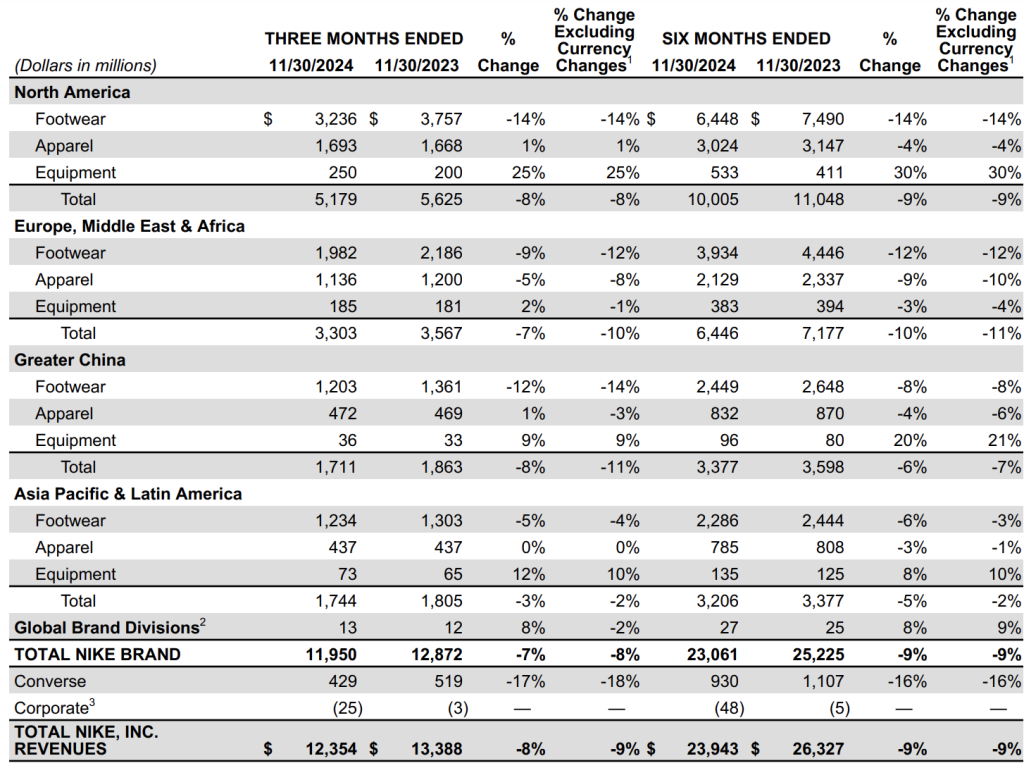

Nike, Inc. reported revenues for its fiscal second quarter amounted to $12.4 billion, down 8 percent on a reported basis compared to the prior-year second quarter and down 9 percent on a currency-neutral basis.

- Nike Brand revenues were $12.0 billion, down 7 percent year-over-year (y/y) on a reported basis and down 8 percent y/y on a currency-neutral basis, driven by declines across all geographies.

- Nike Direct revenues were $5.0 billion, down 13 percent y/y on a reported basis and down 14 percent y/y on a currency-neutral basis, primarily due to a 21 percent decrease in Nike Brand Digital and a 2 percent decrease in Nike-owned stores.

- Wholesale revenues were $6.9 billion, down 3 percent y/y on a reported basis and down 4 percent y/y on a currency-neutral basis.

- Revenues for Converse were $429 million, down 17 percent y/y on a reported basis and down 18 percent y/y on a currency-neutral basis, due to declines across all territories.

Zacks Consensus Estimate for fiscal second-quarter revenues was $12.2 billion, or a 9.1 percent decline from the prior-year fiscal Q2 reported revenues.

“After an energizing 60 days of being back with my Nike teammates, our clear priority is to return sport to the center of everything we do,” said Elliott Hill, president & CEO, Nike, Inc. “We’re taking immediate action to reposition our business, so we can get back to driving long-term shareholder value. Our team is ready to go, and I’m confident you will see more moments of Nike being Nike again.”

The Q2 marketplace trend was said to largely reflect the challenges with traffic and retail sales across the marketplace falling below expectations, especially in September and October. In November, Nike saw momentum build with digital and physical traffic inflecting positive, especially around the quarter’s biggest consumer moments, according to comments from company CFO Matt Friend on a conference call with analysts.

