By Thomas J. Ryan

Easing concerns that it might have been losing ground to Adidas, Under Armour and some newer athleisure players, Nike Inc.(NYSE:NKE) flexed its muscles to show no slowdown for the brand in North America and beyond.

The swoosh reported higher earnings and sales for its fiscal 2017 second quarter ended November 30 that blew past Wall Street’s targets. Earnings in the quarter rose 7.3 percent to $842 million, or 50 cents a share, easily ahead of Wall Street’s consensus estimate of 43 cents. Meanwhile sales advanced 6.4 percent to $8.18 billion and were up 8.4 percent on a currency-neutral basis. Wall Street was forecasting $8.09 billion in revenue on average.

Overall, the North America region was among the encouraging developments in the period. Officials said that the company had cleaned up inventories over the last year and North America had been reestablished as a “pull market. Nike’s direct-to-consumer (DTC) business continues to drive these gains. Nike brand DTC revenue jumped 25 percent in the period, boosted by strong growth in digital commerce, 11-percent comp-store growth and new store expansion. Other highlights in the latest quarter included double-digit currency-neutral growth in Western Europe, Greater China and the Emerging Markets, as well as in its sportswear and running categories. The basketball category is expected to return to growth in the back half of its year ending May 2017, officials said.

Gross margins for the quarter eroded to 44.2 percent versus 45.6 percent a year ago, as higher average selling prices were unable to offset higher product costs, unfavorable changes in foreign exchange rates and the impact of higher off-price sales. Still, the bottom line benefited from a reduction in SG&A expenses to 30.6 percent of sales, versus 33.3 percent a year ago. Net SG&A expense declined 2 percent to $2.5 billion. Marketing costs dipped 1 percent following significant investments in the Olympics and Euro Champs in the prior quarter. Overhead costs were down 3 percent due to productivity gains stemming from its “Edit to Amplify” program. The program aims to reduce overall SKU count while better highlighting key items and concepts.

Areas Of Concern?

One blemish on the fiscal second-quarter performance was the report of flat future orders, or an increase of 2 percent on a currency-neutral basis. Worse, in North America, backlogs were off 4 percent on both a reported and currency-neutral basis. With the company’s first-quarter report in September, Nike reported a rise in futures of 5 percent. While still watched by investors, Nike is urging Wall Street to downplay the futures order metric. In September, it said the metric is becoming “less correlated” to future sales because of its growth in DTC. Indeed, Nike officials said December 20 that sales are expected to grow in its second half in North America despite the drop in order rates.

On the December 20 conference call with analysts, Nike Chairman, President and CEO Mark Parker noted that the period marked the company’s 28th period of consecutive quarterly growth and he addressed concerns that a rash of competitors are grabbing Nike’s market share, especially in the U.S.

“With the energy we see in sports right now, along with today’s more active lifestyle, it’s no surprise that our industry continues to attract competition,” Parker said. “As in sports, competition is a positive thing – it sharpens our focus. And we know there are areas in the short term where we haven’t executed as precisely as we would have liked. As good as we are, we can be even better … by hyper-focusing on our most compelling growth opportunities.”

