Nautilus Inc. said revenues in its retail segment missed plan in the fourth quarter due to heavy discounting online and conservative buying by its retail partners.

Nautilus Inc. said revenues in its retail segment missed plan in the fourth quarter due to heavy discounting online and conservative buying by its retail partners.

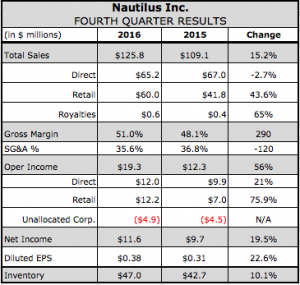

Overall sales for its retail segment jumped 43.6 percent to $60 million, reflecting last year’s acquisition of Octane Fitness. Excluding Octane Fitness, organic retail sales declined 7 percent in the quarter.

On a conference call with analysts, Bill McMahon, COO, noted that the retail segment faced two challenges in the period. First, a pattern of “very deep promotions and daily deal buying” by its competitors in the e-commerce space developed during December and early January. Said McMahon, “We chose not to erode our margins by matching those deals, which we felt were not sustainable and potentially involved aged inventory.”

Second, some of its largest accounts reduced their inventory positions in terms of weeks of inventory on hand, compared to projected sales by significant amounts for the company’s products. The company had already noted in its third-quarter conference call that retailers had been cautious with orders and this could happen.

“These reductions occurred despite sell-through of Nautilus product continuing to be favorable,” said McMahon. “We suspect this is a new focus by certain retailers on optimizing their return on working capital and profitability. We anticipate that this behavior will level out in the long run at a new level of on hand product. And if our sell-through continues to be strong, then our comparable sales will return to normal.”

Regardless, he added that these near-term challenges “will put pressure on our ability to match comparable sales from Q1 2016.”

On the positive side, gross margins for the Retail business improved 570 basis points to 33.3 percent in the quarter, driven by favorable channel and product mix and improved supply chain costs. Operating income for the Retail business totaled $12.2 million, as compared to $7 million in the same period of last year, due to the higher revenue and improved gross margins.

McMahon also noted that Nautilus internally measures the performance of Retail by looking at the last six months of the year since late September and early October are particularly heavy buying periods. On that basis, mass retail sales did increase in the second-half of the year.

McMahon also said the its international business outside U.S. and Canada jumped 56 percent in the quarter, excluding the addition of Octane sales, and now represents 6 percent of its revenue.

The company’s partnership to place the Max Trainer M3 nationwide in Dick’s Sporting Goods, first announced in the third quarter, is off to a solid start.

“I can say now that we’re very impressed with the partnership and teamwork shown by Dick’s Sporting Goods during this initiative,” said McMahon. “If successful, we feel that this approach could further optimize the reach of our direct media advertising to include those who prefer to buy in-store through a trusted major retailer.

Other positives for Retail include the Schwinn Airdyne AD Pro line gaining market share globally. The Zero Runner, or ZR8000 continued to grow sales in the commercial segment.

Meanwhile, sales of Octane branded products at retail were down versus the prior year in the quarter by $1.6 million. This decline was anticipated due to last year’s Q4 launch of the Zero Runner and the Octane XT1 elliptical.

“Commercial and specialty sales improved overall during the second-half of 2016 by 4 percent, and we anticipate growth in this segment for the full-year of 2017,” said McMahon. “We have several new product launches planned for our retail channel in 2017 expanding consumer and commercial markets across a variety of modality.”

In Direct, its other segment, sales declined 2.7 percent in the quarter to $65.2 million due to declines in the TreadClimber product line, which outweighed continued growth in Bowflex Max Trainer.

McMahon said the TreadClimber product line is now entering its 12th year of television advertising and its ongoing television performance is declining due primarily to the natural product lifecycle. He added, “TreadClimber will level out at a new lower revenue point, but we’ve not yet reached that level and thus TreadClimber declines will be a near-term challenge to the overall direct channel growth path.”

The introduction of its newest direct product, the Bowflex Hybrid Velocity Trainer, is intended to offset this decline.

Direct was also hurt by the continuation of soft consumer response conditions that impacted its Q3 performance for about one-half of the quarter. Added McMahon, “Encouragingly, following the election and more specifically from Black Friday onward, we saw a return to positive year-over-year growth in our Max Trainer category.”

Gross margin for the Direct business improved 630 basis points to 66.8 percent although prior year gross margins and operating income results were negatively impacted by a $2.5 million arbitration settlement expense and a $1.4 million inventory reserve of its discontinued nutrition products. Operating income for Direct was $12 million compared to $9.9 million in the same quarter prior year.

As a result, in the first-half of 2017, especially Q1, we likely will not see the same expansion we posted in Q1 of 2016. However, we will continue to invest in growth for Max Trainer and we anticipate growth in our Direct business for the full-year 2017.

Companywide, net sales for the fourth quarter of 2016 totaled $125.8 million, a 15.2 percent increase compared to the same quarter of 2015. Net income grew 19.5 percent to $11.6 million, or 38 cents a share.

For 2016, For the full year 2016, net sales were $406 million, an increase of 20.9 percent over last year. Net income grew 28.5 percent to $34.2 million, or $1.09 a share.

Given the challenges in both its Direct and Retail segments as well as difficult comparisons against the year-ago period, Nautilus projected a down first quarter Sales are projected to be in the range of $110 million to $112 million against $120.9 million in the year-ago period. Similarly, operating income from continuing operations in Q1 of 2017 is expected to be in the range of $12.5 million to $14 million, which is down from $18.8 million a year ago. The decline also reflects added investments and increased expenses related to securing and protecting intellectual property globally.

On a full-year basis for 2017, the company is projecting revenue and operating income growth to be in the range of 5 percent to 7 percent over 2016 with a return in the back half of the year of double-digit growth.

Photo courtesy Nautilus