The National Golf Foundation (NGF) released its latest golf participation figures and took a different approach this time around in assessing who is swinging a golf club in this time of shifting demographics, changes in venue types and behaviors in a post-Covid world when golf had seen a tremendous growth in sales and participation.

The concept of “Modern Golf” put forth by Topgolf Callaway brands is so central to their strategy they changed their ticker symbol to “MODG” after Callaway acquired Topgolf in March 2021. The advent of other non-course concepts, from the PopStroke project from Tiger Woods and TaylorMade Golf, and the BigShots Golf business acquired by Topgolf Callaway Brands in November 2023, to a range indoor concepts and golf range technology that can be installed in other entertainment venues like Golfzon and GolfForever. Many of the younger consumers that found Pickleball during Covid also found off-course golf and those numbers have been under-represented until now.

“NGF’s research on golf participation primarily focuses on the green-grass game, but we’ve also been vocal advocates and very interested observers, measurers and reporters on golf engagement away from the course,” the trade association said in they latest participation report.

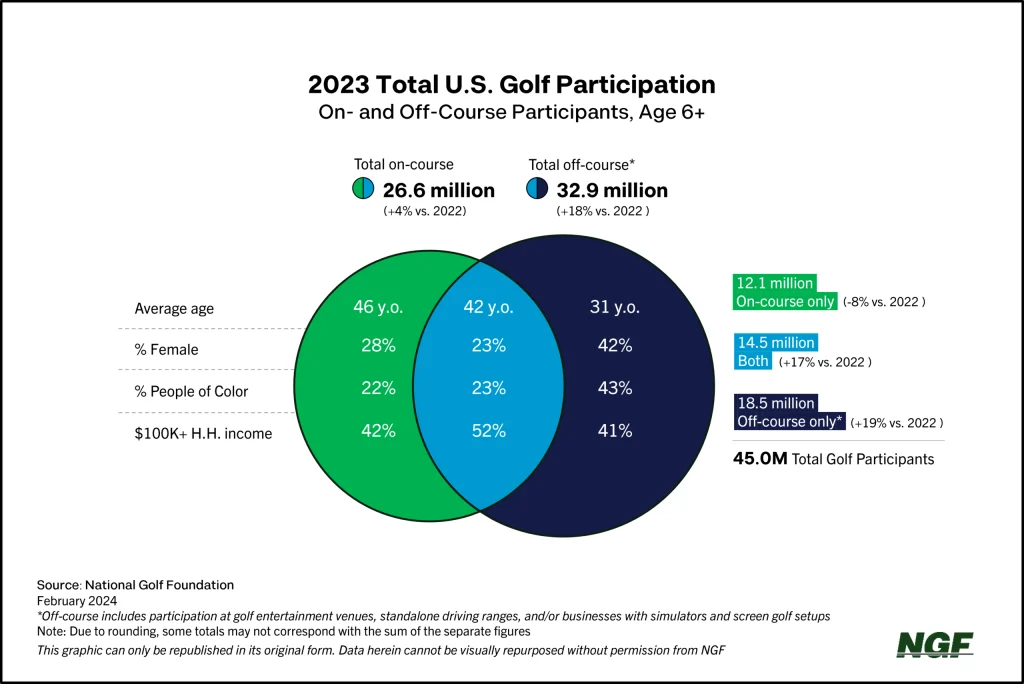

To better understand golf’s consumer base, NGF now looks at three different participant groups: on-course only (12.1 million in 2023), off-course only (18.5 million), and those who engage on both fronts (14.5 million).

The number of on-course golfers has now reportedly increased for six straight years, according to the NGF data, but the trade association also noted that the demographic makeup of the base is changing — albeit gradually in a sport with over 26 million Americans who play recreationally.

NGF said the demographics of off-course only participants have looked more similar to the mix of the U.S. population overall, exhibiting a younger and more diverse representation (age, gender, race and ethnicity) than the on-course population as seen in the Venn diagram below.

Golf has enjoyed a renaissance since the pandemic and that’s resulted in more positive perceptions of the game, particularly among younger age cohorts, the report notes.

“Off-course engagement and social media have played key roles in golf’s popularity and cool factor, as celebrities, athletes, and content creators with sizeable followings are boosting golf’s positive visibility, especially among non-golfers,” NGF noted. “With 45 million Americans participating in golf, and roughly 40 percent of our national population playing, reading and watching golf, there has been a noticeable impact on the demographics of green grass golfers.”

NGF said there has been a slow but significant shift within the on-course participation pool in just the past five years. Over this time, some of the biggest rises in on-course players have reportedly come in categories traditionally under-represented: females and people of color.

“The number of women and girls playing golf on a course has risen 23 percent since 2018, while the number of Asian, Black, and Hispanic golfers has jumped 43 percent, outpacing the changes in a U.S. population that’s becoming more racially and ethnically diverse,” NGF reported. “Meanwhile, there’s been a 40 percent increase in the number of juniors getting out on the golf course. Golf is getting younger and cooler… what an amazing time to be involved in this game.”

NGF members can find the latest golfer research in the 2024 Participation Report here, which features the latest year-end 2023 data on various segments and age groups, along with information on off-course-only participants and interest in the game among non-golfers.

Image courtesy BigShots Golf