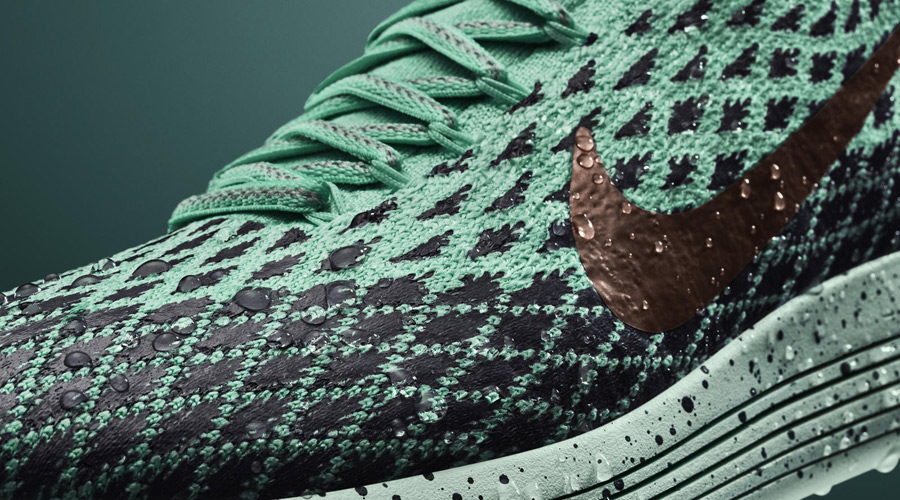

He said Nike is responding with its Edit To Amplify program that brings supply-chain efficiencies while better highlighting key stories on selling floors as well as an Express Lane program that turns around product in weeks instead of months. He said his biggest commitment remains on innovation and pointed to the successful launches of Air VaporMax (pictured above) and Hyperadapt 1.0 in footwear as well as Thermasphere in apparel in the quarter. Parker added, “And there’s a lot more on deck with new cushioning experiences in running and basketball, digitally integrated product, advancements in customization and personalization and breakthroughs in lightweight performance. Our pipeline is very strong.”

He said Nike is responding with its Edit To Amplify program that brings supply-chain efficiencies while better highlighting key stories on selling floors as well as an Express Lane program that turns around product in weeks instead of months. He said his biggest commitment remains on innovation and pointed to the successful launches of Air VaporMax (pictured above) and Hyperadapt 1.0 in footwear as well as Thermasphere in apparel in the quarter. Parker added, “And there’s a lot more on deck with new cushioning experiences in running and basketball, digitally integrated product, advancements in customization and personalization and breakthroughs in lightweight performance. Our pipeline is very strong.”

Finally, Parker implied that Nike sees no challenges competing with footwear trends now being led by lifestyle athletic rather than performance, as it had in recent years. “There is a misconception that growth in our lifestyle business comes at the expense of growth in our performance business,” Parker said. “The reality is, they fuel each other.”

Concerns over Nike facing greater competition from many places, including a resurgent Adidas, Under Armour with its recent Steph Curry success, as well as a whole crop of athleisure players, has weighed on the company’s stock this year. Shares remain on pace to show the first annual decline in eight years, having slid 17 percent for the year through the December 20 close. On December 21, following the release, shares were up just 1 percent by midday.

Sales Breakdown

In the quarter, total Nike brand global sales advanced 8 percent on a currency-neutral basis (5.6 percent reported), to $7.7 million. By category, the gains were led by apparel, which grew 9 percent on a currency-neutral basis (7.3 percent reported), to $2.5 billion. Footwear was ahead 7 percent on a currency-neutral basis (5 percent reported) to $4.8 billion. Equipment sales increased 2 percent on a currency-neutral basis (flat reported), to $346 million. EBIT for the Nike brand eased 0.6 percent in the quarter to $1.25 billion.

Converse’s brand sales grew 5 percent on a currency-neutral basis (4.5 percent reported) to $416 million. EBIT was down 8.2 percent to $78 million.

Sales in North America for the Nike brand increased 3 percent on a currency-neutral basis (2.9 percent reported) to $3.65 billion with balanced growth across footwear and apparel. Footwear increased 3 percent on a currency-neutral basis (4.3 percent reported) to $2.2 billion. Apparel increased 4 percent on a currency-neutral basis (2.6 percent reported) to $1.27 billion. Equipment sales were down 3 percent on a currency-neutral basis (3.7 percent reported) to $158 million.

Inventory Reduction + DTC Boost To Lift Margins

Looking ahead, North America revenue growth is expected to continue to outpace futures coupled with a return to gross margin expansion. Trevor Edwards, president of the Nike brand, said on the call that the North America region is expected to benefit from a reduction in inventories by 4 percent, and efforts to hold down inventory levels are reflected in its future order rates. Added Edwards, “As a result, we expect much stronger sell-through to the end-consumer, which ultimately results in stronger revenue growth.”

