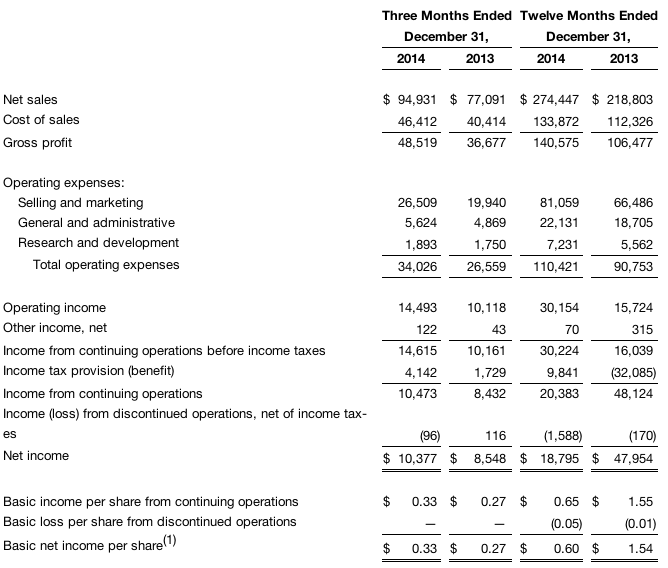

Nautilus Inc. reported net sales for the fourth quarter of 2014 totaled $94.9 million, a 23 percent increase compared to $77.1 million in the same quarter of 2013. The strong growth was driven by higher sales in both the Direct and Retail segments. For the full year 2014, net sales were $274.4 million, an increase of 25 percent over last year.

Gross margins for the fourth quarter improved by 350 basis points to 51.1 percent, reflecting strong margin expansion in the Direct segment, partially offset by lower Retail segment gross margins. Operating income from continuing operations for the fourth quarter of 2014 was $14.5 million, a 43 percent increase compared to $10.1 million in the same period last year. The increase in operating income reflects higher sales in both the Direct and Retail segments and higher Direct segment gross margins, as well as improved leverage of general and administrative and product development costs across higher sales volumes. For the full year 2014, operating income from continuing operations was $30.2 million, compared to $15.7 million last year, an increase of 92 percent.

Pretax income from continuing operations for the fourth quarter of 2014 was $14.6 million, or $0.46 per diluted share, compared to pretax income from continuing operations of $10.2 million, or $0.32 per diluted share, for the fourth quarter of the prior year. For the full year 2014, pretax income from continuing operations was $30.2 million, or $0.95 per diluted share, compared to pretax income from continuing operations of $16.0 million, or $0.51 per diluted share, the prior year.

Income from continuing operations for the fourth quarter of 2014 was $10.5 million, or $0.33 per diluted share, compared to income from continuing operations of $8.4 million, or $0.27 per diluted share, for the fourth quarter of 2013. For the full year 2014, income from continuing operations was $20.4 million, or $0.64 per diluted share, compared to $48.1 million, or $1.53 per diluted share, the prior year. Full year 2013 net income includes an income tax benefit of $33.0 million, or $1.05 per diluted share, due primarily to the partial reversal of a valuation allowance recorded against the company’s deferred tax assets.

As previously stated, beginning in the first quarter of 2014, the company started to record income taxes at a normalized rate following the partial release, in 2013, of its valuation allowance recorded against its deferred tax assets. The effective income tax rate for continuing operations in the fourth quarter of 2014 was 28.3 percent, reflecting the reversal of certain state tax valuation reserves. Cash payments related to income taxes were limited to alternative minimum tax amounts as the company continues to utilize domestic net operating loss carryforwards to offset regular income tax liabilities. As of December 31, 2014, the company had a total of $21.9 million of net deferred tax assets which are comprised mostly of net operating loss carryforwards that can be utilized against future income tax liabilities.

For the fourth quarter of 2014, the company reported net income (including discontinued operations) of $10.4 million, or $0.33 per diluted share; this includes a loss from discontinued operations of $0.1 million. In the fourth quarter of 2013, the company reported net income of $8.5 million, or $0.27 per diluted share; this includes income from discontinued operations of $0.1 million.