“In North America, Black Friday week was our largest demand week ever on Nike Digital with sales up double-digits,” Friend shared. “In Greater China, our 11.11 [Singles Day] performance exceeded plan. However, on Nike Digital, our off price mix was up high single-digits versus the prior year with performance marketing increasing over the same period. As Elliott said, Nike Digital has become a platform where we have been capturing demand and competing with our wholesale partners rather than creating and growing demand for our brands. This is why we must elevate the consumer experience, grow organic traffic and drive full demand.”

Friend said the second quarter showed progress in key areas, especially as teams get back on offense and built support with consumers.

“Overall, our sport performance field of play grew year-over-year, offset by a double-digit decline in sportswear,” Friend continued. “In training, men’s was up high teens, women’s up high single-digits and kids up high single-digits. In Global Football, men’s grew low single-digits and kids’ grew high teens. In basketball, women’s grew strong double-digits and kids’ grew low teens.”

The CFO said the men’s business was flat and women’s was up in low- to mid-single digits.

“In addition, we took another step forward shifting our product portfolio by reducing the proportion of our business driven by our Classic Footwear franchises,” Friend highlighted. “For Q2, these franchises again decelerated faster than the overall business and at a rate greater than the first quarter. As I said last call, we expect the impact of these shifts to continue for the next few quarters.”

North America

In North America, Q2 revenue was said to be down 8 percent.

- Nike Direct declined 15 percent, with Nike Digital down 22 percent and Nike stores down 3 percent.

- Wholesale declined 1 percent.

- Divisional EBIT declined 10 percent on a reported basis.

Friend said highlights in the quarter included growth in kids’ with strong momentum in apparel and performance footwear. “Men’s and women’s training drove strong growth. And in basketball, Ja grew double-digits, Kobe became the market’s largest signature franchise, with demand far exceeding available supply. And Sabrina 2 made a statement as the NBA’s second most worn sneaker this season, behind only the Kobe 6,” he detailed.

EMEA (Europe, Middle East and Africa)

EMEA region Q2 revenue declined 10 percent year-over-year.

- Nike Direct declined 20 percent, with Nike Digital down 32 percent and Nike stores up 3 percent.

- Wholesale declined 4 percent and EBIT declined 10 percent on a reported basis.

“We continue to build momentum in sport performance led by strong growth in men’s and kids global football,” Friend said. “Men’s and women’s running return to growth, and all three of our top performance franchises in EMEA, Mercurial, Pegasus and Phantom grew double-digits. In sportswear, we are seeing momentum from newer franchises, including shocks, Vomero 5, LD-1000 and P-6000.”

Friend said they moved first in EMEA to reposition Nike Digital as a premium platform. “This quarter, full price realization improved with a strong double-digit decline in off-price sales,” he said. “While we are seeing near-term traffic impact as we reduce promotional activity in paid media, we believe these shifts will elevate the total marketplace over time.”

Greater China

Greater China Q2 revenue declined 11 percent.

- Nike Direct declined 7 percent, with Nike Digital down 4 percent and Nike stores down 8 percent.

- Wholesale was down 15 percent.

- EBIT declined 27 percent on a reported basis.

“In Q2, we experienced another quarter of retail traffic declines in a difficult macro environment,” Friend noted. “This quarter also required higher markdown activity to drive sell-through and inventory velocity, which negatively affected gross margins. In a competitive environment, Nike’s focus is on serving consumers with product innovation and brand inflation and fueling the growth of sport in China. This quarter, Ja 2 launched with strong sell-through. Pegasus 41 top sales in women’s running and new ACG apparel releases created social bus.”

The CFO said Nike also continues to see strong full price demand with lower markdowns and higher margins for the locally designed Express Lane products.

“While near-term conditions are challenging, sport continues to grow in China, and we are addressing our current headwinds to reignite brand momentum and a healthy pull marketplace,” he said.

APLA (Asia Pacific Latin America)

APLA Q2 revenue was down 2 percent.

- Nike Direct declined 4 percent, with Nike Digital down 8 percent and Nike stores up 2 percent.

- Wholesale declined 1 percent.

- EBIT declined 12 percent on a reported basis.

“Earlier on, we read consumer trends in Korea and Japan and moved quickly to diversify our sportswear footwear portfolio,” Friend elaborated. “Our mix of Classic Footwear franchises in APLA is below our global business and new styles are resonating with consumers. Our look of running franchises are up triple-digits and new releases like City and Air Max Muse drove positive consumer response. In addition, we drove strong growth in men’s and women’s training and kid’s global football as men’s and women’s running return to growth in the geography.”