A big driver of the North America performance was DTC, which grew 17 percent in the quarter, with 10-percent comp-store growth. Over the Black Friday weekend Nike saw double-digit traffic increases and higher conversion and dollars-per-transaction across its stores and Nike.com. Officials said the opening of a five-story store with trial zones and personalized services in lower Manhattan demonstrates Nike’s commitment to DTC.

EBIT in the North America region advanced 3.4 percent in the quarter to $912 million, helped by revenue growth, full-price gross margin expansion and SG&A leverage. These factors were partially offset by a higher mix of off-price versus the same period in the prior year. Said Edwards, “We have made tremendous progress aligning supply and demand in North America, returning this important geography to a pull market.”

Global Success

In Western Europe, sales on a currency-neutral basis grew 12 percent (6.6 percent reported) to $1.39 billion. Standout categories for the quarter were sportswear, running and Jordan, although growth was broad-based. EBIT was down 23.1 percent to $236 million due to FX headwinds, partially offset by SG&A leverage.

In Greater China, sales advanced 17 percent on a currency-neutral basis (12.5 percent reported) to $1.06 billion. Most categories grew by double digits and DTC businesses continued recent robust momentum, vaulting 42 percent. EBIT climbed 14.7 percent to $375 million due to strong revenue growth and SG&A leverage.

In Emerging Markets, sales grew 13 percent on a currency-neutral basis (6 percent reported) to $1.05 billion. The gains were fueled by double-digit growth across sportswear, running and Jordan. Operating income eased 1.7 percent to $237 million, again reflecting currency headwinds. In the Central & Eastern Europe region, sales inched up 1 percent on a currency-neutral basis (0.6 percent reported) to $328 million, while EBIT gave back 23.7 percent to $58 million. In Japan, sales increased 2 percent on a currency-neutral basis (16.1 percent reported) to $238 million, while EBIT inched up 2.1 percent to $48 million.

Running Category Stays Strong

Elaborating on developments in key categories, Edwards noted that running grew at a double-digit clip in the second quarter and “continues to be one of our most influential and largest drivers of the sportswear business.” Strong launch sellers included the LunarEpic Flyknit Shield with all-weather construction for winter running, as well as the Pegasus 33 and the Air Max 2017. In apparel, the Aeroloft and Sphere platforms that emphasize lightweight yet breathable warmth did well. The Apple Watch Nike+ is selling “well ahead of our plans,” said Edwards. The Air VaporMax, featuring a strong visual appeal in addition to advanced performance attributes, is expected to drive running during the back half of its year.

LunarEpic Flyknit Shield

LeBron Soldier 10

Edwards called basketball “much healthier today than it’s been over the past 18 months.” The category has benefited from redesigning its basketball products “with stronger aesthetics” and adjusting price points that had been near $200 for some products last year. Newer launches such as Kyrie 2, the LeBron Soldier 10, the KD9, the Jordan 31, the Kobe AD and the Westbrook 0.2 “have been incredibly popular with consumers on and off the court.” Jordan footwear in the quarter was boosted by the launch of the Space Jam 11 collection in both performance and lifestyle.

The Nike brand’s sportswear category grew in the high teens, its 12th consecutive quarter of double-digit growth. Edwards said the category continues to benefit from greater efforts at “mixing innovation and style, creating sneaker heat from running to basketball to women’s to young athletes.”

Looking ahead, Nike forecasts full-year revenue to grow in the high single digits with currency-neutral growth within the high-single- to low-double-digit range. For Nike’s fiscal 2017 third quarter, reported revenues are projected in the mid-single-digit range. Gross margin is expected to see less contraction in the second half than in its first half due to stronger full-price sell throughs. For its fiscal third quarter, gross margin is expected to contract by approximately 100 to 125 basis points, driven primarily by foreign exchange pressures.

Photos courtesy Nike