exciting [Nike] stores in the world.” Revenues in China were up 37% in the second quarter. Japan is also showing positive progress as revenue and futures were up and inventories were down. Japan revenues grew about 2% on a currency-neutral basis. Management said that the “results are not dramatic yet,” but “fundamentals there look good.”

Asia Pacific currency-neutral revenues were up 12%, with footwear increasing 16% and apparel growing 11% for the quarter. Pre-tax income increased 19.0% to $174.1 million, driven by strong revenue growth, expanding gross margins and stronger currencies.

The Americas saw stronger currencies deliver five percentage points of the regions growth in the fiscal second quarter, with the biggest gains coming in the apparel sector. Excluding currency changes, revenue growth for the region was driven by the Latin American markets, led by growth of over 20% in Argentina and in Mexico. Second quarter pre-tax income for the America's region grew 12% to $68.7 million, driven by “revenue growth, gross margin expansion, and favorable exchange rates.”

The U.S. region saw solid growth, driven by higher sales to 9 of their top 10 accounts across all channels and a 17% increase in revenues from Nike owned-retail stores. Comp store sales at Nike first quality stores were up 6% for the period. Management was pleased with the footwear business in Q2 as revenues grew 12% and gross margins expanded. Overall unit volume increased double-digits for the quarter, driven by “strong growth” in the sportswear, Jordan, and kid's categories, but those gains were partially offset by a “slight decline” in average price per pair. U.S. apparel revenues were down 3% for Q2 as growth in performance apparel was more than offset by softness in basic sportswear products such as Ts and fleece.

“The softness in our U.S. apparel business is reflected in our sportswear segment,” said Denson. Parker added that the upper end of the sportswear business performed well and noted the performance business is trending at or “slightly above” plan.

While U.S futures were up only 1% at quarter-end, management still believes full year revenues for the U.S. region will grow closer to a mid-single digit growth rate. Denson said that the at-once business was growing faster, fueled in part by expanded auto replenishment programs.

U.S. pre-tax income increased 9% to $306.6 million.

Second quarter revenues from the subsidiary businesses grew 16%. Converse delivered what was called a “tremendous quarter,” with revenues jumping over 40% and pre-tax income growing by a third. Revenues for Nike Golf, Cole Haan, Hurley and Nike Bauer Hockey each reportedly grew in double-digits. Pre-tax income for the other businesses was up 31% to $70.8 million for the quarter, driven by strong revenue growth, expanding gross margins and SG&A leverage.

Looking ahead, NKE now expects low-double-digit revenue growth for the second half of fiscal 2008, driven by “business momentum” and the continued weakness of the U.S. Dollar.