Bruce M. Cazenave, Chief Executive Officer, stated, “We are pleased to deliver another quarter of strong financial performance that helped cement an outstanding year of sales and profit growth for the company. As we reflect back on our performance against major initiatives for 2014, we clearly benefited from the successful execution of our key strategies; namely, continued product innovation, improving margins, and leveraging our infrastructure. This is a continuation of the winning formula that has worked well for us over the past several years. New products had a significant impact for both our Direct and Retail businesses. In its first year on the market, the Bowflex Max Trainer® product line contributed significantly to revenue growth in our Direct business, which increased 28 percent in 2014 compared to the prior year. Our Retail segment revenues grew 21 percent in 2014, which underscores the success of the new cardio line launched in the third quarter of 2013 and our ability to meet the evolving demands of our Retail partners and their consumers.”

Cazenave continued, “As we begin 2015, we are excited about the progress we have made in positioning our company for another year of profitable growth. During this year we hope to further diversify our revenue stream as we gain more traction with new products, both those that were recently introduced as well as others that are in the pipeline for 2015, and also in international markets where the opportunities are still largely untapped.”

Segment Results

Net sales for the Direct segment were $58.0 million in the fourth quarter of 2014, an increase of 35 percent over the comparable period last year. Direct segment sales benefited from the strong performance of the new Bowflex Max Trainer product line, partially offset by a decline in sales of other products. For the full year 2014, net sales for the Direct segment were $175.6 million, an increase of 28 percent over last year. U.S. credit approval rates rose to 43.5 percent in the fourth quarter of 2014, up from 39.7 percent for the same period last year. The company attributes the increase in approval rates to the launch of the Bowflex Max Trainer®, which has thus far attracted consumers with better credit scores, along with its media strategy focused on driving quality consumer leads and an expanded lender base.

Operating income for the Direct segment was $11.0 million for the fourth quarter of 2014, an increase of 96 percent compared to operating income of $5.6 million in the fourth quarter of 2013. Operating income benefited from higher gross margins as well as improved leverage of selling and marketing expenses as a percentage of sales in the fourth quarter of 2014. Gross margin for the Direct business was 64.6 percent for the fourth quarter of 2014, compared to 60.2 percent in the fourth quarter of last year, benefiting from improved overall overhead operating efficiency and improved product mix.

Net sales for the Retail segment were $34.6 million in the fourth quarter 2014, an increase of 8 percent over the fourth quarter last year. The improvement in Retail net sales reflects continued retailer and consumer acceptance of the company’s lineup of cardio products including the recently launched treadmill line. For the full year 2014, net sales for the Retail segment totaled $93.2 million, an increase of 21 percent over the prior year.

Operating income for the Retail segment was $5.7 million for the fourth quarter of 2014, a decrease of 11 percent compared to operating income of $6.5 million in the fourth quarter of 2013. Retail gross margin was 25.2 percent in the fourth quarter of 2014, compared to 27.4 percent in the same quarter of the prior year. Retail gross margins for the fourth quarter of 2014 were negatively impacted by special promotions on discontinued inventory and product mix.

Royalty revenue in the fourth quarter 2014 was $2.3 million, an increase of 15 percent compared to $2.0 million for the same quarter last year, reflecting higher sales-driven royalties for the quarter.

Balance Sheet

As of December 31, 2014, the company had cash and investments of $72.2 million and no debt, compared to cash of $41.0 million and no debt as of December 31, 2013. Working capital of $83.1 million as of December 31, 2014 was $37.4 million higher than the 2013 year-end balance of $45.7 million, primarily due to the cash flow generated by operations, that resulted in a $31.2 million increase in cash and investments. Inventory as of December 31, 2014 was $24.9 million, compared to $15.8 million as of December 31, 2013. The increase in inventory is due to higher revenues, new product introductions, and the addition of a new distribution center.