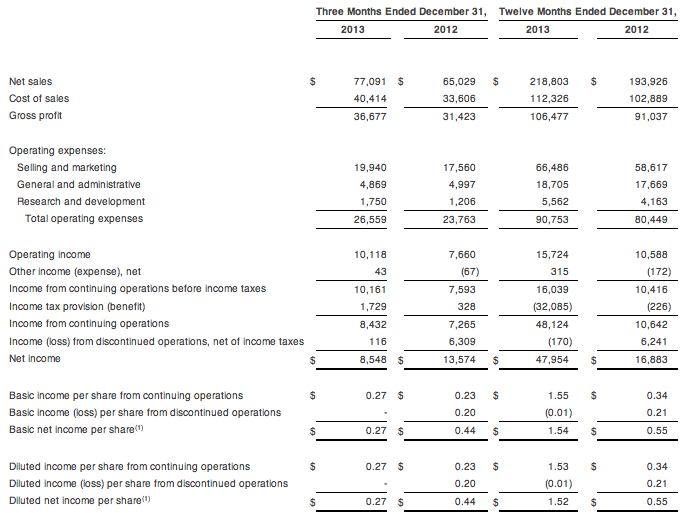

Nautilus reported net sales for the fourth quarter totaled $77.1 million, a 19 percent increase compared to $65.0 million in the same quarter of 2012. Net income from continuing operations rose 15.1 percent to $8.4 million, or 27 cents per diluted share, compared to $7.3

million, or 23 cents per diluted share for the same period last yea

The result was driven by strong growth in the company’s Retail segment, combined with continued gains in the Direct segment. For the full year 2013, net sales were $218.8 million, an increase of 13 percent over last year. Gross margins for the fourth quarter improved in both the Direct and Retail segments, by 130 and 330 basis points respectively, compared to the same period last year; however fourth quarter consolidated gross margin declined 70 basis points to 47.6 percent due to a greater percentage of sales coming from the company's lower gross margin Retail segment. For the full year, consolidated gross margin increased 180 basis points from the prior year to 48.7 percent. Operating income for the fourth quarter of 2013 was $10.1 million, a 32 percent increase over operating income of $7.7 million reported in the same quarter of 2012. The increase in operating income reflects higher sales and gross margins in both the Direct and Retail Segments combined with improved operating leverage of sales and marketing and general and administrative expenses. Full year 2013 operating income was $15.7 million, an increase of 49 percent over last year.

Net income from continuing operations for the fourth quarter of 2013 was $8.4 million, or 27 cents per diluted share, compared to $7.3 million, or 23 cents per diluted share for the same period last year. Adjusted net income from continuing operations for the fourth quarter of 2013 was $9.6 million, or $0.30 per diluted share, compared to $7.3 million, or $0.23 in the same period last year. Adjusted net income figures exclude nonrecurring income tax benefits and expenses. In the second quarter of 2013 the company recognized an income tax benefit of $1.09 per share as a result of the partial reversal of the valuation allowance recorded against the company's deferred tax assets. During the fourth quarter of 2013 it was determined that this reversal underestimated the company's full year profitability and the company reestablished a portion of the reversal, resulting in recognition of income tax expense of approximately $1.1 million, or $0.04 per share, in the fourth quarter of 2013.

For the full year 2013, net income from continuing operations was $48.1 million, or $1.53 per diluted share, compared to $10.6 million, or $0.34 per diluted share, last year. Full year 2013 net income includes income tax benefit of $33.0 million, or $1.05 per share, due primarily to the aforementioned partial reversal of a valuation allowance. Excluding the tax benefit, 2013 net income from continuing operations was $15.1 million, or 48 cents per diluted share, compared to $10.6 million, or 34 cents per diluted share, last year.

For the fourth quarter of 2013, the company reported net income (including discontinued operations) of $8.5 million, or $0.27 per diluted share. In the fourth quarter of 2012, the company reported net income (including discontinued operations) of $13.6 million, or $0.44 per diluted share. Net income for the fourth quarter of 2013 included income from discontinued operations of $0.1 million. Net income for the fourth quarter of 2012 included income from discontinued operations of $6.3 million, or $0.20 per diluted share, which primarily represents a currency translation adjustment gain related to the liquidation of European subsidiaries.