Income Statement Summary

Gross margin decreased 100 basis points y/y to 43.6 percent of revenues, primarily due to higher discounts and changes in channel mix, partially offset by lower product input costs as well as lower warehousing and logistics costs.

Selling and administrative expense decreased 3 percent y/y to $4.0 billion.

Demand creation expense was $1.1 billion, up 1 percent y/y, primarily due to an increase in sports marketing expense offset by a decrease in brand marketing expense.

Operating overhead expense decreased 5 percent y/y to $2.9 billion, due to lower wage-related expenses and lower other administrative costs.

The effective tax rate was 17.9 percent for Q2, compared to 17.9 percent for the fiscal Q2 period last year.

Net income was $1.2 billion for the quarter ended November 30, down 26 percent y/y, and diluted earnings per share was 78 cents, a decrease of 24 percent year-over-year.

Zacks Consensus Estimate for fiscal second-quarter earnings was 64 cents per share, or a decline of 37.9 percent from the year-ago reported number.

NKE shares were up nearly 10 percent in after-hours trading before settling back into the mid- to high-single-digits as the company beat Wall Street estimates for both the top- and bottom-line results.

“Nike’s second-quarter financial performance largely met our expectations, as we continue to make progress in shifting our portfolio,” said Matthew Friend, EVP and CFO, Nike, Inc. “Under Elliott’s leadership, we are accelerating our pace and reigniting brand momentum through sport.”

Balance Sheet Summary

Inventories for Nike, Inc. were $8.0 billion at quarter-end, flat compared to the prior-year quarter-end, reflecting an increase in units offset by lower product input costs and product mix shifts. Elevated supply in North America and Greater China was reportedly offset by declines in EMEA and APLA.

“Footwear inventory declined, while apparel and accessories inventory increased to support marketplace growth,” Friend detailed. “On a year-over-year basis, these trends were partly driven by timing-related factors. That said, inventory levels are higher than we would like, especially given recent sales trends on Nike Direct. Partner-owned inventory declined versus the prior year. We took some steps this quarter and we plan to accelerate inventory actions in our second half to drive a return to a healthy marketplace. In particular, we are moving aggressively to reduce aged inventory, adjust supply with demand on Nike Digital and ensure we have marketplace capacity for our newest product assortments.”

Cash and equivalents and short-term investments were $9.8 billion, down approximately $0.2 billion from last year, as cash generated by operations was more than offset by share repurchases, cash dividends and capital expenditures.

Shareholder Returns

Nike said it continues to have a strong track record of consistently increasing returns to shareholders, including 23 consecutive years of increasing dividend payouts.

In the second quarter, the company returned approximately $1.6 billion to shareholders, including:

- Dividends of $557 million, up 7 percent from the prior year.

- Share repurchases of $1.1 billion, reflecting 13.1 million shares retired as part of the company’s four-year, $18 billion program approved by the Board of Directors in June 2022.

As of November 30, 2024, a total of 112.8 million shares have been repurchased under the program for a total of approximately $11.3 billion.

Outlook

Regarding the company’s fiscal third quarter outlook, Friend said Nike, Inc. expects Q3 revenues to be down in low double-digits. The CFO said this reflects initial steps on the outlined actions and worsening foreign exchange headwinds, partially offset by a timing benefit from Cyber Week shifting into the company’s fiscal third quarter.

“We expect Q3 gross margins to be down approximately 300 basis points to 350 basis points, including restructuring charges during the same period in the prior year,” the CFO detailed. “This reflects the actions described earlier to clean and reset the marketplace. We expect Q3 SG&A dollars to be slightly down year-over-year, including restructuring charges in the prior year. We will continue to tightly manage expenses while we strategically increase investment, as mentioned earlier. We expect other income and expense, including net interest income, to be $30 million to $40 million for Q3.”

Image courtesy Nike, Inc.

See below for additional SGB Media coverage of Nike’s Q2 and the company’s turnaround plan:

EXEC: New Nike Inc. CEO Lays Out Pain Points Ahead and Plans to Re-Focus on Sport

EXEC: Nike Inc. Q2 Reaction May Be More About the CEO’s Plan Rather Than KPIs