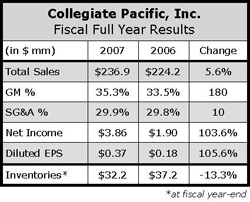

Sport Supply Group, the entity formed after  Collegiate Pacific, Inc. acquired the former Sport Supply Group in November 2006, ended its first fiscal year as a combined business with bottom line gains that more than doubled compared to the previous fiscal year. After focusing on integration initiatives in the past fiscal year, the company looks ahead to fiscal 2008 to focus on cost containment, especially on the SG&A line. The company, now listed as “RBI” on the New York Stock Exchange, sees 2009 as the year to earn the new moniker, as they plan for strong top line growth driven by newer categories like elementary school sales, cheerleading and womens sports, and an expanded Internet business.

Collegiate Pacific, Inc. acquired the former Sport Supply Group in November 2006, ended its first fiscal year as a combined business with bottom line gains that more than doubled compared to the previous fiscal year. After focusing on integration initiatives in the past fiscal year, the company looks ahead to fiscal 2008 to focus on cost containment, especially on the SG&A line. The company, now listed as “RBI” on the New York Stock Exchange, sees 2009 as the year to earn the new moniker, as they plan for strong top line growth driven by newer categories like elementary school sales, cheerleading and womens sports, and an expanded Internet business.

Though RBI did not split out fiscal Q4 results, backing the previous nine-month results from the full year report reveals sales growth of roughly 5.5%, which is in line with the overall annual number, but the company posted a slight net loss on the bottom line. For the fourth quarter, Sports Executive Weekly calculated that RBI sales amounted to $56.1 million, compared to $53.1 million in the year-ago quarter. Gross margins improved 120 basis points to 34.4% of net sales, while SG&A expenses decreased 30 basis points to 32.8%. While the company saw a quarterly loss, it narrowed 67.9% to a loss of $300,000 from a loss of $900,000 in Q4 last year.

During the fiscal year ended June 30, the company narrowed its five subsidiaries into two, while combining its catalog operations and reducing SKU count by consolidating approximately 750 similar SKUs. This move helped to deliver the 180 basis point margin improvement for the fiscal year, driven by a 350 basis point jump in catalog gross margins.

Looking to fiscal 2008, the company expects fully diluted earnings per share of 60 cents to 70 cents, with approximately 3 cents per share of non-cash charges related to stock-based compensation, and an additional 3 cents in estimated dilution from the recent $18.3 million equity infusion from Andell Holdings. Net sales are forecast to grow by approximately 5% to $250 million and gross margins will expand 50 bps to 100 bps. On a conference call with analysts, company CEO Adam Blumenfeld said that he expects sales to build sequentially through the year. EBIT is expected to be $18 million for fiscal 2008.