Bruce M. Cazenave, Chief Executive Officer, stated, “We are pleased to report strong financial results for both the fourth quarter and full year 2013. Our operating performance reflects meaningful improvements in our Retail business, underscoring the early customer acceptance of the new Retail product line, and our ability to continue to grow the Direct business. Initiatives to improve gross margins across both business segments have also been successful. We continued to make strategic investments in marketing and advertising in order to drive consumer awareness of our expanding product line, while tightly managing operating costs. We ended the year in a strong financial position which provides us the financial flexibility to invest in our growth initiatives to enhance long-term shareholder value.”

Cazenave continued, “As we begin 2014, we believe we are well positioned to build upon the strong momentum of our business and expect to deliver another year of positive revenue and operating income growth. We expect to benefit from the recently expanded portfolio of Retail and Direct products as well as additional introductions that we are planning in 2014. Most recently, we announced the launch of the Bowflex MAX Trainer, a one-of-a-kind cardio machine that leverages the strength of our Bowflex® brand and complements our other cardio offerings. We remain intensely focused on continuing to introduce new products to market on a regular cadence.”

For further information, see “Results of Operations Information” attached hereto.

Segment Results

Net sales for the Direct segment were $43.0 million in the fourth quarter of 2013, an increase of 4 percent over the comparable period last year. Direct segment sales benefitted from continued strong demand for cardio products, especially the Bowflex® TreadClimber® product line, partially offset by a decline in Direct sales of strength products. Full year 2013 sales for the Direct segment were $136.7 million, an increase of 9 percent over last year. U.S. credit approval rates rose to 39.7 percent in the fourth quarter of 2013, up from 37.4 percent for the same period last year.

Operating income for the Direct segment was $5.6 million for the fourth quarter 2013, compared to $6.5 million for the fourth quarter 2012. Higher sales and higher gross margins for the Direct segment were offset by higher media and advertising investment designed to help drive new product awareness and expand sales leads. Gross margin for the Direct business was 60.2 percent for the fourth quarter of 2013, compared to 58.9 percent in the fourth quarter of last year. Direct business gross margin benefited from improved overall overhead operating efficiency and cost improvements.

Net sales for the Retail segment were $32.1 million in the fourth quarter 2013, an increase of 47 percent when compared to $21.8 million in the fourth quarter last year. The company's Retail segment sales in the fourth quarter of 2012 were adversely affected as a result of some Retail customers accelerating a portion of their purchases into the second quarter from the third and fourth quarters, compared to their typical buying patterns, in anticipation of the price increases implemented in the second half of last year. Net sales for the full year 2013 for the Retail segment were $76.8 million, an increase of 20 percent compared to last year. The improvement in Retail net sales is due primarily to growth in strength products and strong retailer acceptance of the company’s new lineup of cardio products.

Operating income for the Retail segment was $6.5 million for the fourth quarter 2013, compared to $3.7 million in the fourth quarter last year. Retail gross margin was 27.4 percent in the fourth quarter of 2013, compared to 24.1 percent in the same quarter of last year. Gross margin benefited from a combination of the mix of new products, higher sales volume, and improved overall overhead operational efficiency.

Royalty revenue in the fourth quarter 2013 was $2.0 million, compared to $1.8 million for the same quarter of last year. Royalty revenue for the full year 2013 was $5.4 million, compared to $5.1 million in 2012.

Balance Sheet

As of December 31, 2013, the company had cash and cash equivalents of $41.0 million and no debt, compared to cash and cash equivalents of $23.2 million and no debt at year end 2012. Working capital of $45.7 million as of December 31, 2013 was a $20.3 million increase as compared to $25.4 million at year end 2012, primarily due to higher cash and cash equivalents. Inventory as of December 31, 2013 was $15.8 million, compared to $18.8 million as of December 31, 2012. The company tightly manages inventory levels and believes that inventory is at the proper levels, when combined with planned purchases, to support sales in the first quarter of 2014.

Headquartered in Vancouver, WA, Nautilus' brand portfolio includes Nautilus, Bowflex, TreadClimber, Schwinn, Schwinn Fitness and Universal.